- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- Online Program

- GS Recorded Course

- NCERT Batch

- Polity Module Course

- Geography Module Course

- Economy Module Course

- AMAC Module Course

- Modern India, Post Independence & World History Module Course

- Environment Module Course

- Governance Module Course

- Science & Tech. Module Course

- International Relations and Internal Security Module Course

- Disaster Management Module Course

- Ethics Module Course

- Essay Module Course

- Current Affairs Module Course

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

INTERIM BUDGET 2024

INTERIM BUDGET 2024

"Viksit Bharat by 2047”

On 1 February 2024, finance minister Nirmala Sithamran presented her 6th budget.

- Her budget speech was all of 5,244 words and shorter in comparison to the 5 speeches she gave before this one.

Vision and Development Mantra

- Vision: The goal is to build a prosperous India that balances economic growth with natural harmony, offering modern infrastructure and equal opportunities for everyone.

- Development Mantra: "Sabka Saath, Sabka Vikas" (Together with All, Development for All) is the guiding principle, promoting comprehensive development.

Key Strategies

- The strategy emphasizes unity in India's diverse demography, democratic values, and diverse cultures, supported by a collective effort termed "Sabka Prayas" (Everyone's Effort).

- The document envisions a fully developed India by the year 2047.

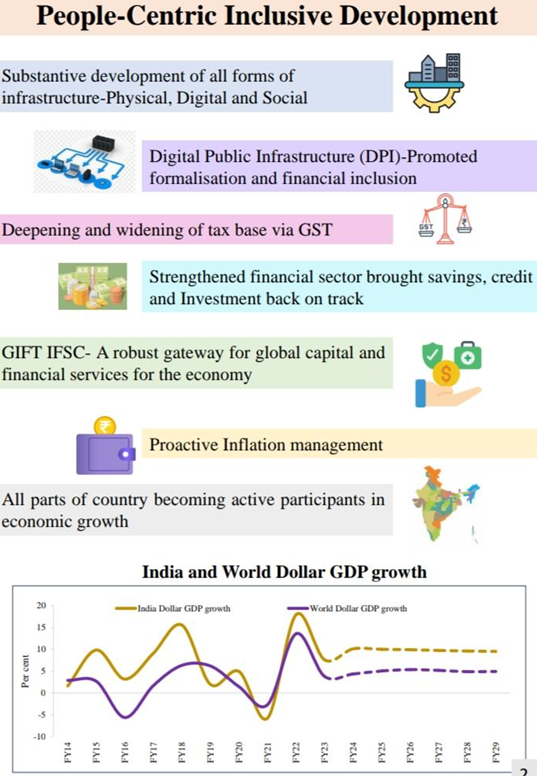

People-Centric Inclusive Development

- Focus on enhancing all types of infrastructure: physical, digital, and social.

- Promotion of Digital Public Infrastructure (DPI) to support formalization and financial inclusion.

- Expansion and deepening of the tax base with the Goods and Services Tax (GST).

- Efforts to strengthen the financial sector to revitalize savings, credit, and investment.

Economic Initiatives

- GIFT IFSC (Gujarat International Finance Tec-City International Financial Services Centre): Designed as a major hub for global capital and financial services.

- Active measures for inflation management to maintain economic stability.

Participation and Growth

- Encouraging all parts of the country to engage actively in economic growth.

Economic Indicators

- The graph compares India's GDP growth in dollars with the world's dollar GDP growth, indicating trends and projections.

