- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

What is Swing Trading

What is Swing Trading

08-05-2024

The stock market has been witnessing ups and downs for the last few days amidst the Lok Sabha elections.

- In the middle of this volatility, swing trading has been prevalent on the Internet as various stocks have gone up and down in a series of ups and downs.

- Swing trading is a way to make money by taking advantage of these activities.

- It's about trying to figure out where the price is going and when it might change direction.

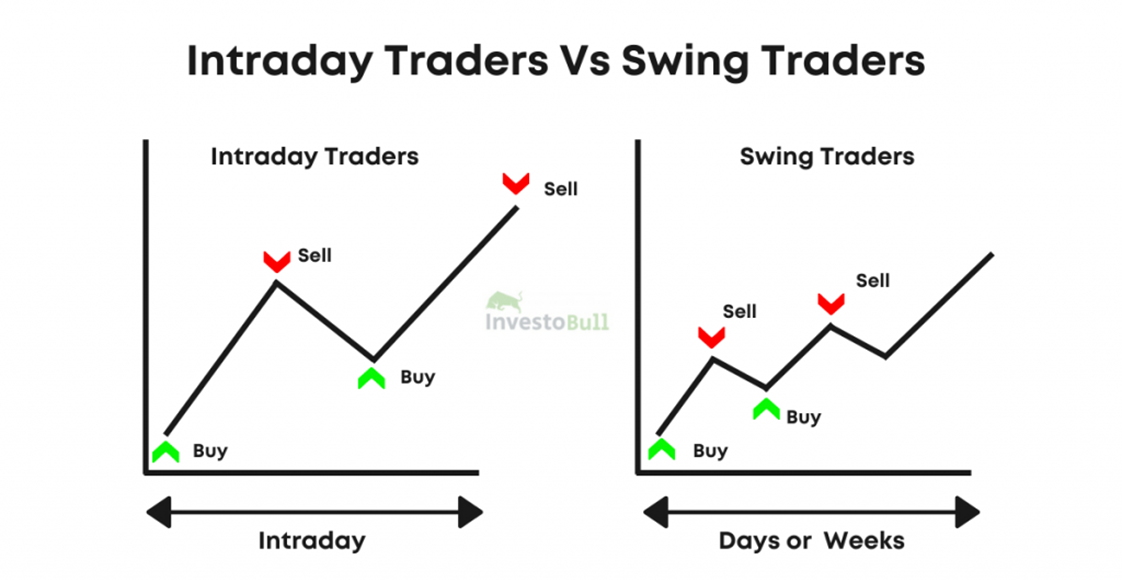

What is Swing Trading ?

- Trading Style: Swing trading involves holding stocks for longer than a single day, typically for several days or weeks.

- Goal: Swing traders aim to capitalize on fluctuations in stock value as it moves up and down.

- Stock Selection: Swing traders seek stocks with high volume (trading activity) and volatility (price movement).

- Trade Execution: Swing traders set up stop-loss orders (to control potential losses) and target prices (to capture profits) based on support and resistance levels.

- Trading Strategy: Swing traders buy stocks at support (lower price level) and sell at resistance (higher price level), anticipating the stock's price to swing back and forth within these boundaries.

Objectives of Swing Trading:

- Profitability: The primary goal is to profit from short- to medium-term fluctuations in stock prices.

- Trading Duration: Traders enter and exit positions quickly, typically holding stocks for a few days to a few weeks.

- Market Opportunity: Swing traders capitalize on both upward and downward market movements, seeking to benefit from trends and momentum.

- Flexibility and Time Efficiency: Swing trading offers flexibility and is less time-consuming compared to day trading. Traders can adjust their positions based on market conditions.

Q: What is Nifty?

NSE Indices, formerly known as India Index Services & Products Limited (IISL), owns and manages NIFTY. NSE Indices is a subsidiary of the National Stock Exchange Strategic Investment Corporation Limited (NSE).

- Nifty was established in 1996 with the name CNX Nifty. Further, in 2015, it was renamed Nifty 50.

- Stock Market Index: Nifty (or more specifically, Nifty 50) is the primary stock market index of the National Stock Exchange of India (NSE). It represents the performance of the top 50 large-cap (large capitalization) companies listed on the NSE.

- Benchmark: Nifty is a widely followed benchmark index that reflects the overall health and direction of the Indian stock market. Investors often compare the performance of their portfolios against the Nifty to gauge how well their investments are doing.

How does Nifty Work?

- Composition: The Nifty 50 comprises the 50 most eligible companies across 13 sectors of the economy. Companies are selected based on criteria like float-adjusted market capitalization, liquidity, trading frequency, and others.

- Calculation: The Nifty 50 index value is calculated using the free-float market capitalization weighted method. This means companies with larger free-float market capitalization (shares available for public trading) have a greater influence on the index's movement.

Significance of Nifty:

- Market Indicator: Nifty is often seen as a reflection of the Indian economy's health. If the Nifty is rising, it generally indicates investor confidence and overall market growth.

- Investment Tools: Many investment products track the Nifty 50:

- Index Funds: Allow investors to buy a basket of stocks mirroring the Nifty composition, enabling participation in the broader market performance.

- Exchange-Traded Funds (ETFs): Similar to index funds, but traded like stocks for more active investors.

- Derivatives: Futures and options contracts based on the Nifty enable investors to hedge their portfolios or speculate on market direction.

Must Check: Best IAS Coaching In Delhi