- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

FINANCIAL DEVOLUTION AMONG STATES

FINANCIAL DEVOLUTION AMONG STATES

26-02-2024

- Several Indian states, especially from South India, claim they aren't receiving their fair share under the current tax devolution scheme.

- They argue that they contribute more to the national tax pool than what they receive.

Devolution of Powers in India

- In India, power is divided between the central government and the states, following a federal system as per the Constitution.

- Devolution means transferring financial resources and decision-making powers from the central government to the states and local governments.

- The Constitution's 7th Schedule outlines the Union List, State List, and Concurrent List, specifying powers of central and state governments.

- Parts V and VI of the Constitution distribute executive powers between the Union and State governments.

- Part VIII details executive powers and functions for union territories.

- The 73rd and 74th Constitutional Amendment Acts of 1992 establish panchayats and municipalities, devolving (transfer) powers and finances to local governments.

-

Tax Devolution in India

- Constitutional provisions: Article 270 of the Constitution outlines the distribution of net tax proceeds between the Union government and the States.

- Statutory laws: Acts like PESA and Forest Rights Act ensure power decentralization to tribal communities.

- PESA stands for Panchayats Extension to Scheduled Areas Act, which was introduced in 1996. The act extends the provisions of Panchayats to the Fifth Schedule Areas (areas with a large tribal population).

- The act's main objectives are to have village governance with participatory democracy and to make the Gram Sabha a nucleus of all activities.

- The Forest Rights Act (FRA) of 2006 recognizes the rights of traditional forest dwellers (resident) and forest dwelling tribal communities to forest resources.

- The FRA was meant to address the historical injustices done to traditional forest dwellers of India.

- Fiscal decentralization: The Finance Commission (FC), appointed every five years, suggests how funds from the central government's tax pool should be divided among states.

- Taxes shared include corporation tax, personal income tax, Central GST, and the Centre's portion of Integrated Goods and Services Tax (IGST).

- Additionally, it provides a formula for distributing funds among individual states.

- States also receive grants-in-aid based on FC recommendations. They are payments in the nature of assistance, donations or contributions made by the Union Government to State Governments.

- Notably, cess and surcharge imposed by the Centre are not part of the divisible pool.

- The 16th Finance Commission, chaired by Dr. Arvind Panagariya, is tasked with making recommendations for 2026-31.

- FC comprises a chairman and four other members appointed by the President.

-

Basis for Allocation

- Vertical Devolution: States receive 41% of the divisible pool according to the 15th FC's recommendation.

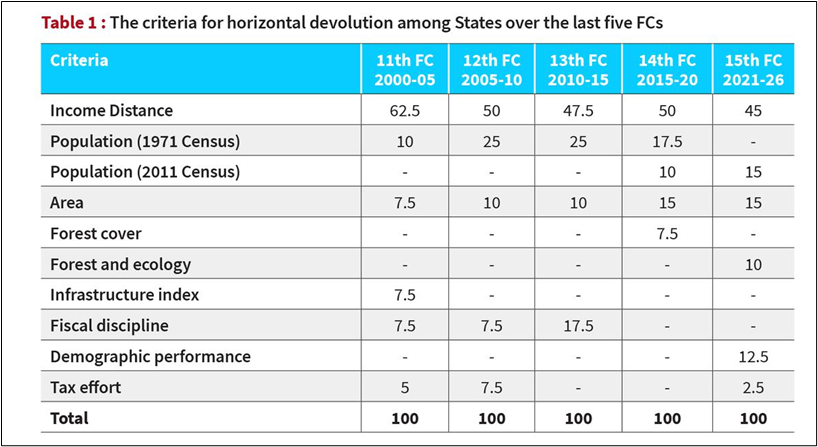

- Horizontal Devolution: Allocation among States is based on different criteria.

- Criteria for Horizontal Devolution:

- Income Distance: Measures a state’s income compared to the highest per capita income State i.e. Haryana. States with lower income get a higher share for fairness.

- Population: Based on the 2011 Census. Earlier, it was according to the 1971 Census, but this changed with the 15th FC.

- Forest and Ecology: Considers each State's share of dense forest compared to all States combined.

- Demographic Performance: Recognizes States' efforts in population control. States with lower fertility rates score higher.

- Tax Effort: Rewards States with efficient tax collection efficiency.

-

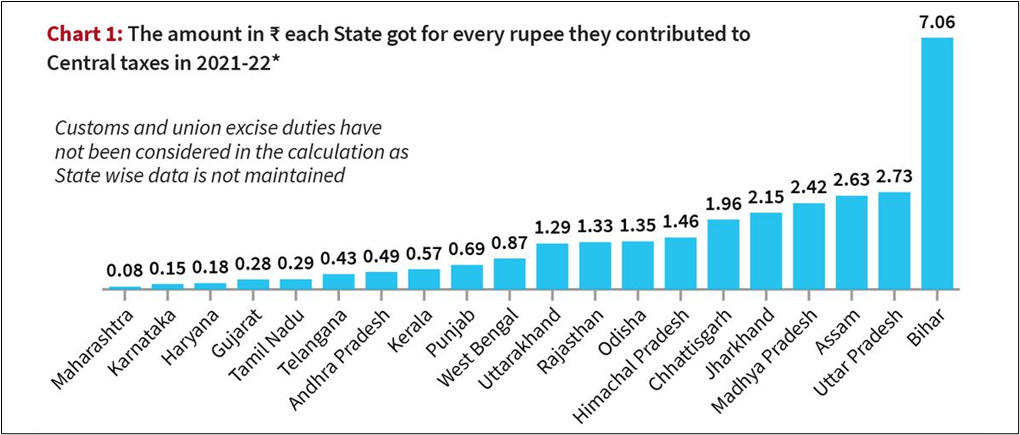

States Contribution Versus Devolution:

-

Challenges in Tax Devolution and solutions:

Challenges in Tax Devolution |

Solutions |

About 23% of the Union government's gross tax receipts for 2024-25 come from cess and surcharge which is not shared with States. |

Enlarging the divisible pool by including some portion of cess and surcharge in the divisible pool and gradually discontinuing them to rationalize tax slabs. |

Industrially developed States receive less than a rupee for every rupee contributed to Central taxes, unlike states like Uttar Pradesh and Bihar. |

Establishing a formal arrangement for State participation in the constitution and workings of the Finance Commission, similar to the GST council. |

Southern States' share in the divisible tax pool has decreased due to emphasis on equity and needs over efficiency in the last six Finance Commissions. |

Increasing efficiency criteria by giving more weightage to efficiency criteria in horizontal devolution, with State GST contribution as a criterion. |

Grants-in-aid vary among states, including revenue deficit, sector-specific, and State-specific grants, as well as grants to local bodies based on population and area. |

Adding more performance indicators like good governance, transparency, and development outcomes could incentivize responsible resource management. |