- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

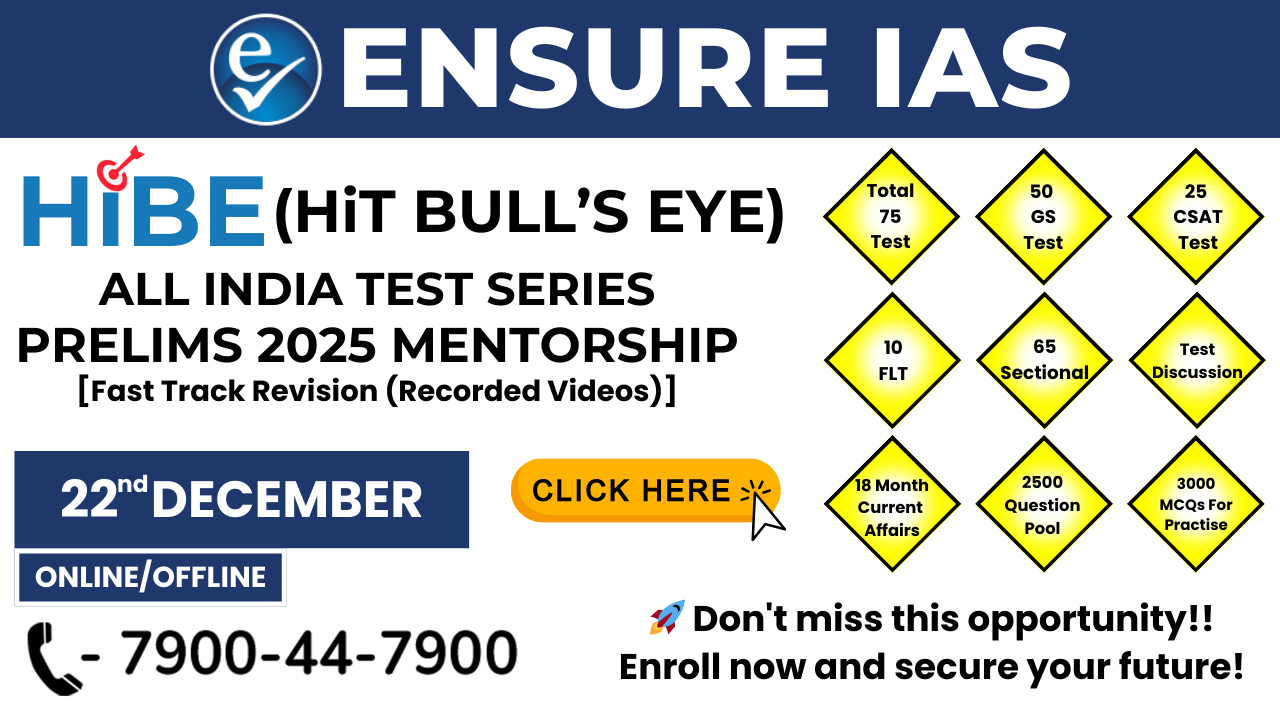

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Why the Government Might Discontinue the Sovereign Gold Bond Scheme

Why the Government Might Discontinue the Sovereign Gold Bond Scheme

- The Sovereign Gold Bond (SGB) scheme was introduced by the Government of India to offer investors an alternative to buying physical gold, while also addressing the country’s gold import dependency.

- However, there is now growing consideration within the government to discontinue the scheme due to concerns about its high cost to the government and the impact of other fiscal measures, such as reducing import duties on gold.

What is the Sovereign Gold Bond Scheme?

The Sovereign Gold Bond (SGB) scheme, launched in November 2015, is a government-backed investment product aimed at curbing the demand for physical gold and, at the same time, offering investors an opportunity to gain from the rising price of gold without the risks associated with storage and security.

- Issuer: SGBs are issued by the Reserve Bank of India (RBI) on behalf of the Government of India.

- Units: Each unit represents one gram of gold, with investors able to buy bonds in multiples.

- Interest Rate: SGBs offer a fixed interest rate of 2.5% annually on the amount of initial investment, which is credited semi-annually to the investor’s account.

- Tenure: The bonds have a ten-year tenure, but they can be redeemed after 5 years.

- Market-Linked Redemption Price: The redemption price is based on the average closing price of 999-purity gold over the previous three business days before maturity, as published by the India Bullion and Jewellers Association Ltd (IBJA).

- This ensures the bond’s return is tied to the market value of gold at the time of redemption.

Why was the Scheme Introduced?

The primary objectives behind the SGB scheme were:

- Diversify Gold Investment: The government wanted to create a paper-based alternative to physical gold investment, which is expensive to store and prone to theft.

- Reduce Physical Gold Imports: India has long been the world’s largest importer of gold, which contributes to a significant trade deficit.

