- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- NCERT- First Ladder

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- Current Affairs

- Indian Society and Social Issue

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Supreme Court’s Verdict on Demonetisation

Supreme Court’s Verdict on Demonetisation

Supreme Court’s Verdict on Demonetisation

Why in News?

Recently, the Supreme Court passed a verdict on the Demonetisation of currency notes of Rs 500 and Rs 1,000 in a majority 4-1 judgement by a 5-judge Constitutional Bench.

What is the Constitutional Bench of the Supreme Court?

- A Constitution Bench is a bench of the Supreme Court having 5 or more judges on it.

- These benches are not a routine phenomenon.

- A vast majority of cases before the Supreme Court are heard and decided by a bench of 2 judges (called a Division Bench), and sometimes of 3.

So, What are the Rulings of the Verdict?

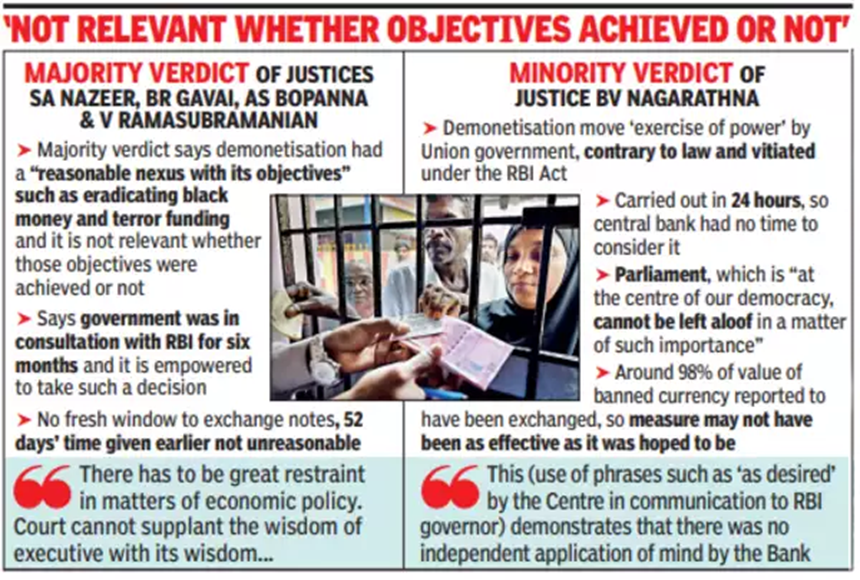

Views of Majority Ruling:

-

- The majority of judges in the bench held that Centre’s notification dated November 8, 2016 is valid and satisfies the ‘Test of Proportionality’.

- The RBI and the Centre were in consultation with each other from almost 6 months prior to the November 8 notification issued under Section 26(2) of the RBI (Reserve Bank of India) Act, 1934.

- The procedure under Section 26(2) of the RBI Act was not violated merely because the Centre has taken the initiative to “advice” the Central Board of RBI to consider demonetisation.

- The government is empowered under the provision to demonetise “all series” of banknotes.

- On hasty decision, the court said such measures undisputedly are required to be taken with utmost confidentiality and speed. If the news of such a measure is leaked out, it is difficult to imagine how disastrous the consequences can be.

- Demonetisation was done for the “proper purposes” of eliminating fake currency, black money and terror financing.

About the Test of Proportionality

- It is a commonly employed legal method used by courts around the world, typically constitutional courts, to decide cases where 2 or more legitimate rights clash.

- When such cases are decided, 1 right typically prevails at the expense of the other and the court thus has to balance the satisfaction of some rights and the damage to other rights resulting from a judgment.

- The principle of proportionality ensures that the administrative measure must not be more drastic than is necessary for attaining the desired result.

Views of Minority Ruling:

1.The government could have issued a notification under Section 26(2) of the RBI Act only if the RBI had initiated the proposal to demonetise by way of a recommendation.

2. Therefore, the government's notification issued under Section 26(2) of the RBI Act was unlawful.

3. In cases in which the government initiates demonetisation, it should take the opinion of the RBI. The opinion of the Board should be “independent and frank”.

4. If the Board’s opinion was in the negative, the Centre could still go forward with the demonetisation exercise, but only by promulgating an ordinance or by enacting a parliamentary law.