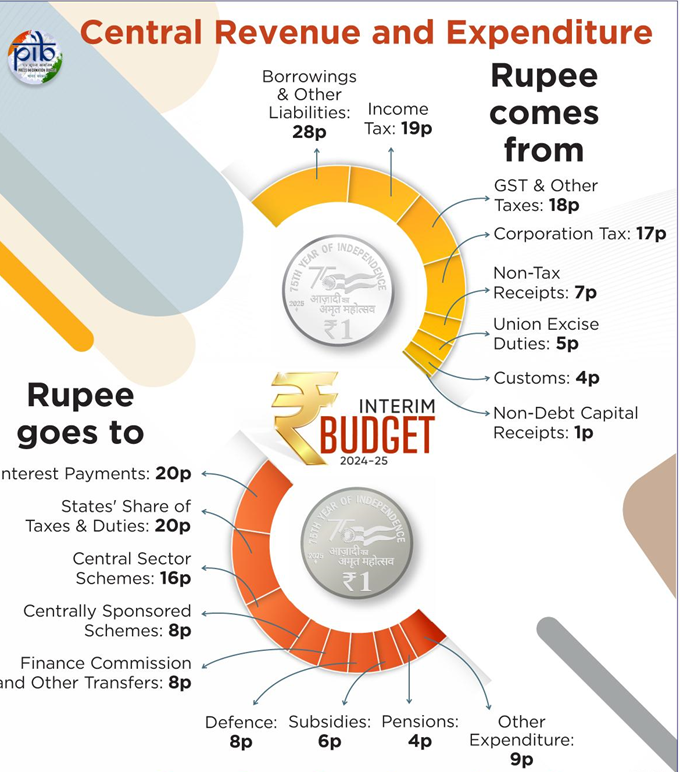

1. Budget Size:

The total size of the budget is 47.66 lakh crore.

2. Gross Tax Revenue:

The total gross tax revenue is 38.31 lakh crore, which is the sum of different taxes collected by the government.

Breakdown of Gross Tax Revenue:

- GST: 10.68 lakh crore

- Union Excise Duties: 3.19 lakh crore

- Customs: 2.31 lakh crore

- Taxes on Income: 11.56 lakh crore

- Corporation Tax: 10.43 lakh crore

- Others (including taxes on Union Territories): 0.14 lakh crore

3. Net Tax Receipts:

- After transferring the State's share and adding other taxes, the net tax receipts are 26.02 lakh crore.

4. Non-Tax Revenue:

- The total non-tax revenue is 4.00 lakh crore, which includes income not generated from taxes.

Breakdown of Non-Tax Revenue:

- Interest Receipt: 0.33 lakh crore

- Dividend & Profit: 1.5 lakh crore

- Others: 2.17 lakh crore

5. Capital Receipts:

- The total capital receipts amount to 17.64 lakh crore.

Breakdown of Capital Receipts:

- Debt Receipts: 16.85 lakh crore (which includes market loans and other debts)

- Non-Debt Capital Receipts: 0.79 lakh crore (which could include proceeds from the sale of capital assets or recovery of loans)

6. Other Financing Sources:

- Small Savings & State Provident Fund & Others: 4.57 lakh crore

- Market Loans: 12.28 lakh crore

- National Small Savings Fund (NSSF) and Other Receipts: 0.79 lakh crore

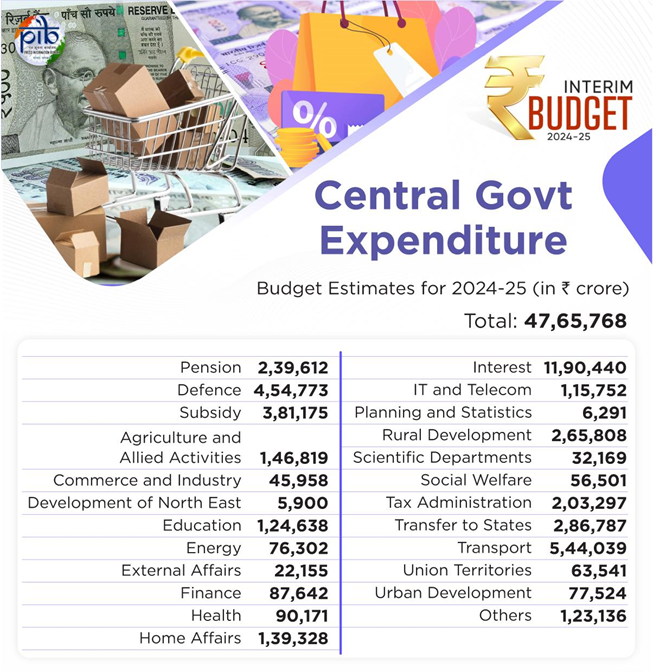

Indian government's expenditure profile in lakh crore. It breaks down the budget allocation into various categories:

1. Scheme Expenditure (19.96 lakh crore):

- Central Sector Schemes: 14.94 lakh crore.

- Centrally Sponsored Schemes: 5.02 lakh crore.

2. Economic Services (7.88 lakh crore):

Includes spending on general economic services and various subsidies.

Subsidy:

- Fertilizer: 1.64 lakh crore.

- Food: 2.05 lakh crore.

- Petroleum: 0.12 lakh crore.

- Others: 0.28 lakh crore.

- General Services: 2.15 lakh crore.

- Social Services: 0.47 lakh crore.

- Others: 0.35 lakh crore.

3. Transfers, Establishment, and Other Expenditure (27.70 lakh crore):

Establishment Expenditure: 7.68 lakh crore, which includes:

- Salary: 1.59 lakh crore.

- Pension: 2.40 lakh crore.

- Interest Payment: 11.90 lakh crore.

