- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- Online Program

- GS Recorded Course

- NCERT Batch

- Polity Module Course

- Geography Module Course

- Economy Module Course

- AMAC Module Course

- Modern India, Post Independence & World History Module Course

- Environment Module Course

- Governance Module Course

- Science & Tech. Module Course

- International Relations and Internal Security Module Course

- Disaster Management Module Course

- Ethics Module Course

- Essay Module Course

- Current Affairs Module Course

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Daily Current Affairs Summary - 27th March 2025

Daily Current Affairs Summary - 27th March 2025

Regional Rural Banks (RRBs)

- Regional Rural Banks (RRBs) achieved a milestone by recording a profit of ₹7,571 crore in the financial year 2023-24.

- Additionally, key financial indicators such as Capital to Risk-weighted Assets Ratio (CRAR), deposits, Non-Performing Assets (NPAs), and Credit-Deposit (CD) Ratio showed steady improvement, reflecting the growing financial stability of RRBs.

Understanding Regional Rural Banks (RRBs)

Genesis and Formation

- RRBs were established in 1975 under the provisions of the Regional Rural Banks Act, 1976, with the objective of providing banking services to rural and underdeveloped areas.

- These banks were created to bridge the gap between cooperative banks and commercial banks in rural credit supply.

Ownership Structure

RRBs follow a tripartite ownership model, where the shareholding pattern is as follows:

- Government of India (GoI): 50%

- Sponsor Bank: 35%

- Concerned State Government: 15%

This ownership model ensures financial backing and operational stability, while also enabling rural credit expansion.

Regulatory Framework

- RRBs operate under the Reserve Bank of India (RBI), which regulates their financial and operational policies.

- The National Bank for Agriculture and Rural Development (NABARD) plays a crucial role in supervising and monitoring their activities, ensuring they align with rural development objectives.

Core Objectives

RRBs are primarily focused on fostering economic development in rural areas by financing the following sectors:

- Agriculture – Providing loans for farming activities, irrigation, and agro-based industries.

- Trade and Commerce – Extending credit to small traders, rural artisans, and self-employed individuals.

- Industry – Supporting rural industries, including small-scale manufacturing and handicrafts.

- Other Productive Activities – Offering financial assistance for activities that promote employment generation and rural entrepreneurship.

Priority Sector Lending (PSL) Norms

- In 2016, the priority sector lending (PSL) target for RRBs was revised to 75% of their total advances.

- The sub-targets within this PSL mandate are set by RBI to ensure a significant portion of credit flows to sectors such as agriculture, micro-enterprises, and weaker sections of society.

Lok Sabha Passed Finance Bill 2025

The Lok Sabha recently passed the Finance Bill 2025, a crucial piece of legislation that outlines the government’s financial proposals, including taxation, revenue, and expenditure-related provisions.

Understanding the Finance Bill

The Indian Constitution classifies financial legislation into two broad categories:

- Money Bills – Defined under Article 110

- Financial Bills – Defined under Article 117

Categories of Financial Bills

- Financial Bill under Article 117(1)

- These bills contain provisions related to matters that fall within the definition of a Money Bill, but they do not solely consist of these matters.

- Can only be introduced in Lok Sabha and requires the President’s recommendation for introduction.

- Passage: Since these bills contain non-money provisions, Rajya Sabha has the power to reject or amend them like an ordinary bill.

- Financial Bill under Article 117(3)

- These bills, when enacted and brought into operation, involve expenditure from the Consolidated Fund of India.

- They can be introduced in either House of Parliament and do not require the President’s recommendation for introduction.

- Passage: However, they cannot be passed by either House unless the President has recommended their consideration.

Role of Rajya Sabha in Financial Bills

- Unlike Money Bills, which Rajya Sabha cannot amend or reject, Financial Bills (Article 117) are treated like ordinary bills.

