- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

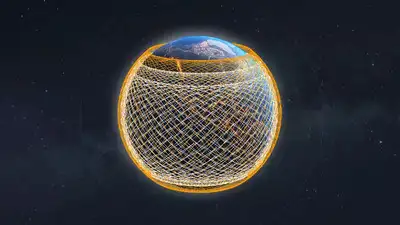

RBI Forms Committee for Ethical Enablement of AI in the Financial Sector

RBI Forms Committee for Ethical Enablement of AI in the Financial Sector

- In December 2024, The Reserve Bank of India (RBI) formed an 8-member committee of experts to develop a framework for the responsible and ethical enablement of artificial intelligence (AI) in the financial sector.

- The committee, named FREE-AI (Framework for Responsible and Ethical Enablement of AI), will be chaired by Pushpak Bhattacharyya, a professor in the Department of Computer Science and Engineering at IIT Bombay.

- The committee’s report is expected within 6 months from its first meeting.

Key Objectives of the Committee:

-

Developing an AI Framework for the Financial Sector:

- The committee will recommend a robust, comprehensive, and adaptable AI framework designed for the financial sector, ensuring ethical and responsible use of AI technologies.

-

Assessment of AI Adoption:

- The committee will assess the current level of AI adoption in financial services, both in India and globally.

- It will also review regulatory and supervisory approaches to AI in the financial sector worldwide.

-

Identifying AI Risks:

- The committee will identify any potential risks associated with AI in the financial sector.

- It will propose an evaluation, mitigation, and monitoring framework for addressing these risks, along with compliance requirements for financial institutions, including:

- Banks

- Non-bank finance companies (NBFCs)

- Fintechs

- Payment System Operators (PSOs)

-

Governance Framework for AI:

- The committee will recommend a governance framework for the responsible, ethical adoption of AI models and applications in the domestic financial sector.

Key Areas of Focus:

- AI in Financial Services: The committee will explore the use of AI in various aspects of financial services, from automated decision-making systems to fraud detection and personalized banking experiences.

- Global Practices: Reviewing the global landscape for AI in finance and understanding the regulatory approaches in developed financial markets, with a focus on ensuring that India’s AI adoption follows ethical guidelines.

- Risk Mitigation: Developing a structured framework for the identification, assessment, and mitigation of AI-related risks.

- This will include potential risks such as algorithmic bias, lack of transparency in decision-making, and data privacy concerns.

Expected Outcome of the Committee:

- Comprehensive AI Framework: A framework for responsible AI use that can be adopted by financial institutions like banks, NBFCs, fintech firms, and PSOs in India.

- Ethical Guidelines: Ethical guidelines that will guide the development and deployment of AI technologies in the financial sector, ensuring the protection of users' interests, data privacy, and transparency.

- Regulatory Recommendations: The committee will provide recommendations on regulatory compliance and supervision of AI adoption in the sector.

Committee's Timeline:

- The committee is expected to submit its final report within six months from the date of its first meeting.

- This report will serve as a blueprint for the ethical integration of AI technologies into the Indian financial system.

Significance of the Initiative:

- With the increasing use of artificial intelligence in the financial sector, ensuring the responsible and ethical use of these technologies is crucial to avoid risks like discrimination, bias, and lack of transparency.

- The formation of this committee by the RBI reflects the importance of AI governance and risk management in a rapidly digitizing financial ecosystem.

- The FREE-AI framework will play a pivotal role in shaping India's future AI policies in the financial services sector.

By creating this committee, the RBI aims to ensure that AI adoption in India’s financial sector is transparent, ethical, and responsible, with safeguards in place to prevent any misuse of the technology.

Differences between Banks, NBFCs, Fintechs, and PSOs

|

Banks |

(Non-Banking Financial Companies) |

Fintechs |

Payment System Operators (PSOs) |

|

Accept deposits, provide loans, and offer financial services like insurance, foreign exchange, etc. |

Provide loans, leases, asset financing, and investment services, but cannot accept demand deposits. |

Use technology to offer financial services such as lending, payments, insurance, and investments. |

Facilitate and operate payment systems (e.g., UPI, payment gateways). |

|

Regulated by Reserve Bank of India (RBI), under Banking Regulation Act. |

Regulated by RBI, under the RBI Act and other regulations for NBFCs. |

Regulated by RBI, Securities and Exchange Board of India (SEBI), and other regulators. |

Regulated by RBI, under the Payment and Settlement Systems Act. |

|

Can offer a wide range of loans (personal, home, business). |

Focus on lending (e.g., personal loans, auto loans, business loans), asset financing, and investment products. |

Digital lending, P2P lending, microloans, or consumer financing via apps. |

Not involved in lending activities. |

|

HDFC Bank, ICICI Bank, SBI, Axis Bank. |

Bajaj Finance, HDFC Ltd., Muthoot Finance, LIC Housing Finance. |

Paytm, PhonePe, Razorpay, LendingKart. |

RBI-approved systems like UPI, Paytm Payments Bank, Google Pay, Razorpay. |

|

Also Read |

|