Economic Survey 2024-25: Summary

Economic Survey 2024-25 tabled by Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman, in the Parliament on January 31, 2025.

Summary of Economic Survey 2024-25

1. Global Economic Overview

- The global economy grew by 3.3% in 2023. The International Monetary Fund (IMF) projects global growth to average around 3.2% over the next five years, which is modest by historical standards

- Regional Growth: The global economy showed steady but uneven growth, with a slowdown in manufacturing (especially in Europe and Asia) due to supply chain disruptions and weak external demand. In contrast, the services sector performed better in many regions.

- Inflation Trends: Inflationary pressures have eased in most economies, but services inflation has remained persistent.

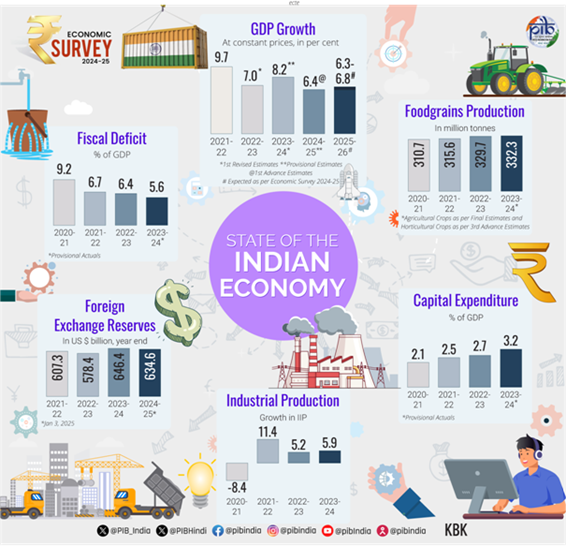

2. India's Economic Performance

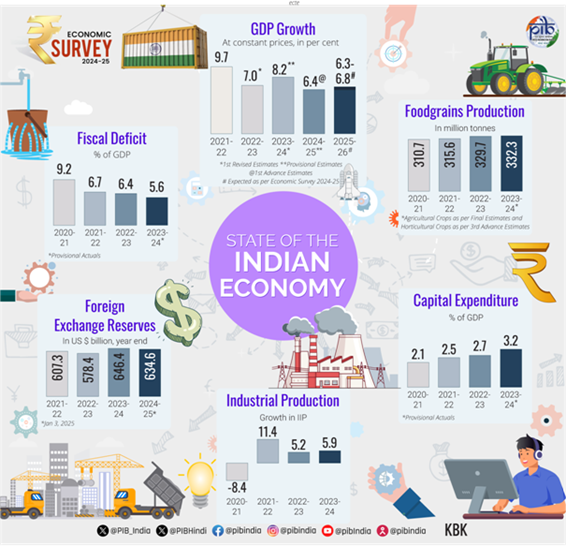

- Real GDP Growth: India’s real GDP growth is projected at 6.4% for FY25, close to the decadal average.

- Private Consumption: Private final consumption expenditure (at constant prices) is estimated to grow by 7.3%, with rural demand playing a significant role in the rebound.

- Sector-wise Growth:

- Agriculture: The agriculture sector is expected to grow by 3.8%, driven by healthy Kharif production and favorable monsoon conditions.

- Industrial Sector: Expected to grow by 6.2%, supported by strong construction and utility services growth.

- Services Sector: Projected growth of 7.2%, fueled by financial, real estate, professional services, and public administration activities.

