- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- Online Program

- GS Recorded Course

- NCERT Batch

- Polity Module Course

- Geography Module Course

- Economy Module Course

- AMAC Module Course

- Modern India, Post Independence & World History Module Course

- Environment Module Course

- Governance Module Course

- Science & Tech. Module Course

- International Relations and Internal Security Module Course

- Disaster Management Module Course

- Ethics Module Course

- Essay Module Course

- Current Affairs Module Course

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

REMITTANCE INFLOWS GROWTH

REMITTANCE INFLOWS GROWTH

20-06-2023

Latest Context

Inflows of remittances to India, which reached a record high of USD 111 billion in 2022, are expected to experience minimal growth of just 0.2% in 2023, according to the World Bank's most recent Migration and Development Brief.

- The OECD economies' slower growth, particularly in the high-tech industry, and the GCC nations' lower demand for migrants are the major causes of this.

- Remittance growth is expected to be slower overall, with Latin America and the Caribbean having the highest growth while South Asia lags behind.

What are Remittances?

- Money transfers known as remittances are made by migrants to their friends and family back home.

- Many developing nations, especially those in South Asia, rely heavily on them as a source of income and foreign exchange.

- Remittances may boost economic growth, raise living standards, help healthcare and education, and combat poverty.

What are the global trends for remittances?

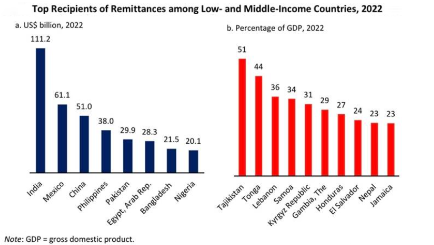

- India, Mexico, China, the Philippines, and Pakistan were the top five recipients of remittances in 2022.

- Remittance inflows of USD 656 billion are expected to reduce to 1.4% in 2023 to low- and middle-income countries (LMICs).

- Remittance growth in East Asia and the Pacific may slow down as a result of tight monetary policies, limited fiscal reserves, and global geopolitical event uncertainty.

- Remittances to Europe and Central Asia are expected to increase by 1%, with the high base effect, weakened flows to Russia and Ukraine, and a weakening Russian currency all having an impact.

- With falling oil prices, remittances to the Middle East and North Africa may recover, especially in nations like Egypt.

- East Asia and the Pacific, as well as Sub-Saharan Africa, are expected to see remittance growth rates of about 1% in 2023.

- Remittance inflows were crucial in helping nations like Tajikistan, Tonga, Lebanon, Samoa, and the Kyrgyz Republic cover their fiscal and current account deficits.

What are the factors influencing the flow of remittances to India?

Top Remittance Sources to India:

- In three high-income countries—the US, the UK, and Singapore—highly skilled Indian migrants account for around 36% of the country's remittances.

- In many areas, the post-pandemic recovery created a tight labour market, which resulted in wage increases that boost remittances.

- As a result of favourable economic conditions, particularly high energy costs and restrained food price inflation, other high-income destinations for Indian migrants, such as the GCC countries, saw a surge in remittance inflows.

Factors influencing Remittance Flows to India:

- Slower development in OECD economies:

- The Organisation for Economic Co-operation and Development (OECD) is a grouping of 38 democratic, high-income countries. High-skilled and high-tech Indian migrants, who make up roughly 36% of India's remittances, frequently choose these nations as their final destination.

- The World Bank anticipates that these economies' growth rates would slow from 3.1% in 2022 to 2.1% in 2023 and 2.4% in 2024.

- This may have an impact on the need for IT personnel and cause formal remittances to be diverted to unofficial money transfer methods.

- Less Demand for Migrants in GCC countries:

- GCC is a political and economic alliance of six Middle Eastern countries—Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman.

- Less skilled South Asian migrants, who provide around 28% of India's remittances, mostly migrate to these nations.

- According to the World Bank, these nations' growth will drop from 5.3% in 2022 to 3% in 2023 and 2.9% in 2024.

- The major cause of this is the drop in oil prices, which has hurt their government expenditure and fiscal revenues.

What steps may be taken to increase remittance inflow to India?

- Unified Payment Interface:

- Remittances may be made and received instantaneously with the use of real-time fund transfers enabled by UPI. Receivers now have speedier access to cash since the requirement for extended processing delays associated with traditional remittance method is eliminated.

- The National Payments Corporation of India (NPCI) began allowing NRIs who reside in ten different nations to utilise UPI in January 2023 using their foreign mobile numbers.

- The 10 countries are Singapore, Australia, Canada, Hong Kong, Oman, Qatar, the United Arab Emirates, Saudi Arabia, the United States, and the United Kingdom.

- Artificial Intelligence (AI)-Driven Risk Assessment:

- India can make use of AI algorithms to examine transactional patterns, detect possible fraud, and evaluate remittance transfer risk factors.

- This strategy can improve security and assist in the prevention of unlawful actions, assuring compliance with regulations.

- Integration with E-commerce Platforms:

- India may work with e-commerce sites to have remittance services included right into the sites.

- This improves financial inclusion and broadens the use of remittances by enabling recipients to use remittance funds for online purchases or bill payments.

Must Check: IAS Coaching Institute In Delhi