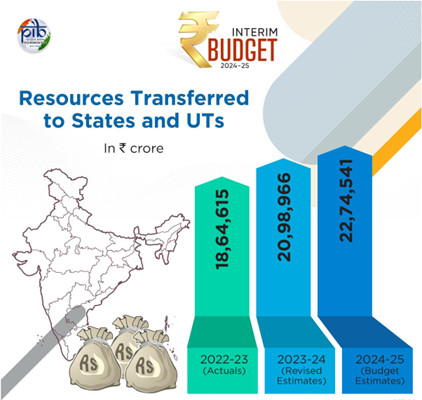

- Transfers to States: 4.82 lakh crore.

- Finance Commission Transfers: 1.32 lakh crore.

- Other Transfers: 3.50 lakh crore.

- Other Central Expenditure: 15.19 lakh crore, which includes spending on autonomous bodies (1.29 lakh crore) and others (2.0 lakh crore).

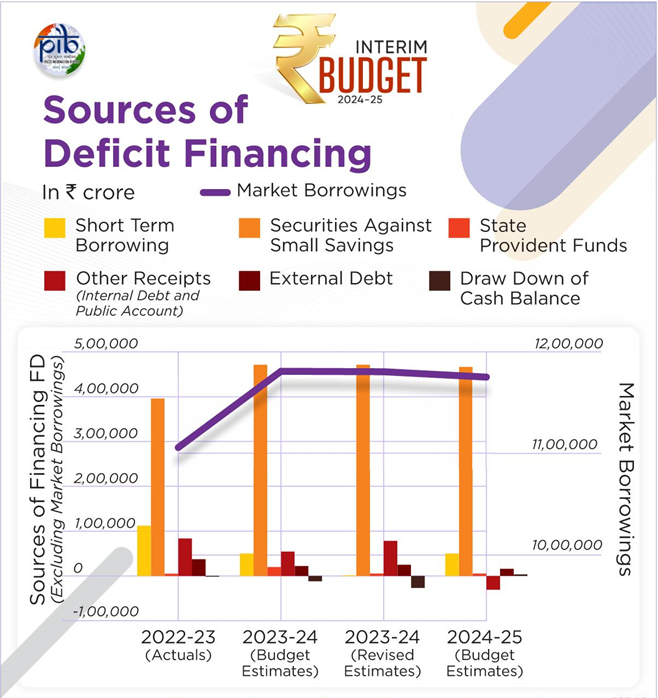

Information on India’s deficit statistics and the sources of financing the fiscal deficit.

1. Fiscal Deficit:

This is the difference between the government's total income and total expenditure. It is reducing over the years, with a projection of ₹16,85,494 crore for 2024-2025, which is lower than previous years.

2. Revenue Deficit:

Indicates the shortfall of the government's revenue compared to its revenue expenditure. It shows a decreasing trend, suggesting improving revenue management.

3. Effective Revenue Deficit:

This is the revenue deficit adjusted for grants for the creation of capital assets. A decreasing effective revenue deficit is a positive sign, implying that the government's revenue is getting closer to covering its operational expenses.

4. Primary Deficit:

The fiscal deficit minus interest payments. It is significantly lower for the year 2024-2025, indicating the government's plan to reduce its borrowing needs excluding interest obligations.

Sources of Financing Fiscal Deficit:

1. Debt Receipts (Net): Represents the net amount that the government borrows. It’s a major part of how the fiscal deficit is financed.

2. Market Borrowings: Borrowing from the market, usually through government securities. It is a significant source of deficit financing, showing an increasing trend.

3. Short-term Borrowing: Money borrowed for a short period, often within a year. There’s a large increase projected for 2024-2025.

4. Securities against Small Savings: Loans taken against the collected small savings. An increase is also projected for 2024-2025.

5. State Provident Funds: Funds from state employee savings. There's an expected decrease in 2024-2025.

6. Other Receipts (Internal Debts and Public Account): Other forms of income including internal debts. The figures show variability across the years.

7. External Debt: Borrowings from outside India. It is relatively small compared to other sources.

8. Drawdown of Cash Balance: The use of the government's cash reserves. This figure fluctuates, with a notable drawdown in 2023-2024.

This presents a detailed financial picture of how the Indian government plans to manage its budget deficit, highlighting reliance on market borrowings, adjustments in provident funds usage, and a strategic approach to utilizing cash balances.

Government's finances, particularly focusing on receipts (money received) and expenditures (money spent) over two fiscal years (2022-23 and 2023-24).