About Demonetisation:

- It is the process of removal of a currency from the economy by the prohibiting its use as a legal tender.

[Coins or banknotes that are recognized by government and must be accepted if offered as a payment are legal tender]

- On 8th November 2016, the Government of India has announced the demonetisation of all 500 and 1,000 banknotes of the Mahatma Gandhi Series.

- Along with this, the government has also announced the issuance of new 500 and 2,000 banknotes in exchange for the demonetised banknotes.

What were the Government’s Objectives behind Demonetisation?

There were 3 main economic objectives behind demonetisation:

- Fighting Black Money

- Removing Fake Currency from the Economy

- Creating a cashless economy by pushing digital transactions.

What were the Outcomes of the Exercise?

- About Black Money:

- Among targets, the biggest one was tackling black money.

- As per the RBI data, almost the entire money (99%) that was invalidated came back into the banking system hence, the demonetisation was a failure in unearthing black money in the system.

- Also, instances of black money captures still continue.

2.About Fake Notes:

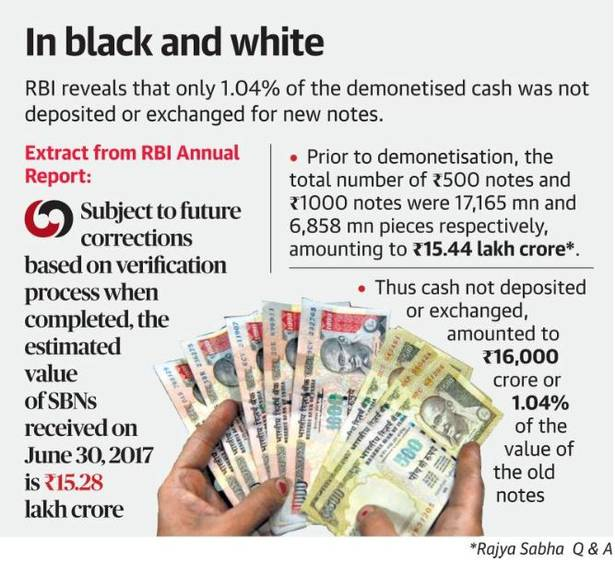

- RBI’s annual report, submitted that Rs.15.44 lakh crore worth of currency was demonetised.

- The withdrawn money amounted to 86.4% of the currency in circulation at the time. Only Rs.16,000 crore out of the Rs.15.44 lakh crore was not returned.

- Also, only .0027% fake currency was “captured” following demonetisation.

3.Digitisation of economy: As per RBI report, demonetisation has made India a lesser cash-based economy, though not completely.

4.Support during Pandemic: The creation of digital infrastructure post-demonetisation helped India in coping with the pandemic. As we already had tools for faceless transactions (cash) at that time, it became easier to move towards contactless transactions (digital).

Operation Clean Money

-

- It was launched by the Income Tax Department (CBDT) for e-verification of large cash deposits made during the period from 9th November to 30th December 2016.

- The programme was launched on 31st January 2017 and entered into the 2nd phase in May 2017.

- It aimed to verify cash transaction status (exchange/savings of banned notes) of taxpayers during the demonetisation period and to take tax enforcement action if transactions do not match the tax status.

Conclusion and Way Forward

- Demonetization was a big move to boldly counter the black money and parallel economy (illegal economy, such as money laundering, smuggling, etc.)

- Though there has been a visible increase in digital payments, it is doubtful that whether the stated and primary goal of demonetisation to control black money was achieved or not.

Additional Information

About Findings of the 2022 Survey:

- The process of demonetisation was conducted 6 years ago to control the circulation of black money but has failed in the long run, as currency in people's hands have only increased in the past 6 years.

- Digital transactions continue to rise in the economy and yet there is a 44% rise in cash transactions, especially in real estate deals.

- The survey has further revealed that 76% people use cash to buy groceries, eat out and on food delivery.

Who Participated in the Survey?

The survey has received more than 32,000 responses from citizens located in 342 districts of India.

- 68% respondents were men

- 32% respondents were women

- 44% respondents were from tier 1 cities

- 34% from tier 2 cities

- 22% from tier 3, 4 and rural districts