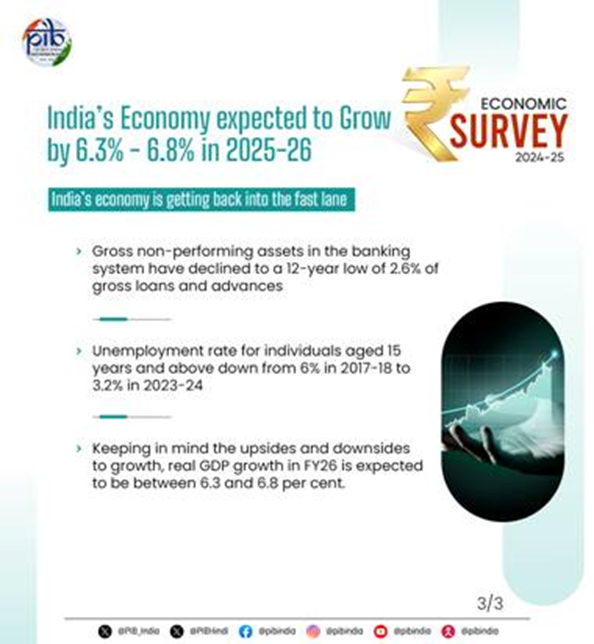

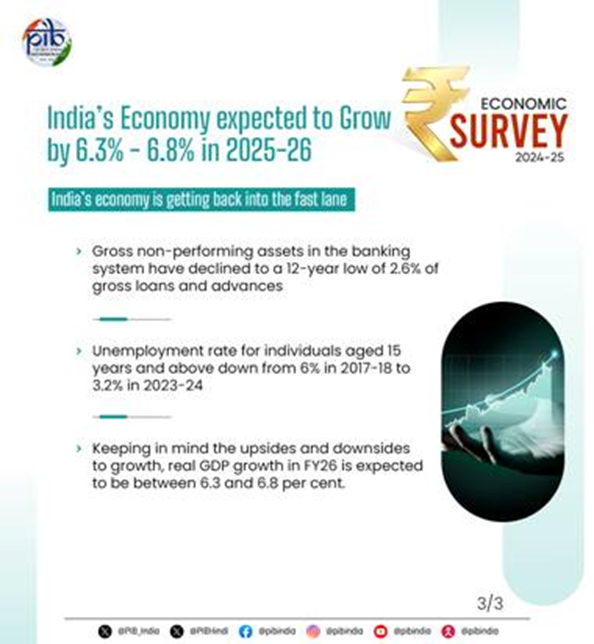

3. Medium-Term Growth Outlook

- FY26 Growth Projections: Real GDP growth is expected to be between 6.3% and 6.8%.

- Key Growth Drivers: The Survey emphasizes the importance of strengthening domestic growth levers, focusing on deregulation to foster economic freedom for businesses and individuals.

4. Sectoral Performance

- Agriculture: Agricultural growth remained steady in FY25, with a record 1647.05 LMT of Kharif food grain production, marking a 5.7% increase from the previous year.

- Industrial Growth: The industrial sector grew by 6% in the first half of FY25, with challenges such as weak manufacturing exports and disruptions in mining and construction activities.

- Services Sector: The services sector grew by 7.1% in the first half of FY25. Services exports surged by 12.8% in April-November FY25, highlighting the sector’s competitiveness.

