- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

India's Balance of Payments

India's Balance of Payments

16-08-2024

- In July 2024, the Reserve Bank of India (RBI) released data indicating that India's current account recorded a surplus in the fourth quarter (January-March) of the 2023-24 financial year.

- This marks the first surplus after 11 consecutive quarters of deficits.

- This surplus highlights the importance of India's Balance of Payments (BoP), highlighting its role in influencing currency exchange rates, sovereign credit ratings, and overall economic health.

About the Balance of Payments (BoP)

- The Balance of Payments (BoP) is a key economic indicator that includes all financial transactions between India and other countries.

- It serves as a comprehensive record of the money flowing in and out of the country, with inflows recorded as positive and outflows as negative.

- The BoP reflects India's economic exchanges with the global economy and is crucial in assessing the relative demand for the rupee against foreign currencies, thereby affecting exchange rates and economic stability.

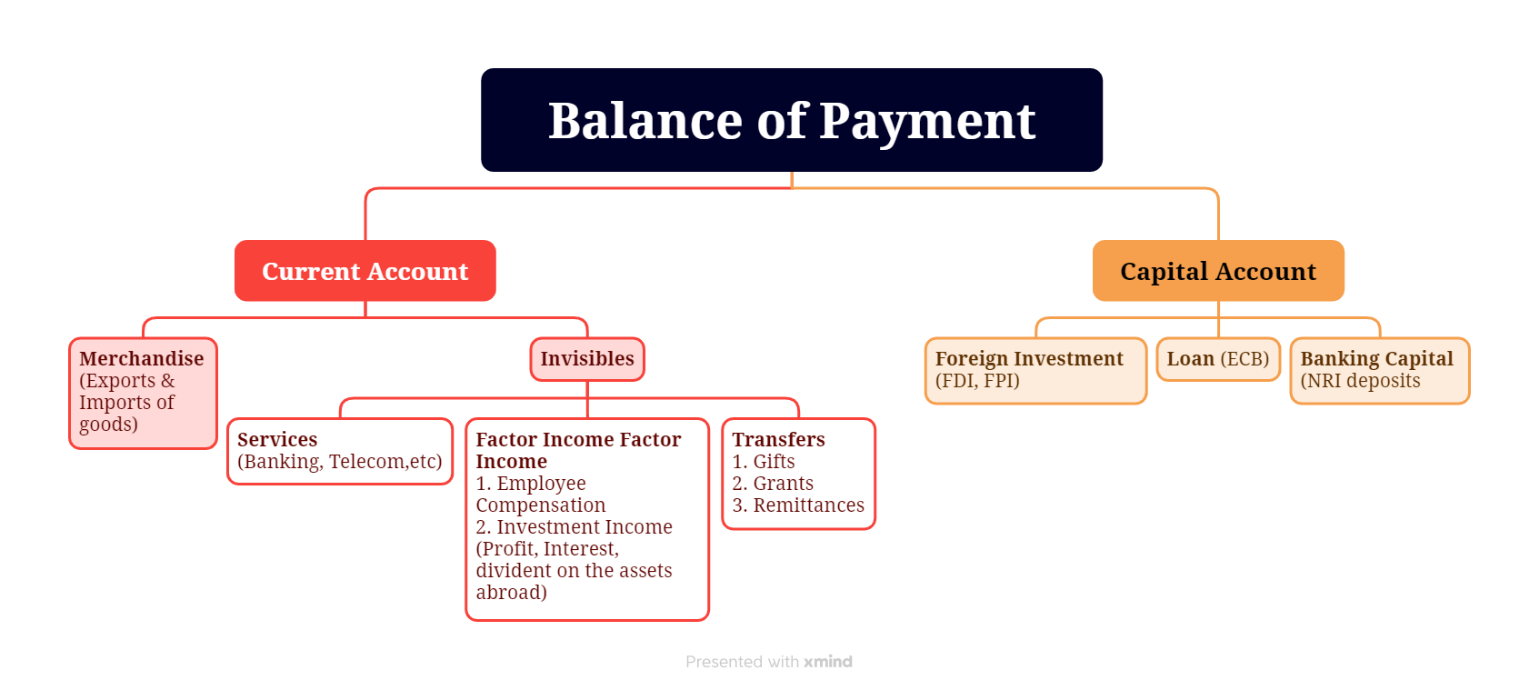

Components of the Balance of Payments

- Current Account:

- Trade of Goods: This component tracks the physical imports and exports of goods, providing insights into the balance of trade. A deficit occurs when imports exceed exports.

- Trade of Services (Invisibles): This includes sectors such as Information Technology (IT), tourism, and remittances. Despite deficits in the trade of goods, these sectors contribute positively to India's current account.

- In the fourth quarter of 2023-24, India recorded a current account surplus due to gains in services (invisibles), although there was a deficit in the trade of goods.

- Capital Account:

- Investment Flows: The capital account records investments such as Foreign Direct Investment (FDI) and Foreign Institutional Investments (FII), which are vital for economic growth and stability.

- It also includes other financial flows such as commercial borrowings, banking transactions, investments, loans, and capital flows.

- In the fourth quarter of 2023-24, India registered a net surplus of USD 25 billion in the capital account.

Disequilibrium

- A disequilibrium in the balance of payments occurs when there is either a surplus or deficit.

- A BoP surplus indicates that a country's income from exports, services, and investments surpasses its expenditures on imports and external commitments.

- Conversely, a deficit shows that expenses exceed earnings, leading to the need for external financing or the sale of assets to bridge (fill) the gap.

Challenges

- The complexity of accurately recording international transactions can lead to errors and omissions in BoP calculations.

- Continuous deficits may pose a risk to economic stability, potentially leading to a reliance on external borrowing or assistance from global financial institutions like the International Monetary Fund (IMF).

- It's important to note that deficits are not always harmful, nor are surpluses always beneficial.

- For example, a deficit could represent strategic investments, while a surplus might result from reduced imports rather than a strong economy.

Managing Balance of Payment (BoP)

- Foreign Exchange Reserves: The Reserve Bank of India (RBI) manages fluctuations in the BoP by adjusting foreign exchange reserves through market interventions.

- This management also involves tools such as adjusting interest rates, conducting open market operations, and influencing borrowing and spending.

- Open Market Operations (OMOs) are a monetary policy tool used by the Reserve Bank of India (RBI) to regulate the money supply in the economy.

- Policy Interventions: Governments introduce trade policies and regulatory measures to maintain a stable BoP, which is essential for sustainable economic growth.

- Deflation: Deflation involves intentionally reducing the money supply or aggregate demand, potentially leading to lower domestic prices.

- This can increase the competitiveness of exports and reduce consumption, including imports. However, deflation carries risks such as economic slowdown, recession, and higher unemployment rates.

- Foreign Investment Promotion: Promoting foreign investment is a strategy to strengthen the capital account.

- This can be achieved through tax incentives, improving infrastructure, creating a favourable business environment, and streamlining regulations for foreign businesses.

- These actions can attract foreign capital and technology, potentially boosting export capacity.