- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Status and Proceeds of Disinvestment

Status and Proceeds of Disinvestment

Why in News?

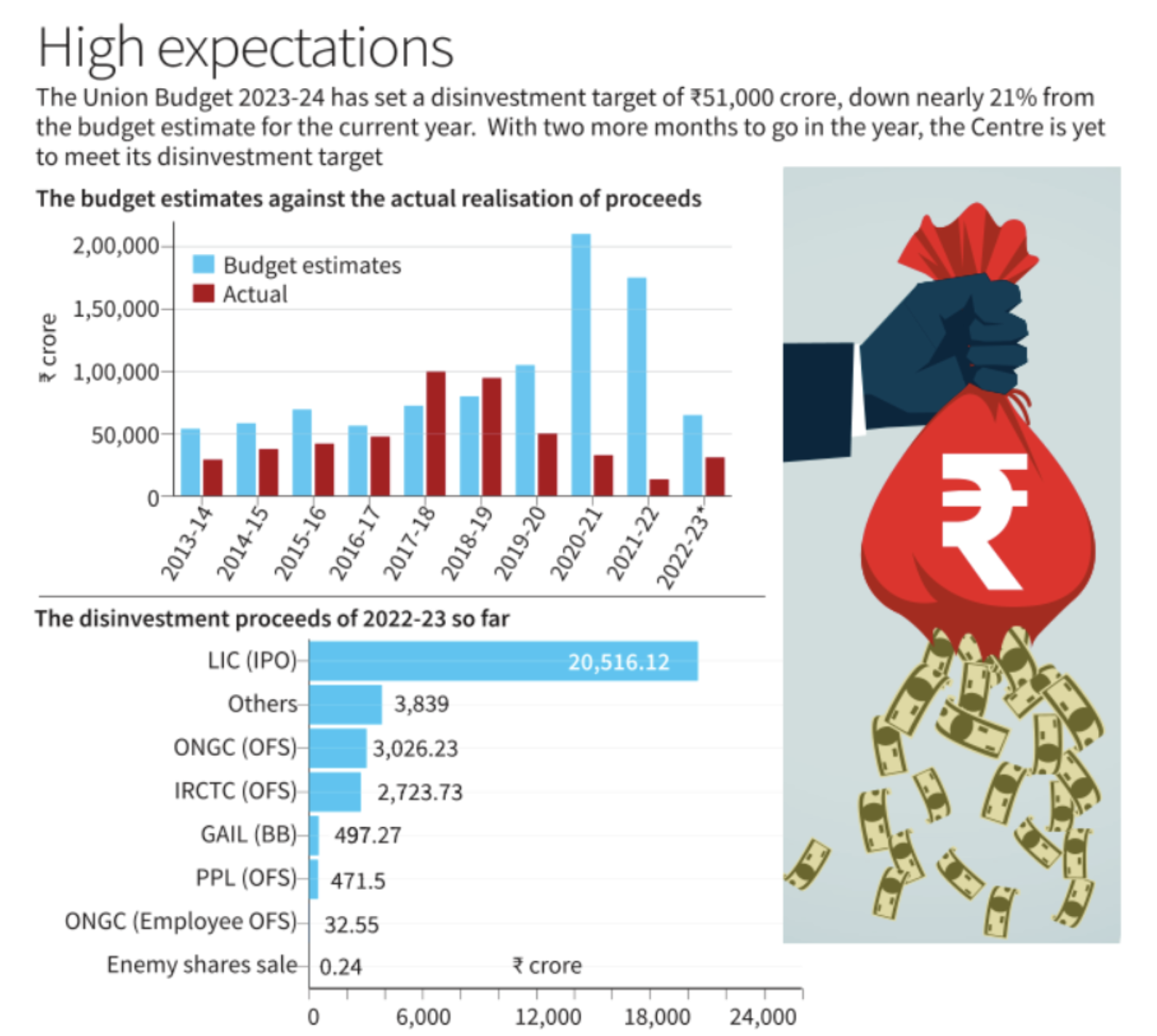

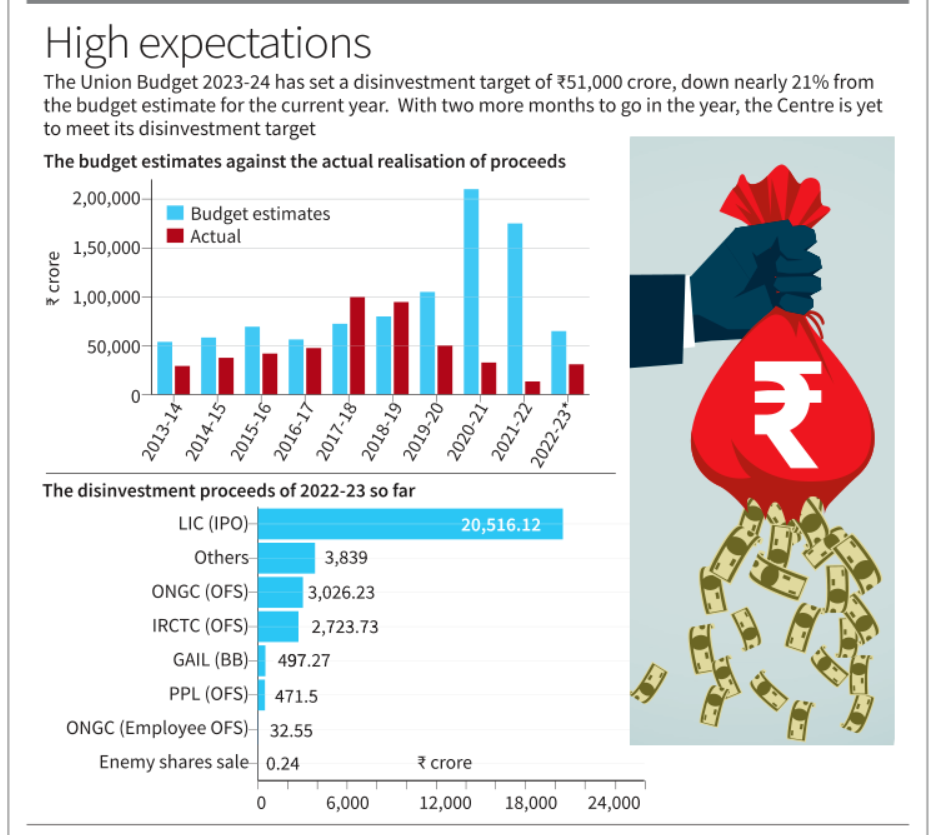

Recently, in the Union Budget 2023-24, the government has set a disinvestment target of Rs 51,000 crore, down nearly 21% from the budget estimate for the current year and just Rs 1,000 crore more than the revised estimate. It is also the lowest target in last 7 years.

So,What is Disinvestment?

1. Disinvestment refers to the government selling or liquidating its assets or stakes in PSEs (Public Sector Enterprises).

2. The Department for investment and public asset management (DIPAM) under Ministry of finance is the nodal agency for disinvestment.

3. It is mostly done when a PSU starts incurring the loss or becomes highly inefficient.

4. Disinvestment proceeds can help the government in funding its fiscal deficit.

What is Strategic Disinvestment?

1. Strategic Disinvestment refers to the sale of a public sector holding/undertaking to a non-government entity and in most cases, to the private sector. Mostly, it is done so by the government to relieve itself from the burden of maintaining a non-performing public enterprise.

2. Unlike the simple disinvestment, strategic disinvestment implies a kind of privatization.

3. The disinvestment commission defines ‘strategic sale’ as the sale of a substantial portion of the government shareholding of a Central Public Sector Enterprises (CPSE) of upto 50%, or such higher percentage as the competent authority may determine, along with transfer of management control.

4. Strategic disinvestment in India is guided by the basic economic principle that the government should not be in the business to engage itself in manufacturing/producing goods and services in sectors where competitive market is already there.