- Rajya Sabha can reject or suggest amendments to these bills, making them subject to debate and modification in both Houses of Parliament.

NPCI Introduced BHIM 3.0

The National Payments Corporation of India (NPCI) has introduced BHIM (Bharat Interface for Money) 3.0, an upgraded version of its UPI-based payment application, offering enhanced features for seamless digital transactions.

Key Features of BHIM 3.0

- Expanded Language Support: The app now supports 15+ Indian languages, ensuring accessibility for a wider user base across different regions.

- Expense Tracking and Management: Users can track, manage, and even split expenses effortlessly, making financial planning more convenient.

- Optimized for Low-Connectivity Areas: BHIM 3.0 is designed to work efficiently even in areas with weak or unstable internet connectivity, ensuring uninterrupted transactions.

- Built-in Task Assistant: A smart assistant feature helps users stay on top of their financial activities by providing:

-

- Bill payment reminders

- UPI Lite activation prompts

- Low balance alerts

-

- BHIM Vega – Seamless In-App Payments

- The newly introduced BHIM Vega feature enables direct integration with online merchant platforms, facilitating faster and more secure transactions.

- It allows interoperability with third-party applications, making digital payments smoother across different platforms.

Medium-Term Government Deposit And Long-Term Government Deposit Discontinued

The Medium-Term Government Deposit (MTGD) and Long-Term Government Deposit (LTGD) components of the Gold Monetisation Scheme (GMS) discontinued from March 26, 2025.

However, existing deposits under these categories will continue until maturity as per the Reserve Bank of India (RBI) guidelines.

About the Gold Monetisation Scheme (GMS)

Launch and Objective

The Gold Monetisation Scheme was introduced in 2015 to address India’s high gold imports and to encourage the mobilization of household and institutional gold for productive economic use.

Implementation

The scheme is implemented by all Scheduled Commercial Banks, except for Regional Rural Banks (RRBs).

Categories of Deposits Under GMS

The scheme initially offered three types of deposits:

- Short-Term Bank Deposit (STBD)

- Duration: 1 to 3 years

- Managed by: Banks

- Allows individuals and institutions to deposit gold and earn interest.

- Medium-Term Government Deposit (MTGD) – Now Discontinued

- Duration: 5 to 7 years

- Managed by: Government of India

- Offered higher interest rates compared to STBD.

- Long-Term Government Deposit (LTGD) – Now Discontinued

- Duration: 12 to 15 years

- Managed by: Government of India

- Designed for long-term gold investment with attractive interest benefits.

Impact of Discontinuation

- Only STBD will remain active for new deposits after March 26, 2025.

- Existing MTGD and LTGD deposits will continue as per RBI guidelines until they reach maturity.

Control of Pollution Scheme

The Department-related Standing Committee on Science and Technology, Environment, Forests, and Climate Change has expressed concerns over insufficient expenditure under the Control of Pollution Scheme in the financial year 2024-25, highlighting the need for better fund utilization to tackle pollution effectively.

About the Control of Pollution Scheme

Administrative Authority

- The scheme is implemented by the Union Ministry of Environment, Forest & Climate Change (MoEF&CC).

Scheme Type

- It is a Central Sector Scheme, meaning it is fully funded by the Government of India.

Year of Launch

- The scheme has been operational since 2018 to address pollution-related issues across India.

Objectives

The primary goal of the Control of Pollution Scheme is to:

- Monitor air quality nationwide and implement necessary pollution control measures.

- Assess and regulate water quality to prevent contamination.

- Track noise pollution levels and take appropriate mitigation actions.

Key Components

- Support for Pollution Control Bodies

- Provides financial assistance to weaker State Pollution Control Boards (SPCBs), Pollution Control Committees (PCCs), and the Central Pollution Control Board (CPCB) for effective pollution control initiatives.

- National Clean Air Programme (NCAP)

- A key component aimed at reducing air pollution levels in major cities by adopting targeted interventions.

