- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Code on Social Security 2020 and Gig Workers

Code on Social Security 2020 and Gig Workers

Latest Context

Recently, the Minister of State for Labour and Employment told the Lok Sabha that ‘gig worker’ and ‘platform worker’ has been defined for the first time in the Code on Social Security (SS), 2020.

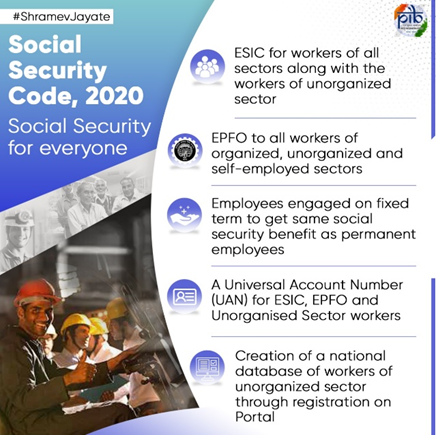

Provisions under Social Security Code, 2020

Objective:

The objective of the Code is to regulate the organized/unorganized (or any other) sectors and extend social security benefits, during sickness, maternity, disability, etc. to all employees and workers across different organizations.

- Integrates Labour Laws: The Code undertakes the integration of the nine labour laws relating to social security into one integrated Code. These nine labour laws are as follows:

- The Employees Compensation Act, 1923.

- The Employees State Insurance Act, 1948.

- The Employees Provident Fund and Miscellaneous Provisions Act, 1952

- The Employees Exchange (Compulsory Notification of Vacancies) Act, 1959

- The Maternity Benefit Act, 1961

- The Payment of Gratuity Act, 1972

- The Cine Workers Welfare Fund Act, 1981

- The Building and Other Construction Workers Cess Act, 1996

- The Unorganized Workers’ Social Security Act, 2008

Coverage and Applicability:

- The Code has widened the scope by comprising the unorganised sector, fixed-term employees, gig workers, platform workers, inter-state migrant workers, and contract employees.

- It applies to everyone on wages in an establishment, irrespective of occupation.

Revised Definition:

- On employees: Now the term ‘employees’ also includes workers employed through contracts.

- On inter-state migrant workers: It also comprises self-employed workers who have migrated from another state.

- Gig workers: Independent contractors, Freelancers, etc. who engage in hourly or temporary work and share a non-traditional employer-employee relationship are grouped as gig workers.

- Platform workers: The workers who use an app or website to get connected to their customers are classified as platform workers. Since there are many kinds of businesses which are starting to use this approach, the labour ministry is also planning to add more categories under this code.

Digitisation:

- All records and returns are required to be maintained electronically. Digitisation of data will assist in the exchange of information among various stakeholders/funds set up by the Government. It will ensure compliance and also facilitate governance.

Maternity Benefits:

- The provision of maternity benefits has not been made universal and is currently applicable for establishments that employ ten workers or more. As per the proposed code, the definition of ‘establishment’ did not include the unorganised sector. Hence, women engaged in the unorganised sector would remain outside the purview of maternity benefits.

Stringent Penalties:

- Any failure to deposit employees’ contributions not only attracts a penalty of Rs 100,000 but also imprisonment of 1-3 years. In the case of repeatedly committed offences, the penalties and prosecution are severe, and there will be no compounding is permitted for repeated offences.

Concerns Related to SS Code

- The code still has thresholds based on establishment size for making certain benefits mandatory. It implies that certain benefits like pension and medical insurance are mandatory only for establishments with a certain minimum number of employees. It means that it will not cover a large number of workers. In addition, it treats employees within the same establishment differently according to their wages. Only those employees whose earnings are above a certain threshold will receive mandatory benefits.

- The distribution of social security benefits is still fragmented and administered by multiple bodies like the Central Board of Trustees, Employees State Insurance Corporation, and Social Security Boards. That makes it very confused confusing and difficult for workers to access the benefits they are entitled to.

Current Status of the Gig Economy in India

Definition:

- A gig economy is a labour market that heavily relies on temporary and part-time positions filled by independent contractors and freelancers rather than full-time permanent employees.

Gig Economy and India:

- As far as the gig economy in India is concerned, it has been growing rapidly in recent years. Digitisation of the economy proffers countless digital platforms that allow individuals to offer their services on a freelance or part-time basis. According to a report by Boston Consulting Group, India’s gig workforce comprises 15 million workers employed across industries such as software, shared services and professional services.

- As per the report of the International Labour Organization, India's gig economy is expected to grow by 23% by 2025.

Growth Drivers of the Gig Economy:

- Rise of mobile technology and easy access to the internet

- Liberalisation of Economy

- High demand for flexible work

- Rapid growth of e-commerce

- It also provides various sources of side income generation to youngsters, educated and ambitious population that seeks to improve livelihoods.

Challenges:

- Lack of job security, uncertain employment status, and irregular wages.

- Stress due to uncertainty in getting fixed and regular income

- Lack of workplace entitlements due to contractual relationship

- Hindered and limited access to the Internet and digital technology

Gig Economy and Women:

-

Gig employment proffers part-time work and flexible working hours that allow women to balance their traditional roles with employment. In addition, it provides women with on-demand work allowing them to join and drop out of the workforce as per their will.

-

Gig employment helps women in earning extra income, boosting confidence and hence giving them decision-making power - all important components of women’s empowerment.

-

Gig employment complemented by Work from Home (WFH) and technology has addressed the issues of safety during travel and night shifts.

Way Forward

-

The SS Code 2020 attempts to bring informal workers under social security, but it doesn't fully achieve its goal of making social security universal. India is facing a growing challenge of an ageing population without proper social security, and the current workforce will not be able to support it in the future. Providing social security can help formalize the workforce.

-

Employers ought to take responsibility for providing social security to their workers as they draw benefits from their productivity.

-

Although the gig economy proffers many opportunities for individuals to earn a livelihood and gain work flexibility, there is a dire need for better regulation and protections for gig workers in India.