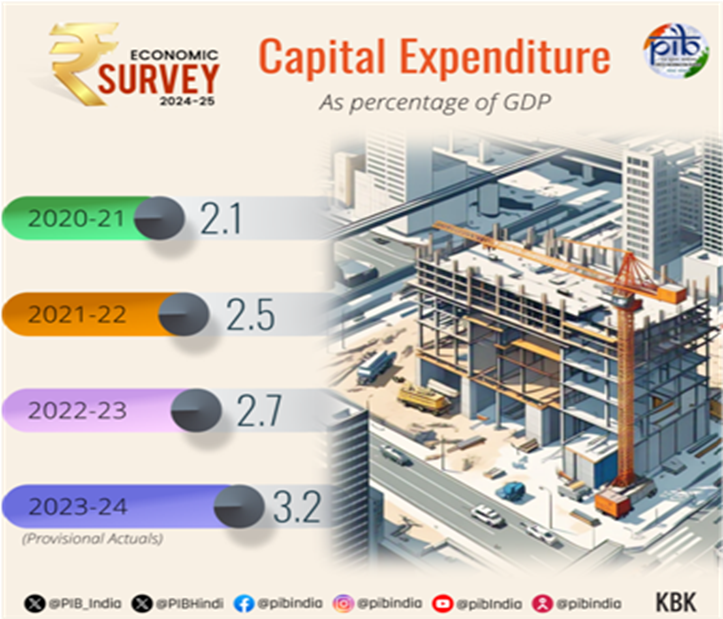

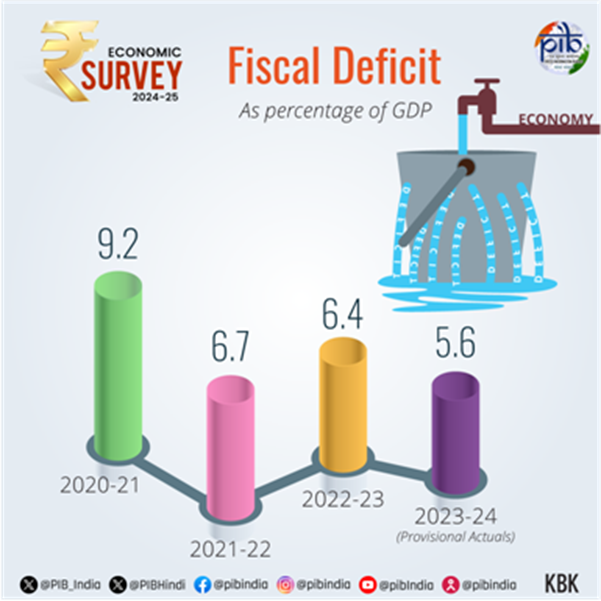

5. Inflation and Fiscal Health

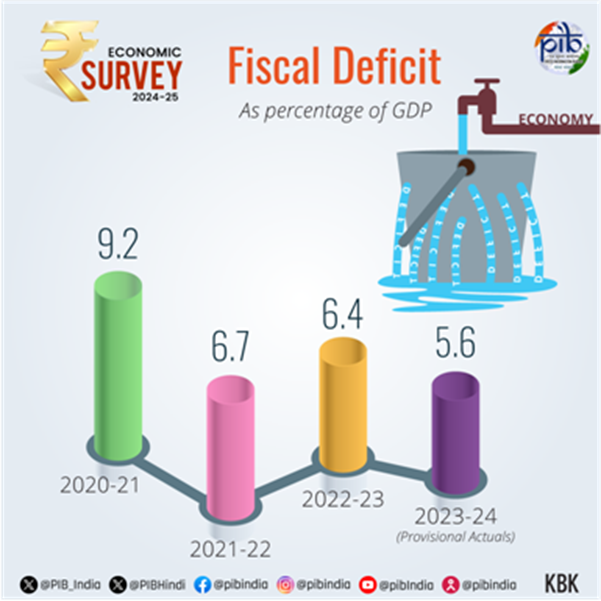

- Inflation: Retail inflation softened to 4.9% (April-December 2024), while food inflation increased to 8.4%, mainly due to vegetables and pulses.

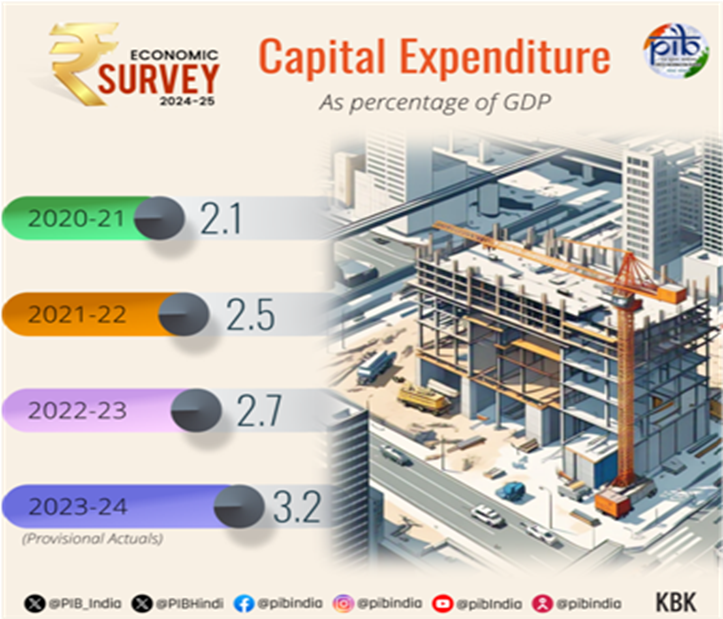

- Government Expenditure: Capital expenditure (capex) has been growing steadily, with an 8.2% Year Over Year (YoY) growth from July-November 2024.

