- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Challenges and Strategic Adjustments for ARCs

Challenges and Strategic Adjustments for ARCs

Asset Reconstruction Companies (ARCs) are facing a slowdown in growth, primarily due to a reduction in Non-Performing Assets (NPAs), which have fallen to a 12-year low of 2.8% as of March 2024. According to Crisil, assets under management (AUM) by ARCs are expected to contract by 7-10% in 2024-25, following a stagnant performance in 2023-24.

Concerns of Asset Reconstruction Companies (ARCs)

Low Business Potential

- Decrease in new non-performing corporate assets has led ARCs to target smaller, less profitable retail loans.

- Despite this focus, there has not been a significant increase in retail NPAs, limiting opportunities for ARCs.

Increased Investment Mandate

- RBI's directive in October 2022 requires ARCs to invest at least 15% of bank investments in security receipts or 2.5% of total security receipts issued, whichever is higher.

- This has placed additional constraints on ARCs' capital usage, with many struggling to meet the new ₹300 crore minimum net owned funds requirement.

Net Owned Funds Requirements

- The RBI raised the minimum net owned funds requirement for ARCs from ₹100 crore to ₹300 crore in October 2022 to ensure robust balance sheets.

- Many ARCs are struggling to meet this requirement, leading to potential mergers or exits.

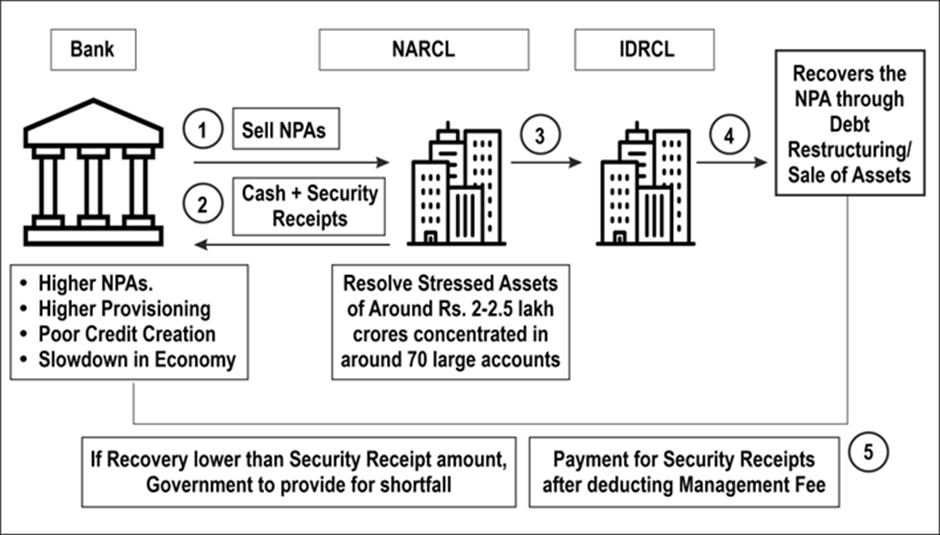

Competition from NARCL

- The state-owned National Asset Reconstruction Company Ltd (NARCL) offers security receipts guaranteed by the government, making them more attractive to financial institutions.

- This creates significant competition for private ARCs.

Regulatory Challenges

- ARCs must now obtain approval from an independent advisory committee for all settlement proposals, leading to delays.

- Increased RBI scrutiny, including the banning of Edelweiss ARC from new loans for bypassing regulations, has impacted major ARCs.

- Trust deficit between the RBI and ARCs, with concerns about transactions potentially helping defaulting promoters regain control of assets, violating Section 29A of the IBC.

What are ARCs?

- Definition: An asset reconstruction company (ARC) buys distressed debts from banks at an agreed value and attempts to recover the debts or associated securities.

- Background: ARCs were introduced by the Narsimham Committee – II (1998) and established under the SARFAESI Act, 2002.

- Current Status: 27 ARCs are registered with the RBI, including prominent ones like NARCL, Edelweiss ARC, and Arcil.

- Registration and Regulation: ARCs must be registered under the Companies Act, 2013 and with the RBI under the SARFAESI Act.

- Funding: ARCs raise funds from Qualified Buyers (QBs) including insurance companies, banks, and asset management companies.

Working of ARCs

Asset Reconstruction

- Acquiring rights in distressed loans or credit facilities for recovery.

- Buying distressed loans at a discount, redeemable within eight years.

Securitisation

- Acquiring financial assets by issuing security receipts to Qualified Buyers.

Non-Performing Asset (NPA)

- Definition: A loan classified as NPA when payments are overdue for 90 days; for agriculture, if overdue for two cropping seasons.

- Categories:

- Sub-standard Assets: Non-performing for ≤12 months.

- Doubtful Assets: Non-performing for >12 months.

- Loss Assets: Uncollectible and needing to be written off.

Recent Changes in ARCs Regulations by RBI

- Strengthening Governance Structure: Chair and at least half of the board must be independent directors.

- Enhancing Transparency: Disclosure of track record of returns and collaboration with rating agencies for schemes launched in the past eight years.

- Revised Investment Requirements: ARCs must invest at least 15% of the transferor’s investment or 2.5% of total receipts issued, whichever is higher.

Measures to Address Challenges Faced by ARCs

- Diversification of Asset Portfolios: Explore sectors beyond traditional corporate and retail loans, such as infrastructure and MSMEs.

- Improving Regulatory Transparency and Collaboration: Work closely with the RBI and other regulatory bodies for transparent operations and compliance.

- Enhancing Efficiency in Settlements: Use technology, such as AI-driven analytics, to speed up settlement processes.

- Adopting Strategic Competition with NARCL: Offer specialized solutions or focus on faster recovery mechanisms to differentiate from NARCL.

Conclusion

Asset Reconstruction Companies (ARCs) are facing multiple challenges, including a reduced pool of non-performing assets, increased regulatory requirements, and competition from the state-owned NARCL. Addressing these challenges requires diversification, improved regulatory collaboration, and enhanced operational efficiency.