1. Revenue Receipts: (Earnings) : Revenue Receipts are the money the government gets from taxes and other sources without borrowing. There's a planned increase each year.

Non Tax Revenue: Income from sources other than taxes, like profits from public sector enterprises, also shows an upward trend.

- 2022-23 (Actuals): The government received 23.8 lakh crore.

- 2023-24 (Budget Estimate, BE): They expected to receive 26.3 lakh crore.

- 2023-24 (Revised Estimate, RE): The estimate was revised to 27.0 lakh crore.

- 2024-25 (BE): The government plans to receive 30.0 lakh crore.

2. Capital Receipts: (Investments and Loans) Capital Receipts are mainly from loans or selling government assets. The government expects to receive less in 2024-25 compared to 2022-23.

- 2022-23 (Actuals): The government received 18.1 lakh crore.

- 2023-24 (BE): They expected to receive 18.7 lakh crore.

- 2023-24 (RE): The estimate was revised down to 17.9 lakh crore.

- 2024-25 (BE): They plan to receive 17.6 lakh crore.

3. Revenue Expenditure: Revenue Expenditure is the money spent on running government services and providing grants. It's increasing every year.

- 2022-23 (Actuals): The government spent 34.5 lakh crore.

- 2023-24 (BE): They budgeted to spend 35.0 lakh crore.

- 2023-24 (RE): The estimate was revised to 35.4 lakh crore.

- 2024-25 (BE): They plan to spend 36.5 lakh crore.

4. Effective Capital Expenditure:Effective Capital Expenditure is the money spent on long-term investments like infrastructure. It fluctuates but is generally increasing.

- 2022-23 (Actuals): The government spent 10.5 lakh crore.

- 2023-24 (BE): They budgeted to spend 13.7 lakh crore.

- 2023-24 (RE): The estimate was revised to 12.7 lakh crore.

- 2024-25 (BE): They plan to spend 15.0 lakh crore.

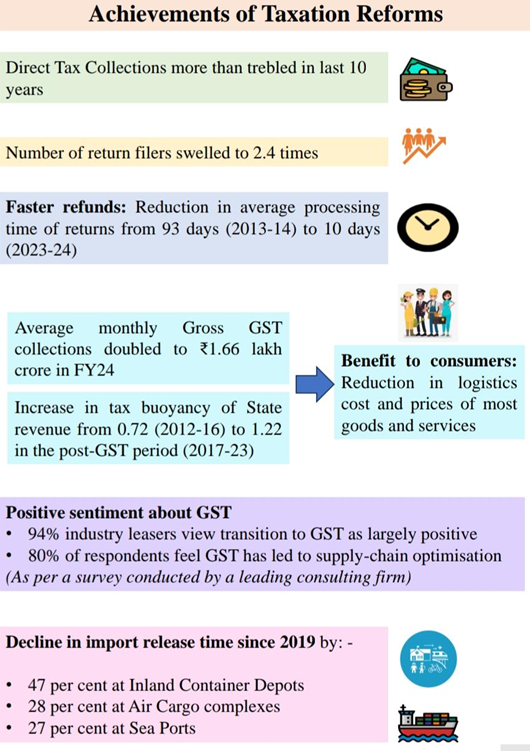

"Achievements of Taxation Reforms"

Direct Tax Collections

- Collections have increased more than threefold over the last 10 years.

- The number of tax return filers has grown to 2.4 times.

Faster Refunds and GST Impact

- Processing time for tax returns has dropped from 93 days in 2013-14 to 10 days in 2023-24.

- Monthly Gross GST collections have doubled to ₹1.66 lakh crore in the financial year 2024.

- Tax buoyancy of state revenue has improved significantly after the implementation of GST.

Consumer Benefits and Sentiments

- GST has led to reduced logistics costs and lower prices for many goods and services.

- Industry leaders (94%) and respondents (80%) acknowledge GST's positive impact and its role in optimizing the supply chain.

Import and Export Efficiency

- Since 2019, there's been a significant reduction in import release times at container depots, air cargo complexes, and sea ports.