- Tax Revenue: Gross tax revenue (GTR) grew by 10.7% YoY from April-November 2024, but the tax revenue retained by the Union government showed only marginal growth.

6. Banking and Financial Sector Stability

- Banking Health: The banking sector remains stable with declining non-performing assets (NPAs), which reached a 12-year low of 2.6% of gross loans.

- Foreign Exchange Reserves: India’s foreign exchange reserves grew to USD 704.9 billion by September 2024, providing a buffer against external vulnerabilities.

- Capital Flows: Foreign Direct Investment (FDI) inflows grew by 17.9% YoY, and foreign portfolio investments (FPI) showed volatility due to global geopolitical developments.

7. Employment and Labour Market

- Unemployment Rate: The unemployment rate for individuals aged 15 and above declined to 3.2% in FY24, from 6% in 2017-18.

- Labour Force Participation: Both the labour force participation rate (LFPR) and the worker-to-population ratio (WPR) have increased, indicating strong post-pandemic recovery.

8. Infrastructure and Renewable Energy

- Infrastructure Growth: Significant investments in infrastructure, including railway connectivity (2031 km commissioned between April-November 2024) and port capacity expansion, improved operational efficiency.

- Renewable Energy: India’s renewable energy capacity grew by 15.8% in FY25, with substantial increases in solar and wind power generation.

- Government Schemes: PM - Surya Ghar: Muft Bijli Yojana, National Bioenergy Programme, National Green Hydrogen Mission and PM-KUSUM. The capacity addition in solar and wind power has lead to a 15.8 per cent year-on-year (YoY) increase in renewable energy capacity by December 2024.

9. Social Services and Inequality

- Social Services Expenditure: The government’s expenditure on social services has grown at a compounded annual growth rate of 15% from FY21 to FY25.

- Income Inequality: The Gini coefficient, a measure of inequality, has decreased, indicating a positive impact of government policies on income distribution.

- Health and Education: The share of government health expenditure increased from 29% to 48% between FY15 and FY22. Education reforms under the National Education Policy 2020 are being actively implemented through various schemes, include the Samagra Shiksha Abhiyan, DIKSHA, STARS, PARAKH, PM SHRI, ULLAS, PM POSHAN, etc.

10. Support for MSME Sector

- MSME Growth: The Micro, Small, and Medium Enterprises (MSME) sector continues to be a vibrant part of India’s economy. The Self-Reliant India Fund, with a corpus of ₹50,000 crore, has been launched to provide equity funding for MSMEs with high growth potential.

- Regulatory Reform: The Economic Survey emphasizes the need for systematic deregulation through the "Ease of Doing Business (EoDB) 2.0" initiative, aiming to reduce excessive regulatory burdens and increase business efficiency.

11. Challenges and Prospects for FY26

- Global Risks: Geopolitical uncertainties and potential commodity price shocks present challenges to growth.

- Domestic Drivers: Key factors for sustaining growth include a pick-up in private sector investment, improved consumer confidence, and rural demand fueled by agricultural recovery.

- Reforms for Global Competitiveness: India’s competitiveness can be strengthened through structural reforms, deregulation, and an emphasis on improving the ease of doing business.

The Economic Survey 2024-25 highlights India’s robust economic performance amidst global uncertainties, driven by steady growth in agriculture, industry, and services. The focus on deregulation, infrastructure development, and green energy investments positions India for sustained growth, though challenges such as geopolitical tensions and inflationary pressures remain. Strategic reforms, especially in enhancing global competitiveness and fostering a business-friendly environment, are crucial for achieving long-term economic goals.