- Courses

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

SEBI TO INTRODUCE BRSR CORE

SEBI TO INTRODUCE BRSR CORE

13-07-2023

Latest Context

Recently, the Securities and Exchange Board of India (SEBI) came out with a regulatory framework for listed entities on Environment, Social, and Governance (ESG) on supply chain assurance.

Objective: Its objective is to make entities listed on the ESG framework relevant to Indian Market by adopting Key Performance Indicators (KPIs). This step has been taken by SEBI to address the need of the ESG. Under this framework, large listed companies will have to make disclosures and obtain assurance as per the ‘BRSR Core’ for their value chain.

Environmental, Social and Governance (ESG) Framework: It is a framework that helps stakeholders understand how an organization is managing risks and opportunities related to ESG criteria.

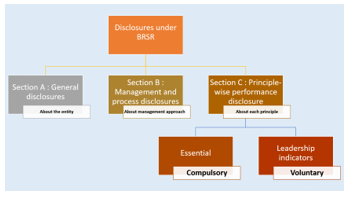

- BRSR Core is a sub-set of the BRSR that contains a set of Key Performance Indicators (KPIs) under 9 ESG attributes.

- Through BRSR reporting, SEBI has defined ESG disclosures in a standardized manner for the listed companies.

- By keeping in view relevance to the Indian / Emerging market context, a few new KPIs have been identified for assurance such as the openness of business, job creation in small towns gross wages paid to women etc.

ESG Disclosures for value chain

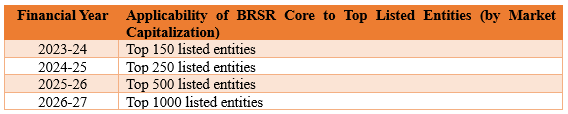

- From FY 2024-25, it will be applicable to the top 250 listed entities.

- As a part of its annual report, disclosures for the value chain will be made by the listed company as per BRSR Core.

- Value chain shall consist of top upstream and downstream partners of a listed entity, cumulatively comprising 75% of its purchases/sales (by value) respectively.

Must Check: IAS Coaching Centre In Delhi