- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Drop in tea production this year leads to 13% price rise

Drop in tea production this year leads to 13% price rise

20-09-2024

Tea production in Assam and West Bengal has dropped this year, leading to a 13% rise in prices. However, this increase does not offset the production loss. Export prices have also fallen by 4%. The industry faces financial challenges due to unpaid subsidies for developmental work from the Tea Board.

- Climate Impact: Extreme weather and climate change have caused significant production losses, necessitating urgent reforms for sustainability.

Current State of the Tea Industry in India:

Recent Trends:

Production Decline:

- West Bengal: 21% drop in 2024.

- Assam: 11% drop in 2024.

- Resulting price increase: 13%.

- Loss of Premium Products: Key crops from the early monsoon season, which are high-quality, were lost, impacting profitability.

- Export Market Decline: 4% fall in export prices, adding pressure to the industry.

- Pending Subsidies: Financial strain due to unpaid subsidies from the Tea Board for developmental projects.

Industry Overview

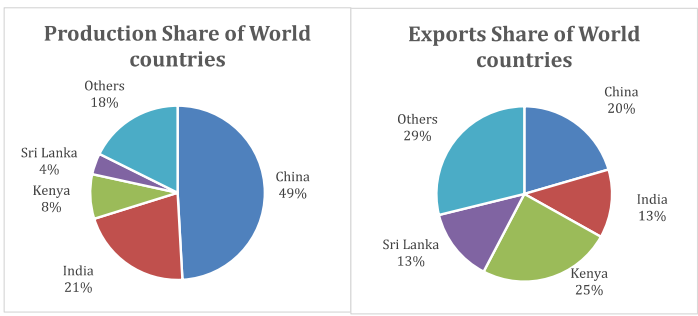

Global Standing:

- Second-largest producer of tea after China.

- Contributes ~10% of global tea exports.

Domestic Consumption:

- India consumes 81% of its tea production, with 19% share of global consumption.

Major Producer States:

- Assam, West Bengal, Tamil Nadu, and Kerala produce 97% of India's tea.

Export Composition:

- 96% of exports are black tea, with Assam, Darjeeling, and Nilgiri teas being highly regarded.

Key Challenges in the Tea Industry:

Weather-Related Challenges

- Extreme Weather Events: Excessive heat in May 2024 led to a production drop to 90.92 million kg, the lowest in over a decade.

- Price Increases: Average tea prices expected to rise by up to 20%.

- Pesticide Ban: Ban on 20 pesticides has increased costs for alternatives but has led to higher demand for Indian tea from certain markets (e.g., Russia, Belarus).

Economic and Structural Challenges

- Stagnant Internal Consumption: Low domestic consumption growth exacerbates market oversaturation.

- Impact on Small Tea Growers (STGs): STGs, holding less than one hectare, produce over 55% of tea. They are disproportionately affected by production and price declines.

- Factory Closures: Approximately 13-14 tea gardens in North Bengal have closed, affecting 11,000 workers.

Global Tea Statistics

- Production and Consumption: 2022 global production: 6,478 million kg; consumption: 6,209 million kg.

- Major Producers: China, India, Kenya, Sri Lanka account for 82% of global production and 73% of exports.

Tea Board of India

- Establishment: Founded in 1953, headquartered in Kolkata.

- Functions: Regulates producers, exporters, and conducts market analysis. Provides data to stakeholders to improve market performance.

Climate Change Impact

- Excessive Rainfall and Drought: Can lead to soil erosion and reduced plantation area.

- Frost Damage: Particularly harmful in sensitive regions, causing significant leaf loss.

- Global Warming Effects: Increased difficulty in producing quality tea, resulting in higher consumer prices.

Suggested Reforms for Viability

- Minimum Benchmark Pricing: Collaborate to establish cost-plus pricing to ensure sustainability and growth.

- E-Commerce Integration: Use technology to facilitate direct sales, increasing growers' profits.

- Focus on Premium Teas: Shift towards quality improvement to enhance income potential.

- Diversification: Explore palm oil as a complementary crop due to suitable growing conditions.

- Learning from Global Models: Implement Farmer Field Schools for sustainable, high-quality production.

- Full Auction System: Ensure all bought leaf tea is sold via public auction to enhance price realization.

- Expand Export Destinations: Target growth in the ready-to-drink tea market in the Asia Pacific.

- Investment in R&D: Focus on enhancing tea quality and developing climate-resilient varieties, alongside eco-friendly pest solutions.

Conclusion

The tea industry in India is facing a convergence of climatic, economic, and structural challenges. Implementing these reforms is critical for ensuring sustainable development and profitability in the face of ongoing adversities.

Must Check: Best IAS Coaching In Delhi

UPSC Prelims Result 2024 Out: Expected Cut Off & Other Details, UPSC Prelims 2024 Answer with Explanation, Daily Prelims Quiz, Daily Current Affairs, MONTHLY CURRENT AFFAIRS TOTAL (CAT) MAGAZINE, Best IAS Coaching Institute in Karol Bagh, Best IAS Coaching Institute in Delhi, Daily Mains Question Answer Practice, ENSURE IAS UPSC Toppers, UPSC Toppers Marksheet, Previous Year Interview Questions, UPSC Syllabus