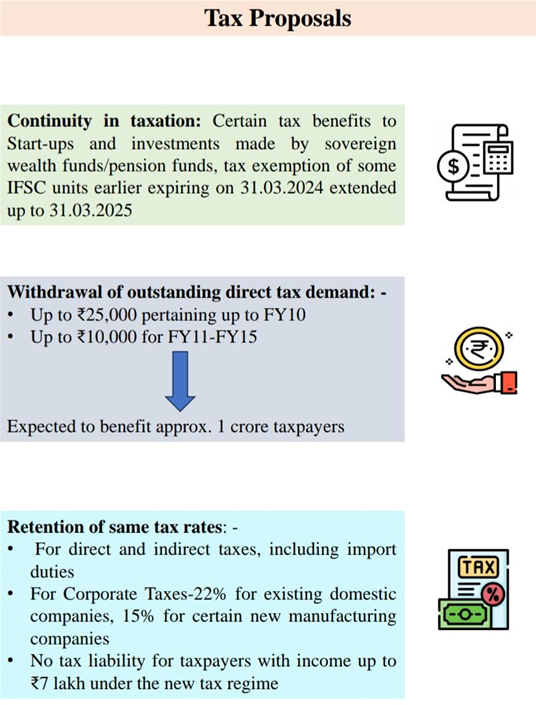

Tax Proposals

- Continuity in taxation: Extension of certain tax benefits for start-ups and foreign investments.

- Withdrawal of outstanding direct tax demand: Relief for tax demands up to ₹25,000 for FY10 and up to ₹10,000 for FY11-FY15, benefiting around 1 crore taxpayers.

- Retention of tax rates: No change in direct and indirect tax rates; corporate tax rates remain at 22% for domestic companies and 15% for new manufacturing firms.

- Tax exemption: No tax for individuals earning up to ₹7 lakh under the new tax regime.

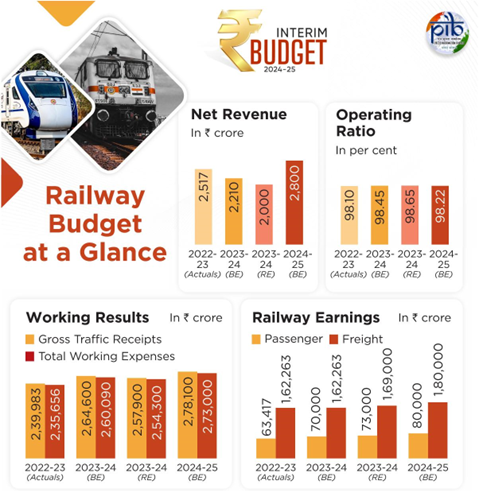

"Allocation for Specific Ministries": Budget Allocations (in ₹ Lakh Crore)

- Ministry of Defence: The highest allocation with 6.2 lakh crore, reflecting the country's focus on national security and defense capabilities.

- Ministry of Road Transport and Highways: Receives 2.78 lakh crore, indicating significant investment in developing and maintaining the road network.

- Ministry of Railways: Allotted 2.55 lakh crore, showcasing the emphasis on improving the railway infrastructure.

- Ministry of Consumer Affairs, Food & Public Distribution: With an allocation of 2.13 lakh crore, this reflects the government's commitment to consumer rights and food distribution for public welfare.

- Ministry of Home Affairs: Given 2.03 lakh crore, underlining the importance of internal security and administration.

- Ministry of Rural Development: Receives 1.77 lakh crore, focusing on the progress and development of rural areas.

- Ministry of Chemicals and Fertilizers: Allotted 1.68 lakh crore, likely to support the chemical industry and fertilizer provision for agriculture.

- Ministry of Communications: With 1.37 lakh crore, this allocation is aimed at enhancing communication services.

- Ministry of Agriculture and Farmer's Welfare: Receives 1.27 lakh crore, indicating support for agricultural development and farmer welfare.

