- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- NCERT- First Ladder

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- Current Affairs

- Indian Society and Social Issue

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

SFBs Should be Worth Rs 1,000 Cr. to Become Universal Banks

SFBs Should be Worth Rs 1,000 Cr. to Become Universal Banks

30-04-2024

The Reserve Bank of India (RBI) has said small finance banks (SFBs) should have a minimum net worth of Rs 1,000 crore to become universal banks in accordance with the on-tap licensing norms.

Introduction to Small Finance Banks:

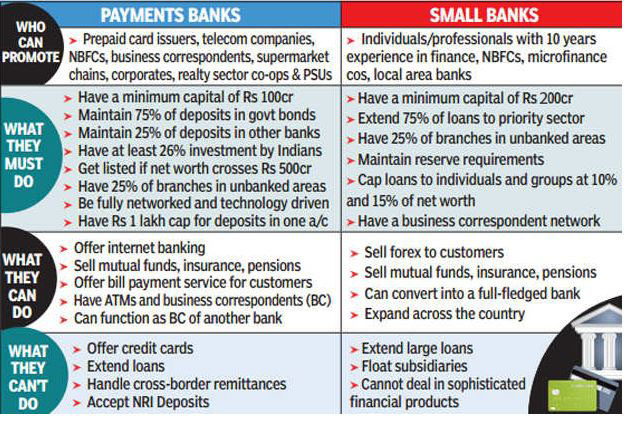

- Small Finance Banks (SFBs) are specialized banking institutions established to provide financial services and products to low-income individuals and underserved communities.

- SFBs are granted scheduled bank status and are governed by the RBI Act, 1934, ensuring their financial stability.

Objectives of SFBs:

-

Financial Inclusion:

- SFBs aim to address the financial exclusion of those sections of the population who do not have access to traditional banking systems.

- They provide microfinance, micro-enterprise services, and other basic banking services to empower these individuals and communities.

-

Access to Financial Products:

- SFBs make financial products such as small loans, savings, insurance, and basic banking services accessible to marginalized communities, promoting financial inclusion and economic empowerment.

Eligibility Criteria for SFBs:

-

Resident Individuals/Professionals:

- Indian citizens with at least 10 years of senior level experience in banking and finance are eligible to set up SFB singly or jointly.

-

Companies and Societies:

- Private sector companies and societies owned and controlled by residents and having a successful business track record of at least 5 years are eligible.

- Existing Non-Banking Finance Companies (NBFCs), Micro Finance Institutions (MFIs), and Local Area Banks (LABs) meeting the criteria can choose for conversion into SFBs.

Regulatory Norms for SFBs:

-

Capital to Risk Weighted Assets Ratio (CRAR):

- SFBs are required to maintain a minimum CRAR of 15%, ensuring financial resilience and stability.

-

Priority Sector Lending:

- SFBs must extend 75% of their Adjusted Net Bank Credit to Priority Sector Lending, supporting the development of key sectors and underserved regions.

-

Branch Network in Rural Areas:

- To promote financial inclusion in rural areas, SFBs are mandated to open at least 25% of their total branches in unbanked rural regions.

-

Required Paid-Up Capital:

- The minimum paid-up voting equity capital for SFBs has been set at Rs 200 crore, ensuring adequate capitalization and financial strength.

Difference Between PAYMENTS BANKS and SMALL BANKS

Regulation and Governance:

SFBs are registered as public limited companies under the Companies Act, 2013, and are governed by the Banking Regulations Act, 1949, the RBI Act, 1934, and other relevant statutes and directives.

Conclusion:

Small finance banks play an important role in promoting financial inclusion and empowering disadvantaged communities in India. Through its distinctive services, eligibility criteria and regulatory norms, SFBs aim to bridge the financial divide and contribute to the economic growth and development of the nation.

Must Check: Best IAS Coaching In Delhi