- The government hoped that the SGB scheme would reduce demand for physical gold and thus reduce gold imports.

- Mobilize Resources for Infrastructure: The government also viewed the scheme as a way to mobilize savings and directly channel these funds into national infrastructure projects.

Key Features and Benefits of the Sovereign Gold Bond Scheme

- Safe Investment Option: Investors can avoid the risks associated with physical gold like theft, and also save on storage costs such as locker fees.

- Market-linked Returns: SGBs offer returns that track the market value of gold, meaning if the price of gold rises, the investor’s returns also increase.

- Interest on Investment: In addition to price appreciation, the SGB scheme offers semi-annual interest payments (2.5% per annum), which makes it a steady income-generating investment.

- Capital Appreciation: Upon maturity, the bonds are redeemed in Indian Rupees at the prevailing price of gold, often leading to significant capital appreciation.

Government's Concerns Leading to Possible Discontinuation

Despite the scheme’s benefits, the cost of maintaining and issuing SGBs has led to concerns within the government about its sustainability, particularly in the context of managing the fiscal deficit.

Several factors are contributing to the government's re-evaluation of the scheme:

High Fiscal Cost of Financing

- The cost of financing the fiscal deficit through SGBs is becoming increasingly burdensome for the government.

- The interest payments to bondholders and the need to redeem bonds based on market prices of gold means that SGBs are an expensive way to raise capital.

- The government has raised significant amounts through this scheme, but the long-term financial burden might not justify the returns for the state.

- Interest Payments: The 2.5% annual interest on the bonds, compounded over years, represents a significant fiscal cost for the government.

- As the price of gold increases, the final redemption payout also increases, thus adding to the government's liabilities.

Reduced Reliance on SGB for Financing

- In the 2024-25 Budget, the government reduced its gross issuances of SGBs from ₹29,638 crore (projected in the interim budget) to ₹18,500 crore.

- This is a significant reduction, indicating that the government is seeking alternative ways to finance its fiscal needs rather than relying as heavily on SGBs.

- Reduction in Borrowing: The net borrowing through SGBs has been slashed from ₹26,138 crore to ₹15,000 crore, reflecting the government’s attempt to shift away from SGBs and focus on more sustainable financing methods.

Policy Shift with Gold Import Duty Reduction

- In July 2024, the government took a bold step by reducing gold import duties from 15% to 6%, the lowest in more than a decade. This has had the dual effect of:

- Lowering the price of gold, making it more attractive to buyers.

- Increasing gold demand, which was one of the original goals of the SGB scheme.

- With the duty cut leading to an increase in gold imports and a boost in market demand, the SGB scheme has become less critical for fulfilling its original purpose of reducing physical gold investment.

Limited Impact on Gold Import Reduction

- Despite the SGB’s aim of curbing gold imports, the reduced import duty has proven to be a more direct and effective measure in stimulating demand for gold.

- With the gold price now lower, demand has surged, and the need for an alternative investment in paper gold (via SGBs) has decreased.

History and Investor Returns

The SGB scheme has proven to be lucrative for investors over the years. Some notable examples include:

- SGB Series I (2016): Bonds issued in 2016 at ₹3,119 per gram were redeemed in August 2024 at ₹6,938 per gram— over double the initial investment. Investors also received interest payments, making the total return even higher.

- SGB Series II (2016): Bonds issued under Series II in 2016 provided an overall return of 126.4% over the initial investment, including the 2.5% annual interest paid over the holding period.

- Premature Redemption: The RBI has also announced a window for premature redemption of bonds issued between May 2017 and March 2020, which allows investors to redeem bonds after five years, providing flexibility for those looking to liquidate their holdings before maturity.

Challenges and Criticisms of the Scheme

- High Financing Cost: The interest payments and the appreciation of gold mean the government faces a growing fiscal burden, especially when gold prices surge.

- Declining Importance of SGB: With the gold import duty reduction spurring gold demand directly, the SGB’s role in promoting paper-based gold investment has been reduced.

- Investor Demand vs. National Goals: While investors benefit from price appreciation, the government’s original goal of reducing gold imports through alternative investment channels (like SGBs) is losing relevance.

Conclusion:

The government’s decision to potentially discontinue the Sovereign Gold Bond (SGB) scheme is shaped by several factors, including the high cost of financing the fiscal deficit, a policy shift toward lowering gold import duties, and reduced reliance on SGBs for fiscal management. While the scheme has been profitable for investors, providing them with market-linked returns and interest payments, it may no longer align with the government’s long-term fiscal strategy.

| Also Read | |

| UPSC Prelims Result | UPSC Daily Current Affairs |

| UPSC Monthly Mgazine | Previous Year Interview Questions |

| Free MCQs for UPSC Prelims | UPSC Test Series |

| ENSURE IAS NOTES | Our Booklist |