- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- Online Program

- GS Recorded Course

- NCERT Batch

- Polity Module Course

- Geography Module Course

- Economy Module Course

- AMAC Module Course

- Modern India, Post Independence & World History Module Course

- Environment Module Course

- Governance Module Course

- Science & Tech. Module Course

- International Relations and Internal Security Module Course

- Disaster Management Module Course

- Ethics Module Course

- Essay Module Course

- Current Affairs Module Course

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

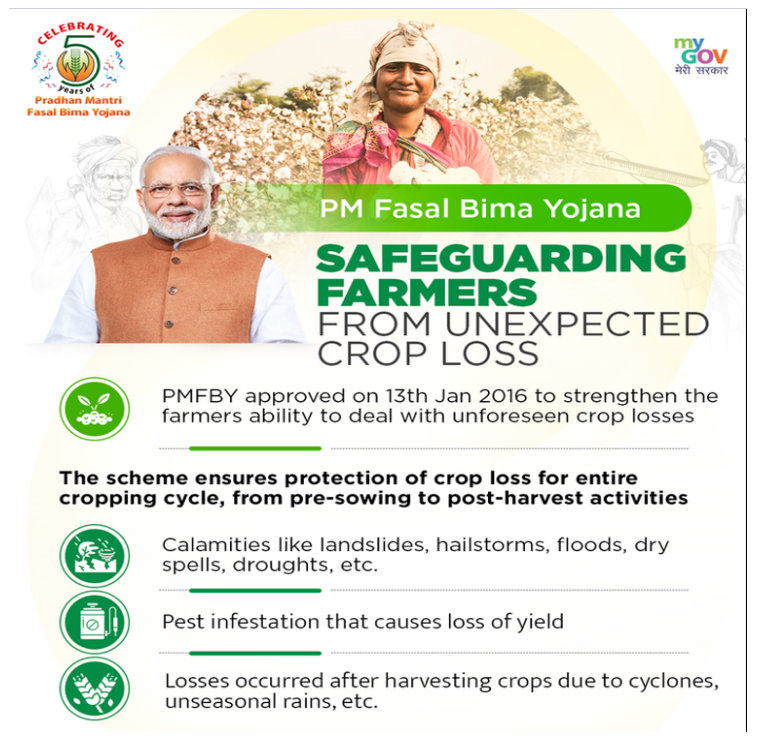

UNDP India Signed MOU to strengthen PMFBY

UNDP India Signed MOU to strengthen PMFBY

18-07-2023

Latest Context:

Recently, the United Nations Development Programme (UNDP) India and Absolute (a bioscience company) have signed MoU to strengthen PMFBY.

About Pradhan Mantri Fasal Bima Yojna (PMFBY)

- It’s a crop insurance scheme launched by the Government of India in 2016.

- The primary objective of the scheme is to provide financial support to farmers in the event of crop failure or damage due to natural calamities, pests or diseases.

Features are:

- Coverage: PMFBY provides coverage to all farmers, including tenant farmers, sharecroppers, and those cultivating on a lease basis. It covers almost all crops grown in India, including food crops, oilseeds, commercial crops, and horticultural crops.

- Premium: The premium rates are determined based on the type of crop and its risk profile. The premium payable by farmers is also kept low, with a maximum limit of 2% of the sum insured for Kharif crops, 1.5% for Rabi crops, and 5% for horticultural crops.

- Sum Insured: The scheme provides comprehensive coverage to farmers by ensuring that the sum insured is equal to the cost of cultivation. It includes pre-sowing to post-harvest expenses such as the cost of seeds, fertilizers, pesticides, labour, etc.

- Claims Settlement: In case of crop damage, farmers are entitled to receive the claim amount as per the insurance coverage. The claim assessment is done by surveying the affected crop area and assessing the crop yield loss. Claims are settled within a specified time frame to provide timely relief to farmers.

- Implementing Agencies: PMFBY is implemented by multiple insurance companies selected through a competitive bidding process. These insurance companies work in collaboration with state governments, which act as implementing agencies. The state governments are responsible for the enrolment of farmers, collection of premium, and distribution of claims.

- Technology Integration: The scheme promotes the use of technology for efficient implementation. It involves the use of remote sensing, drones, smartphones, and satellite imagery for accurate estimation of crop losses. This helps in faster claim settlement and reduces the chances of fraud.

- Awareness and Enrolment: The government conducts awareness campaigns to educate farmers about the benefits of the scheme and the enrolment process. Farmers can enrol themselves in the scheme through a common registration portal or through notified banks and other financial institutions.

Issues with the PMFBY are:

- Low Farmer Enrolment: One of the main challenges faced by PMFBY is the low farmer enrolment rate. Despite efforts to create awareness, many farmers are still unaware of the scheme or face difficulties in understanding the enrolment process. As a result, a significant number of farmers remain uninsured and are unable to benefit from the scheme.

- Limited Coverage for Small and Marginal Farmers: PMFBY has been criticized for providing limited coverage to small and marginal farmers. The scheme primarily focuses on providing insurance to loanee farmers who have taken institutional loans. However, a large percentage of Indian farmers are non-loanee farmers and who rely on informal sources of credit. The limited coverage leaves these farmers vulnerable to crop losses and financial distress.

- Delayed Claim Settlement: Timely claim settlement is crucial for the success of any crop insurance scheme. However, there have been instances of delayed claim settlement under PMFBY. Farmers have reported lengthy bureaucratic processes, resulting in delayed payouts. This hampers the purpose of the scheme as farmers do not receive the necessary financial support, when they need it the most.

- Discrepancies in Assessment of Crop Losses: Accurate assessment of crop losses is essential for fair claim settlement. However, there have been complaints regarding discrepancies in the assessment process under PMFBY. There have been instances of underestimation or incorrect assessment of crop losses, leading to inadequate claim payouts for farmers.

- Lack of Transparency: Transparency in the implementation of the scheme is crucial to ensure accountability and build trust among farmers. However, there have been allegations of lack of transparency in the selection of insurance companies, premium calculations, and claim settlement processes. This creates doubts among farmers regarding the fairness of the scheme.

- Limited Risk Coverage: PMFBY primarily covers crop losses due to natural calamities such as droughts, floods, and pests. However, there are other risks that farmers face, such as market fluctuations, price volatility, and others, which are not adequately covered under the scheme. This limits the effectiveness of PMFBY in providing comprehensive risk coverage to farmers.

Signing of this MoU will help in:

- Digitalising service delivery of crop insurance and agricultural credit processes to increase reach and uptake of scheme among the farmers.

- It will help in advancing technology to facilitate farmland identification and will enhance the farm monitoring, R&D etc.

Conclusion:

PMFBY aims to protect farmers from the uncertainties in crop production and provide them with financial stability. The scheme has undergone certain modifications and improvements since its launch to make it more farmer-friendly and effective in mitigating agricultural risks but still many more improvements need to be done.

Must Check: IAS Coaching Centre In Delhi