- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Investment models in India

Investment models in India

Investment models in India

- Over the years, India has emerged as one of the fastest-growing economies in the world, and it now offers a growing and thriving environment for investments, both domestic and foreign. With the largest youth population in the world, it provides prospective investors with a highly skilled workforce and a strong work ethic.

- A host of government initiatives has also enabled India's investment growth, which includes developing India's financial system, improving the infrastructure and relaxing FDI norms.

- The Government has propagated an investor-friendly FDI policy, in which most sectors are open for 100% FDI under the automatic route. India's FDI policy is also reviewed on an ongoing basis to ensure that India remains an attractive and investor-friendly destination.

What is an Investment?

- Investment in an economy refers to the purchase or creation of physical or financial assets with the expectation of generating income or appreciation in value over time. Investment can take many forms, including the purchase of stocks, bonds, real estate, or equipment.

- In the context of the economy, investment refers to the accumulation of capital, which can be used to finance the production of goods and services. This capital can be invested in new machinery, equipment, or infrastructure, or it can be used to fund research and development or other forms of innovation.

- Investment is a key driver of economic growth, as it helps to create new jobs, increase productivity, and stimulate demand for goods and services. When businesses invest in new capital, they can produce more output with the same amount of labor, which leads to higher economic output and higher incomes.

Relationship between GDP (Gross Domestic Product) and Investment

- The relationship between GDP (Gross Domestic Product) and investment in an economy is crucial. Investment is a key driver of economic growth, and a higher level of investment generally leads to higher economic output, as measured by GDP.

- When businesses invest in new machinery, equipment, buildings, or research and development, they create new jobs and increase productivity, which leads to higher GDP. Investment also helps to create new markets and opportunities, and can lead to the development of new industries and technologies.

- For example, in the 1990s, India undertook significant economic reforms that led to a surge in investment, particularly in the information technology (IT) sector. This investment led to the development of a thriving IT industry, which helped to propel India's GDP growth rate to over 8% per year by the early 2000s.

- Similarly, China's rapid economic growth over the past few decades has been fueled by significant investment, particularly in infrastructure and manufacturing. This investment has led to the development of new cities, airports, railways, and highways, which have helped to create new jobs and drive economic growth.

- On the other hand, if there is a lack of investment in an economy, it can lead to slower growth or even a recession. For example, during the global financial crisis of 2008-2009, many businesses cut back on investment, which led to a decline in GDP and rising unemployment in many countries.

Types of investments in India

- Public Investment: Public investment refers to the money invested by the government in various infrastructure projects and social welfare programs. In 2021-22, the Indian government has allocated INR 5.54 lakh crore ($75 billion) for capital expenditure, which includes investments in infrastructure and other development projects.

- Private Investment: Private investment refers to the funds invested by private individuals or companies in various business ventures. In recent years, private investment in India has been increasing steadily. According to a report by the Reserve Bank of India, gross fixed capital formation by the private sector increased by 10.6% in 2019-20.

- Foreign Direct Investment: Foreign Direct Investment (FDI) is a type of private investment in which foreign companies invest in Indian businesses. According to data from the Department for Promotion of Industry and Internal Trade, FDI inflows into India increased by 13% in 2020, despite the global economic slowdown caused by the COVID-19 pandemic. The data also showed that sectors such as computer software and hardware, telecommunications, and automobiles were the top recipients of FDI inflows.

- Infrastructure Investment: Infrastructure investment is a key area of focus for both public and private investors in India. According to a report by the National Investment and Infrastructure Fund (NIIF), India needs to invest $4.5 trillion in infrastructure by 2040 to sustain its economic growth. The report also noted that the private sector is expected to contribute about 65% of the required investment.

- Trends in Private Equity Investment: Private equity (PE) investment in India has been growing rapidly over the past few years. According to a report by Bain & Company, PE investment in India reached $47 billion in 2019, up from $26 billion in 2014. The report also noted that the average deal size for PE investment in India increased from $29 million in 2014 to $62 million in 2019.

Investment models in India

Infrastructure investment in India has been a key priority of the government in recent years, as the country aims to improve its transportation, energy, water, and communication systems. There are different investment models available for infrastructure creation in India, which can be broadly classified into the following categories:

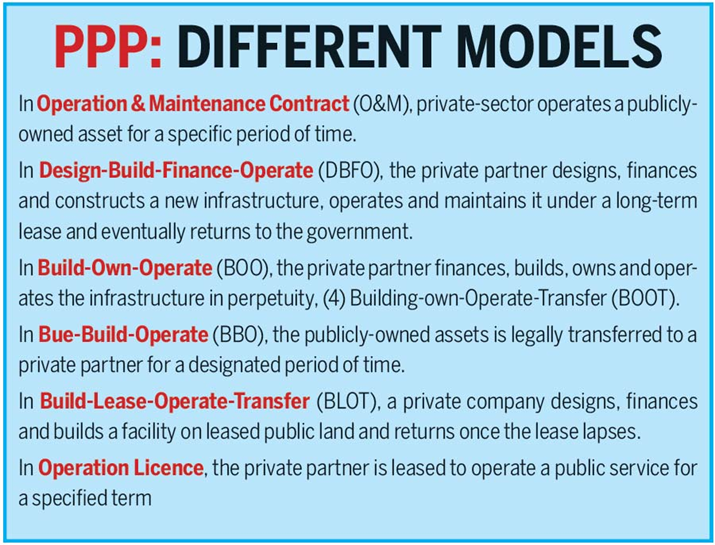

- Public-Private Partnerships (PPP): PPPs involve collaboration between the government and private sector entities to develop infrastructure projects. The government provides the necessary regulatory and policy framework, while private companies invest their capital, expertise, and technology to implement and operate the project. PPPs can take various forms, such as build-operate-transfer (BOT), build-own-operate-transfer (BOOT), and design-build-finance-operate (DBFO).