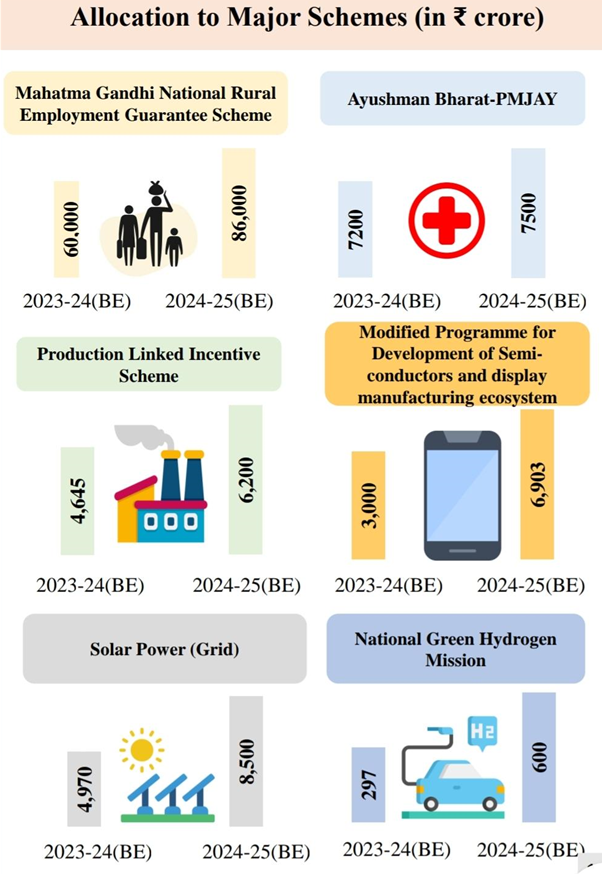

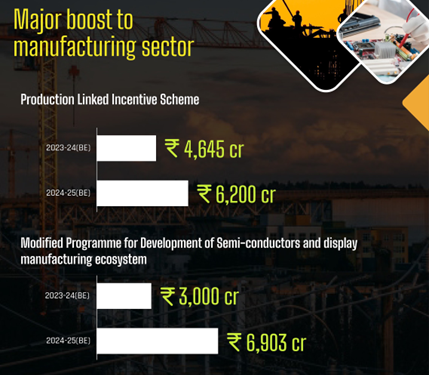

Allocation of funds to major schemes in India for the years 2023-24 (Budget Estimate, BE) and 2024-25 (BE).

1. Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS):

- 2023-24 (BE): ₹60,000 crore allocated.

- 2024-25 (BE): ₹86,000 crore allocated.

2. Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana (PMJAY):

- 2023-24 (BE): ₹72,000 crore allocated.

- 2024-25 (BE): ₹75,000 crore allocated.

3. Production Linked Incentive Scheme:

- 2023-24 (BE): ₹4,645 crore allocated.

- 2024-25 (BE): ₹6,200 crore allocated.

4. Modified Programme for Development of Semiconductors and display manufacturing ecosystem:

- 2023-24 (BE): ₹3,000 crore allocated.

- 2024-25 (BE): ₹6,900 crore allocated.

5. Solar Power (Grid):

- 2023-24 (BE): ₹4,070 crore allocated.

- 2024-25 (BE): ₹8,500 crore allocated.

6. National Green Hydrogen Mission: Received largest allocation

- 2023-24 (BE): ₹297 crore allocated.

- 2024-25 (BE): ₹19,700 crore allocated.

Analysis of Budget Allocation to Foreign Governments

The Indian government has allocated a total of ₹5,700 crore in the 2024 budget as loans and grants to various foreign governments.

- Bhutan: The largest allocation with ₹2,398.97 crore, reflecting strong bilateral ties and strategic interests.

- Maldives: Receives ₹770.90 crore, indicating a focus on enhancing relations and possibly on strategic maritime interests.

- Nepal: Given ₹650 crore, which is likely aimed at maintaining friendly relations and development assistance.

- Myanmar: ₹370 crore allocated, possibly for fostering stability and development in the bordering region.

- Mauritius: ₹330 crore, reflecting historical ties and cooperation in the Indian Ocean region.

- Afghanistan: ₹220 crore, potentially for humanitarian or reconstruction efforts.

- Bangladesh: ₹130 crore, showcasing continued support and strengthening of neighborhood relations.

- Sri Lanka: ₹60 crore, likely as part of aid during economic challenges or to maintain diplomatic ties.

- Seychelles: ₹9.91 crore, indicating a small but significant investment in island nation partnerships.

- Mongolia: ₹5 crore, a modest amount likely aimed at diplomatic relations.

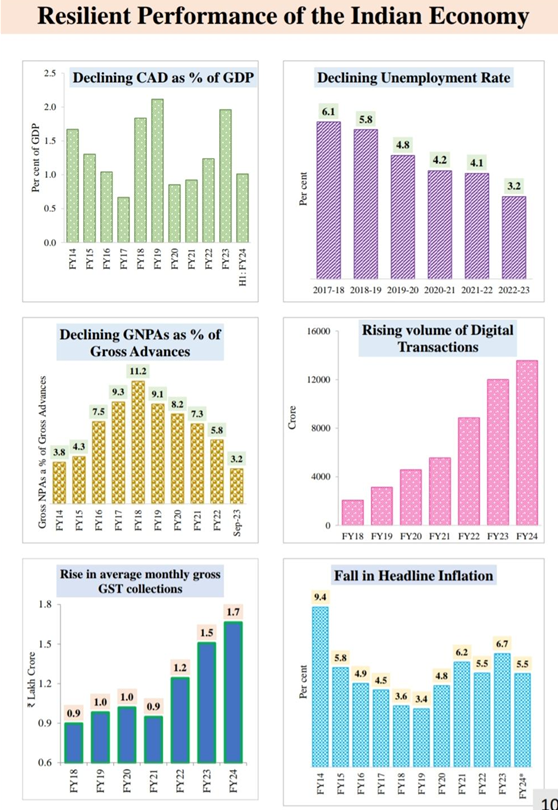

Resilient Performance of the Indian Economy

1. Declining CAD as % of GDP: The Current Account Deficit (CAD) as a percentage of GDP has been decreasing over the years. It started at above 2% in FY14 and dropped to around 1% by H1 FY23, indicating an improvement in the country's trade balance.

