- Courses

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

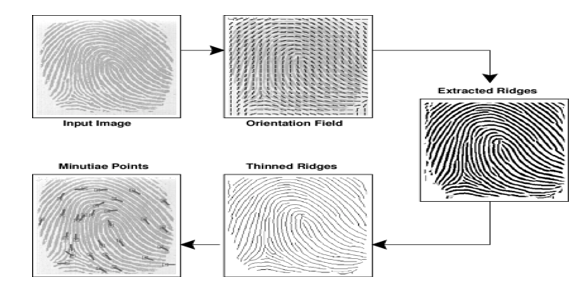

FINGER MINUTIAE RECORD - FINGER IMAGE RECORD (FMR-FIR) MODALITY

FINGER MINUTIAE RECORD - FINGER IMAGE RECORD (FMR-FIR) MODALITY

05-08-2023

MODALITY-1691413010782.png)

Latest Context

The Finger Minutiae Record-Finger Image Record (FMR-FIR) modality, which is based on internal AI/ML technology, was recently released by the Unique Identification Authority of India (UIDAI).

This technique, which was developed expressly to improve Aadhaar-enabled Payment System (AePS) transactions, aims to combat fraud, including the abuse of duplicate fingerprints.

Facts about Finger Minutiae Record - Finger Image Record (FMR-FIR) Modality

- The UIDAI created the FMR-FIR modality, a cutting-edge AI/ML-based technology, to improve security controls inside the Aadhaar-enabled Payment System (AePS).

-

Features and Functionality:

- Hybrid Authentication: To confirm the validity of fingerprint biometrics during Aadhaar identification, FMR-FIR integrates the examination of two unique components, finger minutiae and finger picture.

- Liveness Detection: The modality's main job is to determine if the collected fingerprint is still alive. It can distinguish between a real, "live" finger and a cloned or false fingerprint, thwarting attempts to forge documents.

- Real-time Verification: During the authentication procedure, FMR-FIR functions in real time and delivers immediate verification results.

- Robust Fraud Prevention: The method dramatically lowers the danger of AePS fraud by identifying and discouraging the use of cloned fingerprints.

-

Rationale and Implementation:

- Addressing Emerging Threats: A complex method to secure AePS transactions has to be created because of the rise in fraudulent operations employing cloned fingerprints. Over 700,000 payment-related fraud cases were registered in India in FY21, a dramatic increase. Data from monitored companies of the Reserve Bank of India (RBI) show that the numbers sharply increased to around 20 million in FY23. Financial fraud cases continue to be substantial even though many incidents go unreported because of the lack of public awareness of cyber fraud.

- Silicone-based Fraud: The necessity for a more secure and technologically sophisticated technique was brought on by instances of unauthorised money transfers utilising silicone-based false fingerprints.

- Integration of AI/ML: The accuracy and efficiency of fingerprint authentication are increased by the use of artificial intelligence and machine learning technology.

- Advantages and Implications: UIDAI's FMR-FIR technology is an example of technical innovation for social benefit since it improves security, reduces vulnerabilities, increases transaction trust, and strengthens security.

Unique Identification Authority of India (UIDAI)

- Statutory Authority: By the requirements of the Aadhaar Act 2016, the Indian government formed the UIDAI on July 12, 2016, under the control of the Ministry of Electronics and Information Technology.

- The Planning Commission served as the umbrella organisation when the UIDAI was first established by the Indian government in January 2009.

- Mandate: Every Indian citizen must have an Aadhaar, a 12-digit unique identity number, which is the responsibility of the UIDAI. UIDAI had given 131.68 crore Aadhaar numbers as of October 31, 2021.

What is AePS?

- The AePS is a bank-led model that allows online interoperable financial transactions at Point of Sale (PoS) or micro-ATMs through the Business Correspondent (BC) of any bank using the Aadhaar authentication.

- The National Payments Corporation of India (NPCI), a joint project of the Indian Banks' Association (IBA) and the Reserve Bank of India (RBI), adopted it.

- The AePS is designed to give the underprivileged and excluded members of society, especially those who live in rural and distant locations, simple and safe access to financial services.

- OTPs, bank account information, and other financial details are no longer required.

- Only the bank name, Aadhaar number, and fingerprint that were taken during Aadhaar enrolment are required for transactions.

Must Check: IAS Coaching Centre In Delhi