- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

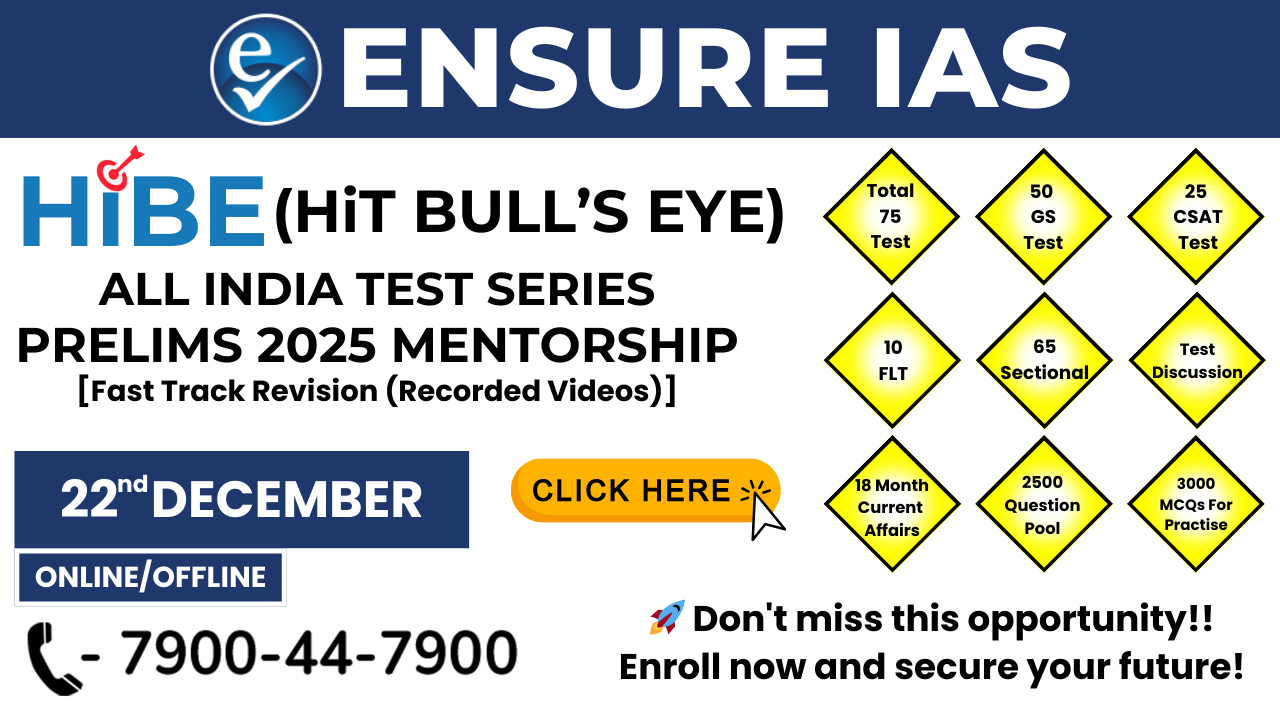

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

GST on Used Car Sales

GST on Used Car Sales

25-12-2024

- In December 2024, The Goods and Services Tax (GST) on used vehicle sales was clarified by the GST Council and is crucial for businesses and individuals involved in the purchase and sale of vehicles.

- The revised rate, announced at the 55th GST Council meeting, applies to all old and used vehicles, including electric vehicles (EVs), sold by registered businesses.

- However, individuals who are not registered under GST remain unaffected by this change.

Background :

- The GST Council, chaired by Finance Minister Nirmala Sitharaman, has approved a significant hike in the tax rate for used cars, including electric vehicles (EVs).

- The GST on the sale of second-hand vehicles will increase from 12% to 18%.

- This change aims to standardize the taxation of used vehicles.

- Previously, vehicles with certain engine sizes and dimensions, such as larger petrol, LPG, CNG, and diesel vehicles, were already taxed at 18%.

- The new ruling extends this 18% rate to all used vehicles sold by businesses, ensuring consistency in the taxation framework.

GST Liability – Who Is Affected?

- Registered Persons:

- GST applies only to registered persons (mainly businesses or dealers involved in the purchase and sale of vehicles).

- A "registered person" is anyone who is registered under GST to conduct business. This includes car dealers, businesses selling pre-owned cars, etc.

- GST is applicable on the sale of used vehicles by registered persons only when a margin is earned on the sale.

- Individual-to-Individual Sales:

- GST will not apply if an individual sells a used car to another individual.

- Example: If Person A (an individual) sells a used vehicle to Person B (another individual), no GST will be levied on the sale, regardless of the selling price.

