- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Current Affairs Recoded Course

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

KARNATAKA'S TEMPLE TAX BILL

KARNATAKA'S TEMPLE TAX BILL

07-03-2024

The Karnataka Hindu Religious Institutions and Charitable Endowments (Amendment) Bill, 2024, passed in both the State Legislative Assembly and Council. It now awaits approval from the Governor.

- The Bill aims to amend provisions in the Karnataka Hindu Religious Institutions and Charitable Endowments Act (KHRI& CE), 1997.

Historical Background of State Regulation of Temples

- The British government's Religious Endowments Act of 1863 aimed to secularize temple management by transferring control to local committees.

- In 1927, the Justice Party enacted the Madras Hindu Religious Endowments Act, one of the earliest efforts by an elected government to regulate temples.

- The Law Commission of India recommended legislation in 1950 to prevent misuse of temple funds, leading to the enactment of The Tamil Nadu Hindu Religious and Charitable Endowments (TN HR&CE) Act, 1951.

- This act established the Department of Hindu Religious and Charitable Endowments to administer, protect, and preserve temples and their properties.

- The TN HR&CE Act faced a constitutional challenge before the Supreme Court in the Shirur Mutt case (1954). While the court upheld the law but it struck down some provisions.

- A revised TN HR&CE Act was passed in 1959 to address the court's concerns.

Key Highlights of the Bill

-

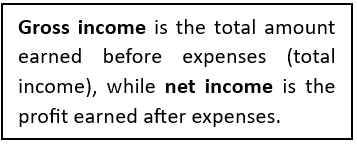

Alteration of Taxation System

- The Bill aims to change the taxation rules for Hindu temples.

- It proposes diverting 10% of gross income from temples earning over Rs 1 crore annually to a common pool for temple maintenance.

- Previously, 10% of net income was allocated for temples earning over Rs 10 lakh annually.

- Additionally, the Bill suggests allocating 5% of income from temples earning between Rs 10 lakh and Rs 1 crore to the common pool.

- These changes would generate an extra Rs 60 crore from 87 temples with incomes over Rs 1 crore and 311 temples with income exceeding Rs 10 lakh.

-

Utilisation of Common Fund

- The common fund can be used for religious studies, temple maintenance, and charity.

- The common fund pool was created in 2011 through amendments to the 1997 Act.

-

Composition of Committee of Management

- The bill proposed the addition of a member skilled in Vishwakarma Hindu temple architecture and sculpture to the temple "committee of management."

- Temples and religious institutions are required to form a nine-member ‘committee of management.’

- It includes a priest, a member of Scheduled Caste or Scheduled Tribe, two women, and a local member, as per Section 25 of the KHRI& CE 1997 Act.

-

Rajya Dharmika Parishat

- It empowered the Rajya Dharmika Parishat to appoint committee chairpersons and resolve religious disputes, manage temple affairs, and appoint trustees.

- Mandated (authorize) the formation of district and state committees to oversee infrastructure projects for temples with annual earnings exceeding Rs 25 lakh.

Management of Religious Institutions in India

-

Places of Worship Act, 1991

- Enacted to maintain the status of religious places as they were on August 15, 1947.

- Prohibits conversion of places of worship and ensures their religious character.

- Excludes (leaves) ancient monuments governed by the Ancient Monuments and Archaeological Sites and Remains Act, 1958.

-

Constitution of India

- Article 26 grants religious groups the right to establish and manage institutions for religious and charitable purposes.

- Allows them to manage their religious affairs and administer property.

- Muslims, Christians, Sikhs, and others use these rights to manage their institutions.

-

Shiromani Gurdwara Parbandhak Committee (SGPC)

- Manages Sikh Gurdwaras in India and abroad.

- Elected directly by Sikh voters above 18 years old, registered under the Sikh Gurdwaras Act, 1925.

-

Waqf Act of 1954

- Established the Central Waqf Council advising the Central Government on waqf administration.

- State Waqf Boards oversee mosques, graveyards, and religious waqfs.

- Ensures proper management and utilization of waqf properties and revenue.

- Waqf refers to the permanent dedication of properties for religious or charitable purposes recognized by Muslim Law.

Temple Revenue Management in Different States

-

Telangana's Approach

- Telangana's system is similar to Karnataka's, creating a ‘Common Good Fund’ under Section 70 of the Telangana Charitable and Hindu Religious Institutions and Endowments Act, 1987.

- Temples earning over Rs 50,000 annually must give 1.5% of their income to the state government.

- These funds are used for temple maintenance, renovations, religious schools, and building new temples.

-

Kerala's System

- Kerala manages temples mainly through state-run Devaswom (temple) Boards.

- The state has five autonomous Devswom Boards overseeing 3,000+ temples, with board members usually chosen by the ruling government.

- Each board gets a budget from the state government and isn't required to disclose revenue figures.

Must Check: Best IAS Coaching In Delhi