2. Declining Unemployment Rate: The unemployment rate has been falling over the years:

- 2021-22: 4.1%

- 2022-23: 3.2%

This trend shows that more jobs are being created, or more people are engaged in gainful employment.

3. Declining GNPAs as % of Gross Advances: The percentage of Gross Non-Performing Assets (GNPAs) in the banking system has been decreasing, indicating an improvement in the quality of the bank's loan assets:

- FY22: 5.8%

- H1 FY23: 3.2%

This shows the banking sector's improving capacity to recover loans.

4. Rising Volume of Digital Transactions: There has been a significant increase in digital transactions:

- FY22: Close to 12,000 crore

- FY23: Over 14,000 crore

- FY24: The volume is projected to increase further.

This reflects the growing comfort and trust in digital financial services.

5. Rise in Average Monthly Gross GST Collections: Monthly GST collections have shown an upward trajectory, indicating improved tax collection efficiency and compliance:

- FY22: 1.2 lakh crore

- FY23: 1.5 lakh crore

- FY24: Projected to rise to 1.7 lakh crore.

6. Fall in Headline Inflation: The rate of inflation has generally been on a declining trend, although with some ups and downs:

- FY21: 6.2%

- FY22: 5.5%

A lower inflation rate suggests that price rise is under control, which is crucial for economic stability. These data points give an insight into the economic health of India, showing positive trends in trade, employment, banking, digital economy, tax collection, and inflation control.

Viksit Bharat by 2047

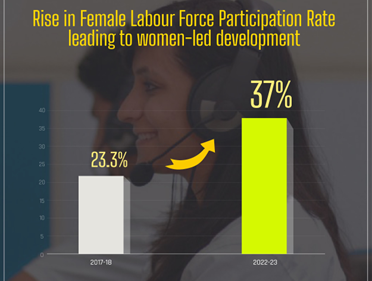

Momentum to Nari Shakti

- 30 crore Mudra Yojana loans disbursed to women entrepreneurs

- Female enrolment in higher education increased by 28 per cent in 10 years

- Female constitute 43 per cent of enrolment in STEM courses, one of the highest in the world

- 1 crore women assisted by 83 lakh SHGs to become Lakhpati Didis

Welfare of Farmers-Annadatas

- Direct financial assistance to 11.8 crore farmers under PM-KISAN

- Crop Insurance to 4 crore farmers under PM Fasal Bima Yojana

- Integration 1,361 mandis under e-NAM, supporting trading volume of ₹3 lakh crore

- Increased procurement of Wheat and Rice in the year 2023-24

Empowering Amrit Peedhi, the Yuva

- 1.4 crore youth trained under Skill India Mission

- 43 crore loans sanctioned under PM Mudra Yojana

- Number of AIIMS increased from 7 in 2014 to 22 in 2022

- IITs increased from 16 in 2014 to 23 in 2023

Garib Kalyan, Desh ka Kalyan

- DBT of ₹34 lakh crore using PM-Jan Dhan accounts; 2.7 lakh crore saved due to avoidanace of leakages

- Credit assistance to 78 lakh street vendors under PM-SVANidhi, out of which 2.3 lakh received credit for the third time

Sunrise Technologies

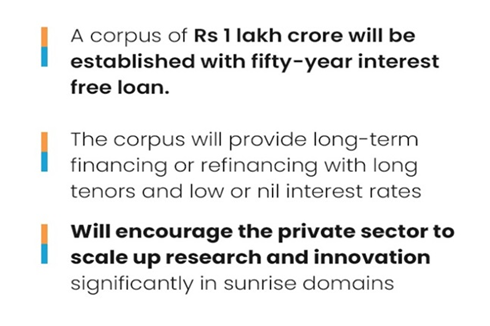

During the Interim Budget 2024-25 presentation, Finance Minister Nirmala Sitharaman revealed a plan to create a corpus of Rs 1 lakh crore. The goal is to encourage private investment in sunrise technologies and usher in a "golden era for our tech-savvy youth”.

