- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- Online Program

- GS Recorded Course

- NCERT Batch

- Polity Module Course

- Geography Module Course

- Economy Module Course

- AMAC Module Course

- Modern India, Post Independence & World History Module Course

- Environment Module Course

- Governance Module Course

- Science & Tech. Module Course

- International Relations and Internal Security Module Course

- Disaster Management Module Course

- Ethics Module Course

- Essay Module Course

- Current Affairs Module Course

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

OPEC+ announces Cut in Oil Production

OPEC+ announces Cut in Oil Production

10-10-2022

OPEC+ announces Cut in Oil Production

Why in News?

Recently, the Organisation of the Petroleum Exporting Countries and its allies (OPEC+) has decided to cut oil production by almost 2 million barrels per day (bpd).

- This is the largest production cut by OPEC+ since the beginning of the Covid-19 pandemic.

- US in May 2022 passed the ‘No Oil Producing and Exporting Cartels (NOPEC) bill’, which is intended to protect US consumers and businesses from high oil prices.

So, What is OPEC+?

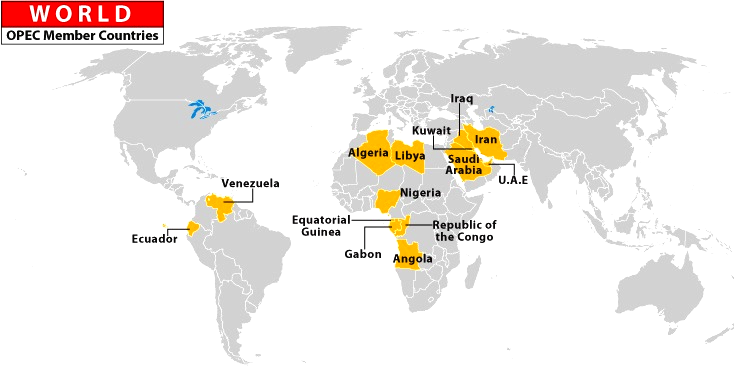

- OPEC was established in 1960 by countries like Iran, Iraq, Kuwait, Saudi Arabia and Venezuela.

- Then, OPEC has since expanded and now it has a total of 13 member countries.

- Member countries of OPEC are: Algeria, Angola, Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, United Arab Emirates, Venezuela.

- Qatar terminated its membership on 1st January 2019.

- The objective of OPEC is to “coordinate and unify the crude oil policies of its Member Countries” and to ensure the stabilisation of oil markets in order to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers and a fair return on capital for those investing in the crude oil industry.

- With the addition of another 10 allied major oil-producing countries, the OPEC becomes OPEC+.

- OPEC+ include 13 OPEC member countries and 10 new countries and these are: Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan and Sudan.

- OPEC gives the oil-producing nations a greater influence over the global crude oil market.

- As per a report, OPEC countries accounts for roughly 40 % of the world’s crude oil and 80 % of the global oil reserves.

- OPEC+ usually meet every month to determine how much oil the member states will produce. However, many allege that OPEC behaves like a ‘cartel’, determining the supply of oil and influencing its price in the world market.

Reasons for Cutting OIL Production are:

- Oil prices increased badly after Russia’s invasion of Ukraine and have since begun to soften over the past few months, before dropping sharply to under USD 90 per barrel in September,2022 due to fears of recession in Europe and reduced demands from China because of its lockdown measures.

- The reduction of oil production will boost prices and will be extremely beneficial for the OPEC+ member states.

- OPEC+ members are concerned that a slowing global economy will reduce the demand for oil, and the cut in oil production are seen as a way to protect profits.

- Increased oil prices, which first occurred during the invasion of Russia into Ukraine, have helped Saudi Arabia which is one of the founding members of OPEC, become 1 of the world’s fastest-growing economies.

- It is possible that Russia might be influencing OPEC+, to make it more expensive for the West to extend energy sanctions on Russia.

What can be its Impact?

1.Impact on India:

-

- India imports nearly 85% of its crude requirement. So, the oil import bill will rise after the rise in prices.

- The rise in import bills will not only lead to inflation and a rise in the Current Account Deficit (CAD) and fiscal deficit but will also lead to weakening of Indian rupee against the dollar.

- As per Investment Information and Credit Rating Agency (ICRA), for every $10 per barrel increase in the price of the Indian crude oil basket, the CAD could widen by almost $14-$15 billion, or 0.4% of GDP.

- On European Countries:

- Recently, the European Union has announced its plan to implement a price cap on oil imports from Russia.

- Under this plan, countries will only be permitted to purchase Russian oil and petroleum products transported via sea that are sold at or below the price cap.

- However, the recent decision to reduce the supply is likely to keep the global oil prices high, allowing Russia to continue aiming for significant revenue from its crude export.

- Impact on the U.S:

- This move will likely to have a big impact on the US, which has repeatedly asked the OPEC+ to increase oil production.

- Reduction in oil production and subsequently increased oil prices can be dangerous for the US, who is trying to reduce inflation rates before the midterm elections in November 2022.