GST Only on Positive Margin

- What is a Margin?

- Margin is defined as the difference between the selling price and the cost of acquisition of the used vehicle.

- For the cost of acquisition, if the vehicle’s owner had claimed depreciation under the Income Tax Act, the depreciated value will be used. In all other cases, the actual purchase price at which the vehicle was bought will be the cost of acquisition.

- GST Application:

- GST is applicable only if the margin is positive, i.e., if the selling price of the used vehicle is higher than the cost of acquisition (or depreciated value).

- If the margin is negative, i.e., if the selling price is lower than the acquisition cost, no GST will be payable.

Impact of Depreciation on Cost of Acquisition

- Claiming Depreciation:

- If a registered person has claimed depreciation on the vehicle, the depreciated value will be considered as the cost of acquisition for GST purposes.

- The margin is calculated as the difference between the selling price and this depreciated value.

- Non-Depreciation Scenario:

- If no depreciation was claimed, the actual purchase price of the vehicle will be considered as the cost of acquisition.

- In either case, GST is levied only on the positive margin between the sale price and the cost of acquisition.

GST Rate on Sale of Used Vehicles

- Unified GST Rate for All Used Vehicles:

- The GST Council has decided on a single GST rate of 18% for the sale of all used vehicles, including electric vehicles (EVs).

- This is a significant move to harmonize the taxation structure across all types of used vehicles, ensuring uniformity.

- Old GST Rates:

- Before this decision, used vehicles powered by petrol, diesel, and LPG attracted an 18% GST.

- Electric vehicles (EVs) had a lower rate of 12% GST.

- The recent decision simplifies this by applying 18% GST on all used vehicles, including EVs.

GST Scenarios and Examples

Example 1: Negative Margin (No GST)

- Scenario: A registered person sells a used vehicle for Rs 10 lakh, but the original purchase price was Rs 20 lakh, and the person claimed Rs 8 lakh depreciation.

- Depreciated value of the vehicle: Rs 20 lakh - Rs 8 lakh = Rs 12 lakh.

- Selling price: Rs 10 lakh.

- Margin: Rs 10 lakh - Rs 12 lakh = negative Rs 2 lakh.

- Conclusion: Since the margin is negative, no GST is applicable.

Example 2: Positive Margin (GST Applicable)

- Scenario: A registered person sells a used vehicle for Rs 15 lakh, with a depreciated value of Rs 12 lakh.

- Margin: Rs 15 lakh - Rs 12 lakh = Rs 3 lakh.

- GST: 18% on Rs 3 lakh = Rs 54,000.

- Conclusion: GST of Rs 54,000 is applicable on the margin.

Example 3: Negative Margin Based on Purchase Price (No GST)

- Scenario: A registered person sells a used vehicle for Rs 10 lakh, which was originally purchased for Rs 12 lakh (no depreciation claimed).

- Margin: Rs 10 lakh - Rs 12 lakh = negative Rs 2 lakh.

- Conclusion: Since the margin is negative, no GST is applicable.

Example 4: Positive Margin (GST Applicable)

- Scenario: A registered person sells a used vehicle for Rs 22 lakh, which was purchased for Rs 20 lakh.

- Margin: Rs 22 lakh - Rs 20 lakh = Rs 2 lakh.

- GST: 18% on Rs 2 lakh = Rs 36,000.

- Conclusion: GST of Rs 36,000 is applicable on the margin.

GST on Electric Vehicles (EVs)

- The decision to apply 18% GST on the sale of used electric vehicles aligns EV taxation with that of conventional vehicles (petrol, diesel, LPG).

- Earlier, used EVs were taxed at 12% GST, whereas other used vehicles were taxed at 18%.

- With the new policy, the 18% GST rate is applicable to both used petrol/diesel vehicles and used electric vehicles (EVs).

Rationale Behind the Decision

- The GST Council's decision to implement a unified 18% GST rate for all used vehicles is aimed at:

- Simplifying the tax structure and providing clarity to both businesses and consumers.

- Harmonizing GST rates across different types of used vehicles, ensuring fairness in the taxation system.

- Reducing complexity for vehicle dealers, who previously had to navigate different GST rates for petrol/diesel vehicles and EVs.

- Promoting the sale of electric vehicles by removing the tax disparity between conventional and electric vehicles.

This decision by the GST Council provides greater clarity and certainty in the used vehicle market, addressing previous ambiguities and ensuring simplified taxation for businesses involved in the sale of pre-owned cars.

GST (Goods and Services Tax) in India

Key Features of GST:

3. GST Tax Slabs: GST rates are divided into multiple slabs, which apply to different categories of goods and services. The common GST slabs are:

|

|

Also Read |

|