- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- NCERT- First Ladder

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- Current Affairs

- Indian Society and Social Issue

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

RBI’S FINANCIAL STABILITY REPORT, 2023

RBI’S FINANCIAL STABILITY REPORT, 2023

15-01-2024

Context

- The Reserve Bank of India (RBI) recently issued its biannual Financial Stability Report.

- The report indicates enhanced asset quality in the banking system, with the Gross Non-Performing Assets (GNPA) ratio hitting a seven-year low.

What is the Financial Stability Report?

- It's a biannual publication by RBI, assessing the nation's financial stability, incorporating inputs from all financial sector regulators.

- The report includes a Systemic Risk Survey (SRS) where experts evaluate the financial system across Global, Financial, Macroeconomic, Institutional, and General risks.

Significance of FSR

- Offers insights into the resilience or vulnerability of the financial system, especially banks, to economic changes.

- It helps gauge the capacity of banks and lending institutions to support future growth.

- High NPAs coupled with a high government fiscal deficit could pose challenges for both banks and the government.

Key Highlights of Report

- Gross NPA: Non-Performing Assets (NPA) are delayed loans and arrears from banks or financial institutions. GNPA ratio reached a seven-year low of 5% in September 2022. Macro-stress test assessed banks' resilience to unforeseen shocks.

- Capital to Risk (Weighted) Assets Ratio: CRAR is a bank's capital to risk-weighted assets and current liabilities ratio. The CRAR of 46 major banks is 15.8%, exceeding the 9% minimum requirement.

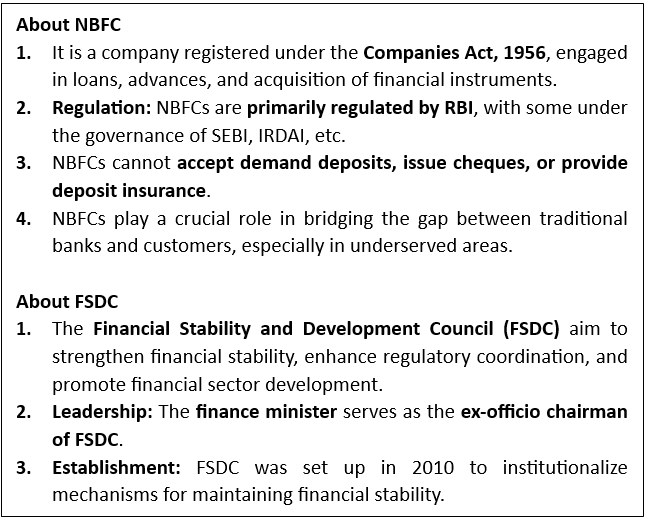

- Performance of NBFCs: A Non-Banking Financial Company (NBFC) deals in loans and advances. The NBFC sector rebounded after the second Covid wave, with improving asset quality.

- Financial Markets: Multiple shocks led to tightened financial conditions and increased volatility in financial markets.

- Insurance Sector: Solvency ratio for life and non-life insurance companies remained above the prescribed minimum level.

- Accelerated Credit Growth: Credit growth in the post-pandemic period has gained momentum, signifying economic recovery.