- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Do cryptos have any rationale?

Do cryptos have any rationale?

Recently, former President Donald Trump expressed support for Bitcoin at a crypto gathering, even suggesting it could become a strategic reserve if he returns to office. This is surprising, given that cryptocurrencies lack the stability of gold or cash.

- Amid dissatisfaction with traditional financial systems, there is a growing interest in cryptocurrencies and blockchain technology for financial autonomy and innovation.

- However, the long-term viability and sustainability of these technologies remain uncertain.

What is Cryptocurrency and How Does it Work?

- Cryptocurrency is a decentralized digital or virtual currency that uses cryptography for security.

- Examples: Bitcoin, Ethereum, Ripple, Litecoin.

- Functionality:

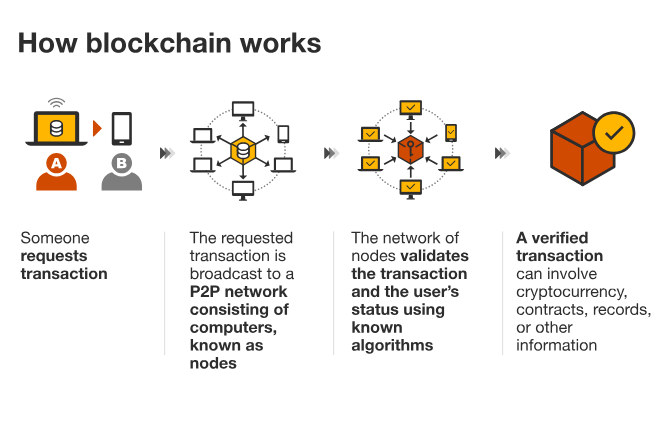

- Transactions are recorded on a public digital ledger called the blockchain.

- The blockchain is maintained by a decentralized network of computers that verify and add transactions.

- Users need a digital wallet to store their public and private keys for transactions.

- Cryptocurrencies can be acquired through "mining," which involves solving complex mathematical problems to validate and record transactions.

What is Blockchain Technology?

- Definition: Blockchain is a decentralized digital ledger that records transactions across a network of computers.

- Mechanism:

- Each block contains a set of transactions.

- New transactions are added to every participant's ledger, ensuring security and transparency.

- Applications Beyond Cryptocurrency:

- Financial Institutions: Used for secure and transparent transaction processing, reducing fraud and operational costs.

- Education: Potential for managing student records and academic achievements.

- Scholarship Systems: Could incentivize academic excellence and maintain records efficiently.

What is the Legal Status of Cryptocurrency in India?

- Regulation:

-

Cryptocurrency is unregulated but not banned. The government does not recognize it as legal tender and aims to limit its use in illegal activities.

- Taxation: Transfers of virtual currencies/cryptocurrencies are subject to a 30% tax as per the Union Budget 2022-23.

-

- Central Bank Digital Currency (CBDC):

- India has introduced its own CBDC, the Digital Rupee (e-RUPI), in collaboration with NPCI and other stakeholders.

- CBDCs are legal tenders issued and backed by central banks, differing from decentralized cryptocurrencies.

Pros and Cons of Cryptocurrency:

- Pros:

- Security and Transparency: Blockchain technology offers enhanced security and transparency in transactions, reducing fraud.

- Innovation and Tokenization: Enables tokenization of assets and innovation in financial instruments.

- Reshaping Finance: Potential to transform global finance, offering new paradigms for value storage and transfer.

- Financial Autonomy: Provides alternatives to traditional banking, especially beneficial in unstable economies.

- Cons:

- Speculative Nature: High volatility and speculative trading undermine stability and reliability as a medium of exchange.

- Regulatory Challenges: Uncertain regulatory environment and concerns over illegal activities can hinder adoption and integration.

- Limited Acceptance: Low acceptance by merchants and high transaction costs limit practical utility and integration with traditional systems.

- High Costs and Inefficiency: Cryptocurrencies can have high transaction fees and slower processing times compared to conventional payment methods.

Conclusion:

India's rapid adoption of cryptocurrency highlights the nation's shift towards digitalization. However, the absence of a regulatory framework presents significant challenges, including potential risks of fraud, money laundering, and financial crimes. To foster a secure and functional cryptocurrency ecosystem, there is an urgent need for robust regulatory oversight and measures to integrate these technologies into the mainstream financial system while addressing their inherent risks.