Boost to Agriculture and Food Processing

- Application of Nano-DAP to be expanded in all agro-climatic zones

- Atmanirbhar Oilseeds Abhiyaan to be formulated to achieve atma nirbharta for oilseeds

- Allocation for PM-Formalisation of Micro Food Processing Enterprises scheme increased from 639 crore in 2023-24 to ₹880 crore in 2024-25

Inclusive Development across sectors

- Enrolments under PMJJBY in Aspirational Districts increased from 1737 per lakh population in 2018 to 13195 per lakh population in October 2023

- Health cover under Ayushman Bharat scheme to be extended to all ASHA, Angawadi workers & helpers

- PM Awas Yojana (Grameen) close to achieving target of 3 crore houses; additional 2 crore targeted for next 5 years

- PMJJBY: Pradhan Mantri Jeevan Jyoti Bima Yojana

Infrastructure and Investment

- Increase in Capital Expenditure by 11.1% to 1,11,111 cr

- FDI Inflow doubled from 298 USD Billion during 2005-14 to 596 USD Billion during 2014-23

- Length of National highways increased from 97,991 kms in FY15 to 1,44,634 kms in FY22

- Electrified rail route more than doubled, from 22,224 kms in FY15 to 50,394 kms in FY22

Sustainable Development

- New scheme of biomanufacturing and bio-foundry to be launched to support environment friendly alternatives

- Adoption of e-buses for public transport

- Increase in non-fossil fuel installed electricity capacity from 32.3% in 2014 to 43.9% in 2023

Rooftop solarization

- 1 cr households will be able to get up to 300 units free electricity every month

- Savings up to 15 to 18 thousand rupees annually for households

Rise in Female Labour Force Participation Rate leading to women-led development

Resilient Performance of the Indian Economy

- Unemployment Rate declined from 6.1% in 2017-18 to 3.2% in 2022-23

- GNPAS as % of Gross Advances declined from 11.2% in FY18 to 3.2% in Sept 23

- More than six fold increase in Digital Transactions from FY18 to FY24

- Rise in average monthly gross GST collections from 0.9 lakh cr in FY18 to 1.7 lakh cr in FY24

- Headline Inflation moderated to 5.5% in FY24

Research & Innovation for catalyzing development

- A corpus of rupees one lakh crore to be established with fifty-year interest free loan for boosting private investment in sunrise technologies

- A new scheme to be launched for strengthening deep-tech technologies for defence purposes and expediting 'atma nirbharta’

Railways

- Three major economic railway corridor programmes will be implemented

- Energy, Mineral and Cement Corridors

- Port Connectivity Corridors

- High Traffic Density Corridors

- 40,000 normal rail bogies will be converted to the Vande Bharat standards

People-Centric Inclusive Development

- Multipronged economic management

- Robust gateway for global capital and financial services via GIFT IFSC

- Proactive Inflation management

- Active participation in economic growth of all regions of the country

- Deepening and widening of tax base via GST

People-Centric Inclusive Development

- Multipronged economic management

- Substantive development of Physical, Digital and Social infrastructure

- Promoted formalisation and financial inclusion via Digital Public Infrastructure

- Savings, credit and Investment back on track by strengthening of financial sector

Indian Economy maintaining robust Macroeconomic Fundamentals

- India's Real GDP projected to grow at 7.3 per cent in FY 2023-24

- Fiscal deficit to reduce below 4.5 per cent by 2025-26

- Capital Expenditure outlay for the next year increased by 11.1 per cent to Rs. 11,11,111 crore

- Allocation of Rs. 1.3 lakh crore in BE 2023-24 towards fifty-year interest free loans to the states to boost capital expenditures

Green Energy Moving towards commitment of 'Net-zero' by 2070

- Viability gap funding for offshore wind energy for initial capacity of one giga-watt

- Coal gasification & liquefaction capacity of 100 MT to be set up by 2030

- Phased mandatory blending of compressed biogas (CBG) in compressed natural gas (CNG) for transport and piped natural gas (PNG) for domestic purposes

- Financial assistance to be provided for procurement of biomass aggregation machinery

Focus on a more comprehensive 'GDP”

- 'Governance, Development and Performance'

- Transparent, accountable, people-centric and trust-based administration

- Macro-economic stability and all-round development in all sectors

- Increasing average real income, empowerment of people and timely delivery of programmes

Enhancing Tourism across the nation

- A framework for rating iconic tourist centres based on quality of facilities & services to be established

- Long-term interest free loans to be provided to states to encourage comprehensive development of tourist centres

- Projects for port connectivity, tourism infrastructure, and amenities to be taken up in islands, including Lakshadweep