- Environmental Monitoring Network Programme

- Focuses on real-time monitoring of environmental parameters, including air, water, and noise pollution.

- Research and Outreach Programmes

- Encourages scientific research on pollution control and public awareness campaigns to promote environmental conservation.

CBDT Notified Amendments To The Income-Tax Rules: Safe Harbour Rule

The Central Board of Direct Taxes (CBDT) has recently notified amendments to the Income-tax Rules, increasing the threshold for availing safe harbour from ₹200 crore to ₹300 crore. This move aims to provide greater clarity and ease of compliance for businesses engaged in international transactions.

Understanding the Safe Harbour Rule

What is the Safe Harbour Rule?

- A key provision in India’s transfer pricing framework, designed to reduce litigation by allowing eligible taxpayers to adopt predefined prices for certain international transactions.

- It helps multinational enterprises (MNEs) and businesses by providing certainty and simplified compliance.

Legal Framework

- Safe harbour provisions are defined under Section 92CB of the Income-tax Act, 1961.

- These rules establish circumstances under which tax authorities will accept the transfer price declared by a taxpayer without detailed scrutiny.

Key Concepts in Transfer Pricing

- Transfer Price: The actual price charged in a transaction between related entities that are part of the same multinational enterprise (MNE) group.

- Arm’s Length Price

- The price that two independent, unrelated parties would agree upon in a transaction under open market conditions.

- Ensures that transactions between related entities do not lead to artificial profit shifting.

James Webb Space Telescope (JWST) captures a Star in Formation

- The NASA and European Space Agency (ESA) have released stunning composite images captured by the James Webb Space Telescope (JWST).

- These images reveal a plume of gas and dust streaming from a forming star, located approximately 625 light-years away in one of the nearest star-forming regions of our Milky Way galaxy.

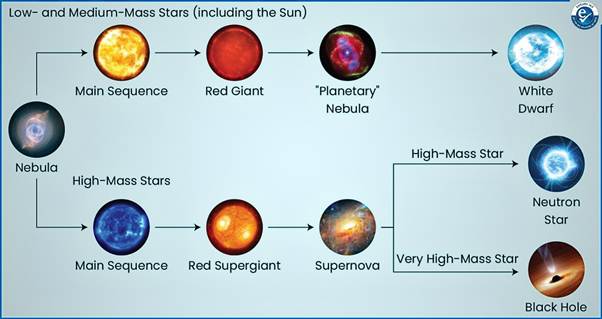

Life Cycle of a Star

About the James Webb Space Telescope (JWST)

- Successor to the Hubble Space Telescope, JWST is an advanced space-based observatory launched in 2021.

- It is designed to study the universe primarily in the infrared spectrum, allowing scientists to observe the earliest galaxies, stellar formations, and planetary systems with unprecedented clarity.

Stages of Star Formation and Evolution

1. Nebula – The Birth of a Star

- A star begins its life as a vast cloud of gas and dust, primarily composed of hydrogen and helium.

- Gravity pulls these particles together, initiating the process of star formation.

2. Protostar – The Formation Stage

- The nebula collapses under gravity, forming a dense, hot, and spinning region known as a protostellar disk.

- This early stage marks the beginning of nuclear fusion, where hydrogen atoms start combining to release energy.

3. Main Sequence – The Longest Phase

- A star enters the main sequence phase, where it steadily fuses hydrogen into helium in its core.

- This is the most stable and long-lasting stage of a star’s life.

- Our Sun is currently in the middle of its main sequence phase.

4. Red Giant or Supergiant – The Expansion Phase

Once the hydrogen in the core is depleted, the star’s fate depends on its mass:

- Low to Medium Mass Stars (e.g., the Sun): The core contracts, while the outer layers expand, forming a red giant.

- Massive Stars: They expand into supergiants and begin fusing heavier elements like carbon, oxygen, and iron in different stages.