- Engineering, Procurement, and Construction (EPC): EPC contracts are typically used for large-scale infrastructure projects, such as highways, bridges, airports, and power plants. Under this model, a contractor is responsible for designing, procuring materials, and constructing the project. The government or the project owner pays the contractor a fixed price for the completed project.

- Build-Own-Operate-Transfer (BOOT): The BOOT model involves private sector investment in infrastructure projects, where the investor builds the project, operates it for a specified period, and then transfers ownership to the government or a public entity. BOOT contracts are commonly used for projects like ports, airports, and power plants.

- Real Estate Investment Trusts (REITs): REITs are investment vehicles that allow investors to pool their money and invest in a portfolio of income-generating properties, such as commercial real estate and infrastructure assets. In India, REITs can invest up to 20% of their assets in infrastructure projects, making them a viable option for infrastructure investment.

- Infrastructure Debt Funds (IDFs): IDFs are investment vehicles that invest in debt securities issued by infrastructure companies or projects. They provide long-term debt financing to infrastructure projects, which have a longer gestation period and require large amounts of capital. IDFs can be set up as mutual funds or NBFCs (non-banking financial companies).

- Sovereign Wealth Funds (SWFs): SWFs are government-owned investment funds that invest in various asset classes, including infrastructure. In India, the National Investment and Infrastructure Fund (NIIF) is a government-sponsored SWF that invests in infrastructure projects.

Hybrid Annuity Model (HAM)

- The Hybrid Annuity Model (HAM) is a type of public-private partnership (PPP) model used in India for infrastructure projects, particularly in the road sector.

- In this model, the government provides 40% of the total project cost as a grant, while the remaining 60% is financed by the private sector. The private sector is responsible for designing, constructing, operating, and maintaining the project for a period of 15-20 years.

- Under the HAM, the private sector developer is paid a fixed amount (called an "annuity") by the government over the project's operating period. The annuity is paid out in biannual instalments, which cover the cost of construction, operation, and maintenance of the project.

- The HAM model was introduced in 2016 as a replacement for the earlier Build-Operate-Transfer (BOT) model, which had faced several challenges such as delays in land acquisition, difficulty in obtaining project finance, and inability to attract bidders. The HAM model was designed to address these challenges by sharing risks between the government and private sector and providing a more attractive financial structure for private sector investors.

- The HAM has been used successfully in the road sector, and has helped to increase private sector investment in infrastructure projects in India.

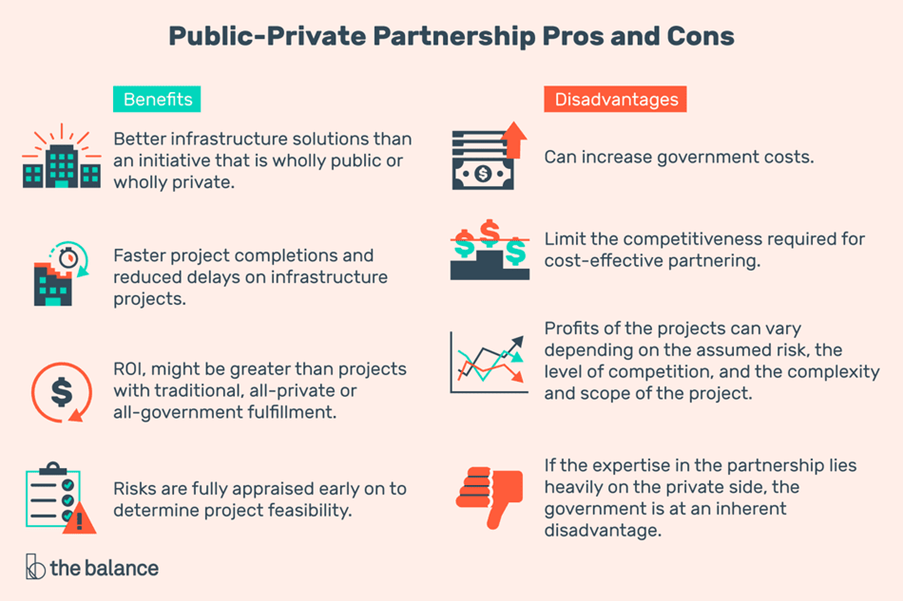

Problems associated with PPP model

While the PPP model has been used successfully in India for many infrastructure projects, there have also been several challenges and problems associated with its implementation. Some of the key issues include:

- Delayed implementation: PPP projects often face delays in implementation due to issues such as land acquisition, obtaining necessary permits and clearances, and delays in financial closure.

- Cost overruns: PPP projects are often subject to cost overruns due to factors such as delays, changes in scope, and unforeseen circumstances. These cost overruns can result in higher costs for the government and the private sector.

- Revenue uncertainty: PPP projects involve revenue risk for the private sector partner, as the revenue generated from the project is often dependent on factors such as usage and demand. This can lead to uncertainty and risk for the private sector partner.

- Limited availability of finance: Financing PPP projects can be a challenge, particularly for smaller projects or those located in less developed areas where investors may be reluctant to invest.

- Contractual disputes: PPP projects often involve complex contracts and agreements between the government and private sector partner, which can lead to disputes and legal challenges.

Investment trends in India

Investment trends in the Indian economy are constantly evolving, influenced by a range of factors including government policies, macroeconomic conditions, and global trends.

- Digitalization: The COVID-19 pandemic has accelerated the adoption of digital technologies in India, and this trend is likely to continue in the coming years. