- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

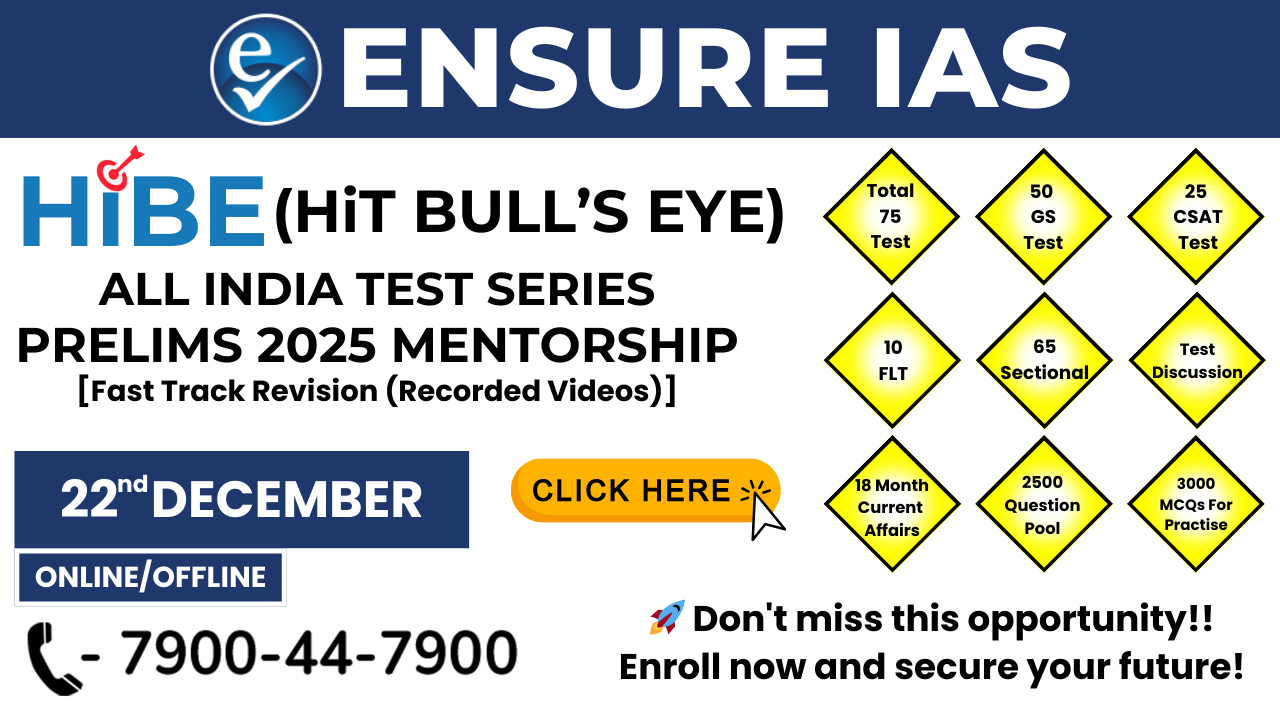

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

RBI Keeps Repo Rate Unchanged at 6.5% Amid High Inflation

RBI Keeps Repo Rate Unchanged at 6.5% Amid High Inflation

07-12-2024

1. Monetary Policy Review by the RBI

- On December 6, 2024, The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) decided to keep the repo rate at 6.5%. This is the 11th time in a row that the RBI has not changed the repo rate.

- The decision was made to control high inflation while considering the slowdown in the economy.

2. Reasons for Keeping Repo Rate Unchanged

- Even though inflation is high, the RBI chose not to change the rate to keep prices stable, which is one of its main goals.

- They want to bring inflation down to their 4% target.

- Inflation in October 2024 was 6.2%, the highest in 14 months.

- The GDP growth forecast for FY 2024-25 was revised down to 6.6% from 7.2%.

- In the 2nd quarter of FY 2024-25 (July–September), growth slowed to 5.4%, much lower than the RBI's earlier prediction of 7%.

3. Inflation and Growth Outlook

- Food inflation will continue to be a problem in the third quarter (Q3) of 2024-25, but is expected to ease in the 4th quarter (Q4) due to lower vegetable prices, new crops, and better harvests.

- The RBI Governor, Shaktikanta Das, mentioned that inflation could rise because of bad weather, global political issues, and market fluctuations.

4. Cash Reserve Ratio (CRR) Cut

- To help banks handle liquidity issues (lack of enough cash), the RBI decided to lower the Cash Reserve Ratio (CRR) for banks by 50 basis points to 4%.

- This is the 1st time in four years that the CRR has been cut.

- The cut will be done in two parts, 25 basis points each, starting from December 14, 2024, and December 28, 2024.

- This change will provide ₹1.16 lakh crore in cash to the banking system.

5. Neutral Stance Maintained

- The MPC agreed to keep a neutral stance, meaning they are focusing on long-term price stability and aligning inflation with the 4% target.

- Despite concerns about slower growth, the RBI Governor said it’s important to keep inflation under control for future economic stability.

6. FCNR(B) Deposit Ceiling Increase

- To attract more foreign money, the RBI raised the interest rate limits for FCNR(B) deposits (foreign currency deposits from non-residents).

- For deposits with a maturity of 1 year to less than 3 years, the limit has been raised to ARR + 400 bps (up from ARR + 250 bps).

- For deposits with 3 to 5 years maturity, the limit is now ARR + 500 bps (up from ARR + 350 bps).

- These changes will remain until March 31, 2025.

What is Repo Rate (Repurchase Rate)?

What is CRR (Cash Reserve Ratio)?

What is FCNR(B) Deposit Ceiling?

|

7. Conclusion

The main goal of the RBI is to control inflation while making sure the economy grows steadily. The RBI is being careful in making decisions, as it wants to better understand future trends in growth and inflation before making any more changes.

What is the Monetary Policy Committee (MPC)?

|