5. The economic potential of such companies may be better discovered in the hands of the strategic investors due to various factors, e.g. infusion of capital, technology up-gradation and efficient management practices etc

Main objectives of Strategic Disinvestment in India are:

1. Meeting budgetary requirements

2. Reduce fiscal burden

3. Raise funds to finance growth and development projects

4. Improve market competitiveness and discipline

5. Transfer of commercial risks

Evolution of Disinvestment Policy in India:

1. The liberalization reforms undertaken in 1991 has led to an increased demand for privatization/ disinvestment of PSUs.

2. The ‘new economic policy of 1991’ indicated that PSUs have shown a very negative rate of return on capital employed due to:

A) Subsidized price policy of public sector undertakings

B) Under–utilization of capacity

C) Problems related to planning and construction of projects

D) Problem of labour, personnel, management and lack of autonomy

3. In the initial phase, this was done through the sale of a minority stake in bundles through auction. This was followed by a separate sale for each company in the following years, a method popularly adopted till 1999-2000.

4. India adopted strategic sale as a policy measure in 1999-2000 with the sale of a substantial portion of government shareholding in identified Central PSEs (CPSEs) up to 50% or more, along with transfer of management control. This was started with the sale of 74 % of the Government’s equity in Modern Food Industries Limited (MFIL).

5. Thereafter, 12 PSUs (including four subsidiaries of PSUs), and 17 hotels of Indian Tourism Development Corporation (ITDC) were sold to private investors along with transfer of management control by the Government.

6. Another major shift in disinvestment policy was made in 2004-05 when it was decided that the government may “dilute its equity and raise resources to meet the social needs of the people”, a distinct departure from strategic sales.

7. Department of Investment and Public Asset Management (DIPAM) has laid down comprehensive guidelines on “Capital Restructuring of CPSEs” in May 2016 by addressing various aspects, such as payment of dividends, buyback of shares, issue of bonus shares and splitting of shares.

8. Since 2014, the government has met (and overachieved) its disinvestment targets twice.

9. In 2017-18, the government earned disinvestment receipts of a little over ₹1 lakh crore as against a target of ₹72,500 crore, and in 2018-19, it brought in ₹94,700 crore when the target was set at ₹80,000 crore.

10. The Government has not met the disinvestment target for 2022-23 so far and having realised Rs 31,106 crore to date, of which, Rs 20,516 crore or close to a third of the budgeted estimate came from the IPO (Initial Public Offering) of 3.5% of its shares in the Life Insurance Corporation (LIC).

What is the Disinvestment Plan for 2023-24?

1. The Centre is not going to add new companies to the list of CPSEs to be divested in 2023-24.

2. The government has decided to stick to the already-announced and planned privatisation of State-owned companies.

3. These include IDBI Bank, the Shipping Corporation of India (SCI), the Container Corporation of India Ltd (Concor), NMDC Steel Ltd, BEML, HLL Lifecare, and so on.

Issues related to Disinvestment are:

1. It is against the socialist ideology of equal distribution of resources amongst the population.

2. It can lead to monopolistic and oligopolistic practices by corporates.

3. Proceedings of disinvestment has been used to cover the fiscal deficit of the state which can lead to unhealthy fiscal consolidation.

4. Private ownership does not guarantee the efficiency (Rangarajan Committee 1993).

5. As per many experts, in past disinvestment exercise has been done by undervaluation of public assets and favoritism bidding, thereby, leading to loss of public money.

Significance of the Disinvestment:

1. Trade unionism and political interference often lead to halting of PSU projects thereby hampering the efficiency in long run.

2. Outdated skills in PSU employees is the major cause of inefficiency.

3. Private players works out of red tapism, bureaucratic mentality and focus on performance-driven culture.

4. More competitive bidding leads to competition in private sectors to participate in PSUs.

Conclusion and Way Forward

If we look at some of the most developed countries of the world, it is hard to find that the government itself is engaged in doing business by maintaining a large number of public companies as the primary function of government is to provide ‘Good Governance’ to its citizens. So, Disinvestment is the need of the hour but it should be done in a very transparent manner so that the real purpose of disinvestment can be served.