5. End Stage – The Final Fate

- Low to Medium Mass Stars (like the Sun):

- The outer layers eject as a planetary nebula, while the core contracts into a white dwarf.

- If its mass is below the Chandrasekhar Limit (1.4 solar masses), it remains stable.

- High Mass Stars (10+ Solar Masses):

- When the core accumulates iron, it collapses under gravity, triggering a supernova explosion.

- The fate of the remnant depends on its final mass:

- If the core remnant is 1.4–3 solar masses, it becomes an extremely dense neutron star.

- If it exceeds ~3 solar masses, it collapses into a black hole, where gravity is so strong that even light cannot escape.

Permafrost Melting In Kashmir Himalayas

- A recent study published in Remote Sensing Applications: Society and Environment has highlighted the growing risks associated with permafrost degradation in the Jammu & Kashmir (J&K) Himalayas.

- The study emphasizes the potential hazards, including infrastructure damage, hydrological disruptions, and increasing risks of Glacial Lake Outburst Floods (GLOFs).

Understanding Permafrost

- Permafrost refers to any ground that remains frozen (at or below 0°C/32°F) for a minimum of two consecutive years.

- It plays a crucial role in maintaining the stability of mountain landscapes, regulating water flow, and preserving ancient organic carbon stores.

Extent of Permafrost in Jammu & Kashmir and Ladakh

The study estimates that 64.8% of the total geographic area in J&K and Ladakh is under permafrost cover:

- 26.7% Continuous Permafrost – Most of the soil remains permanently frozen.

- 23.8% Discontinuous Permafrost – More than half of the soil is frozen, but thawing occurs in some areas.

- 14.3% Sporadic Permafrost – Patches of frozen soil interspersed with thawed regions.

Environmental Hazards Linked to Permafrost Melting

1. Rising Glacial Lake Outburst Flood (GLOF) Risks

- The study identified 332 proglacial lakes, of which 65 pose varying degrees of GLOF risks.

- Recent disasters such as Chamoli (2021) and South Lhonak (2023) have been linked to permafrost degradation.

- Proglacial lakes form when melting glaciers create depressions in the landscape or are blocked by ice/moraine dams. Their sudden rupture can lead to catastrophic floods.

2. Infrastructure and Security Challenges

- Several strategic roads in Ladakh traverse permafrost zones, making them vulnerable to subsidence, landslides, and structural damage.

- Thawing permafrost weakens the ground, posing risks to roads, bridges, and settlements.

3. Hydrological Changes

- Permafrost acts as a natural water storage system, regulating river flows and groundwater recharge.

- Its degradation disrupts seasonal water availability, impacting agriculture, drinking water sources, and hydroelectric projects.

Causes of Permafrost Degradation

The primary drivers of permafrost melting include:

- Rising Surface Temperatures – Global warming accelerates thawing.

- Natural Events – Earthquakes and landslides trigger permafrost breakdown.

- Human Activities – Deforestation, infrastructure expansion (roads, dams, and settlements), and unplanned real estate development disturb permafrost stability.

Way Forward: Mitigation and Adaptation Strategies

1. Integrated Regional Planning

- Incorporate permafrost and cryosphere data into infrastructure development and land-use planning.

- Implement risk-sensitive zoning regulations to minimize damage.

- Enhanced Monitoring Systems

- Utilize satellite-based remote sensing and ground-based LiDAR technology to track permafrost degradation and detect landscape changes.

- Establish early warning systems for GLOFs and landslides.

3. Strengthening Environmental Impact Assessments (EIA)

- Revise EIA frameworks to explicitly evaluate permafrost-related risks, including:

- GLOFs, landslides, and ground instability caused by thawing.

- Potential threats to existing and future infrastructure projects.

- Promote sustainable tourism and construction practices in permafrost-prone areas.

Also Read

UPSC Foundation Course

UPSC Monthly Magazine CSAT Foundation Course