- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Trends in Remittances Inflow

Trends in Remittances Inflow

19-07-2024

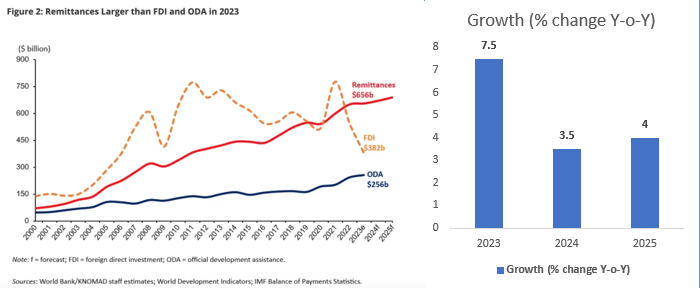

- According to the latest report by the World Bank, the growth in remittances to India is expected to halve (reduce by 50%) in 2024 compared to 2023.

- This slowdown is due to reduced outflows from GCC (Gulf Cooperation Council) countries, amid declining oil prices and production cuts.

- The Gulf Cooperation Council (GCC) is a political and economic alliance of six Middle Eastern countries: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and United Arab Emirates.

What are Remittances?

- Remittances are funds or goods that migrants send back to their families in their home country to provide financial support.

- Sources:

- Migrant Workers: Migrant workers are the primary source of remittances, sending money back to their families.

- Diaspora Communities: Diaspora community members often send remittances to support their relatives and community projects in their home countries.

- Channels:

- Formal Channels: These include banks, money transfer operators like Western Union and MoneyGram, and mobile money services.

- Informal Channels: These include methods like hand-carry, hawala systems, and other informal networks.

- Types:

- Personal Remittances: Funds sent by individuals to their families or friends.

- Collective Remittances: Contributions from diaspora communities for community development projects.

- They are a significant source of income and foreign exchange for many developing countries, especially in South Asia.

- Remittances help reduce poverty, improve living standards, support education and health care, and stimulate economic activity.

- In 2023, India had 18.7 million emigrants.

Growth of Remittances

- India received USD 120 billion in remittances in 2023, with a growth rate of 7.5%.

- The forecast for 2024 is a growth rate of 3.7%, reaching USD 124 billion.

- For 2025, the growth estimate is 4%, expected to reach USD 129 billion.

Remittances Inflows in Countries

- In 2023, India topped the remittances inflow list, followed by Mexico (USD 66 billion), China (USD 50 billion), the Philippines (USD 39 billion), and Pakistan (USD 27 billion).

- According to RBI data, India's foreign assets increased more than liabilities in 2023-24.

Migration Trends

|

Top Sources of Remittances for India

- Around 36% of total remittance flows to India come from high-skilled Indian migrants in high-income countries such as the United States, the United Kingdom, and Singapore.

- Post-pandemic recovery led to a tight labour market in these regions, resulting in wage hikes that boosted remittances.

- Among other high-income destinations, the Gulf Cooperation Council (GCC) countries are significant contributors.

- The UAE accounted for 18% of India's remittance flows, while Saudi Arabia, Kuwait, Oman, and Qatar collectively accounted for 11%.

Reason for Consistent Remittance Inflow

- Strong Economic Conditions: Developed economies like the US, UK, and Singapore have lower inflation and strong labor markets, benefiting skilled Indian professionals and increasing remittance inflows to India.

- High employment growth and decreasing inflation in Europe have also contributed to the rise in global remittances.

- Diversified Migrant Pool: India's migrant pool is diversified, with a significant portion residing in the Gulf Cooperation Council (GCC) countries. This diversification offers a buffer during economic downturns in either region.

- Favourable economic conditions in the GCC, such as high energy prices and controlled food price inflation, have positively impacted employment and incomes for Indian migrants, especially those in less-skilled sectors.

- In 2023, India and the UAE signed a pact to establish a Local Currency Settlement System (LCSS) to promote the use of the Indian rupee (INR) and UAE Dirham (AED) for cross-border transactions.

- This has further boosted remittance flows.

- Improved Remittance Channels: Initiatives like Unified Payment Interface (UPI) have enabled real-time fund transfers, allowing remittances to be sent and received instantly.

- The National Payments Corporation of India (NPCI) has enabled NRIs to use UPI in several countries, including Singapore, Australia, Canada, Hong Kong, Oman, Qatar, USA, Saudi Arabia, UAE, the United Kingdom, Sri Lanka, Bhutan, Mauritius, France, and Nepal.

How to Increase Remittance Inflow in India

- Boosting Financial Inclusion: World Bank data shows that only 80% of Indians have bank accounts.

- Expanding formal financial services, especially in rural areas, can make remittance transfers easier through a broader network of bank branches, ATMs, and digital platforms.

- Reducing Remittance Costs: According to World Bank data, remittance costs in India are high (5-6%).

- Introducing competition among remittance service providers and promoting digital channels can reduce transaction costs.

- Additionally, government incentives for using formal channels can encourage more people to adopt them.

- Enhancing Remittance Infrastructure: Upgrading payment systems and leveraging new technologies like blockchain can streamline the remittance process.

- The Reserve Bank of India has implemented the Centralized Payment System, including Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT), to achieve this goal.

- Targeted Diaspora Engagement: Increased government engagement with the Indian diaspora through programs like Pravasi Bharatiya Divas and the Know India Programme can strengthen connections.

- Offering attractive investment options and tax breaks, as suggested by International Monetary Fund (IMF) data, can encourage higher remittance inflows.

- Promoting Economic Stability: Implementing sound macroeconomic policies, improving the ease of doing business, and addressing corruption are crucial for building diaspora confidence.

- This can create a more attractive environment for remittance flows.

Conclusion

Remittance inflows are crucial for the economies of many developing countries, offering significant support to millions of households. By enhancing financial access, lowering transaction costs, and assisting migrants, countries can optimize the benefits of remittances, boosting economic growth and improving social outcomes.

Local Currency Settlement System (LCSS)

|

Must Check: Best IAS Coaching In Delhi

UPSC Prelims Result 2024 Out: Expected Cut Off & Other Details, UPSC Prelims 2024 Answer with Explanation, Daily Prelims Quiz, Daily Current Affairs, MONTHLY CURRENT AFFAIRS TOTAL (CAT) MAGAZINE, Best IAS Coaching Institute in Karol Bagh, Best IAS Coaching Institute in Delhi, Daily Mains Question Answer Practice, ENSURE IAS UPSC Toppers, UPSC Toppers Marksheet, Previous Year Interview Questions, UPSC Syllabus