- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- NCERT- First Ladder

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- Current Affairs

- Indian Society and Social Issue

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Global Debt

Global Debt

20-12-2023

Context

- Sri Lanka's unsustainable debt and severe balance of payments crisis highlight the broader issue of increasing debt in developing countries.

About Global Debt

- Global debt encompasses borrowings by governments, private businesses, and individuals worldwide.

- Governments borrow to cover various expenditures not met by taxes and revenues. This may include paying interest on past borrowings. Private entities primarily borrow for making investments.

Growing Debt Trends

- Developing nations often accumulate debt for large-scale infrastructure projects, promoting economic growth.

- A recent United Nations report reveals that global public debt surged to an all-time high of $92 trillion in 2022 from $17 trillion in 2000.

Reasons Behind Growing Debt

- Higher Costs: Developing countries face significantly higher interest rates than developed ones.

- Resource Allocation: Half of these nations allocate over 1.5% of GDP and 6.9% of government revenues to interest payments.

- Shift to Private Creditors: Increasing reliance on market-driven borrowings from private creditors, diverging from traditional reliance on multilateral institutions.

- Debt Restructuring Challenges: External creditors avoid restructuring debt for countries in crisis.

- Internal Factors: Poor debt management, inefficient tax policies, and legal weaknesses contribute to the problem.

Concerns Raised Due to High Debt Burden

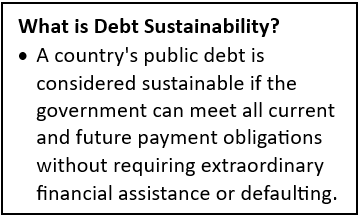

- Debt Sustainability: High debt burdens force countries to borrow from more expensive sources, exacerbating vulnerabilities and complicating debt crisis resolution.

- Example: Sri Lanka losing international financial market access in 2022 due to unsustainable public debt.

- Impact on Developmental Spending: Countries spending more on interest than health or education affects developmental priorities for 3.3 billion people.

- Hindrance to Sustainable Development: Over 70% of public climate finance is in the form of debt, limiting spending on climate initiatives in debt-ridden countries.

- Political and Social Turmoil: Economic struggles blamed on governments lead to political instability.

- Global Financial Stability: High debt levels in developing countries contribute to global financial instability.

Way Forward

-

Inclusive Financial Governance: Enhance the genuine involvement of developing countries in international financial governance.

Inclusive Financial Governance: Enhance the genuine involvement of developing countries in international financial governance.- Implement reforms, such as updating IMF quota formulas, to reflect the evolving global scenario.

- Ensuring Liquidity in Crisis: Provide increased liquidity during crises through IMF and MDBs to discourage unsustainable high-interest financing by developing nations.

- Transparent Debt Reporting: Mandate comprehensive and transparent reporting of public debts by all countries.

- Greater transparency helps prevent the accumulation of significant "hidden" liabilities, which may later transform into explicit government debt.

- Prudent Debt Management: Encourage low-income countries to adopt cautious approaches in acquiring new debt.

- Focus on attracting foreign direct investment and boosting tax revenues instead of heavily relying on loans.

- Lenders should assess the impact of new loans on the borrower's debt position before extending fresh credit.

- Promoting Debt Restructuring Collaboration: Foster collaboration among official creditors to prepare for debt restructuring cases, especially those involving non-traditional lenders.

- Fulfilling Climate Finance Commitments: Provide credit for climate mitigation to address one of the leading causes of high public debt.

Conclusion

- Balanced Approach: Maintaining a balanced approach to global debt management is crucial for economic stability and sustainable growth.

- Key Measures: Monitoring debt levels, implementing prudent fiscal and monetary policies, and strengthening international financial systems are vital steps in mitigating risks associated with growing global debt.

- Long-Term Prosperity: Striking the right balance between debt accumulation and economic growth remains essential for long-term economic prosperity.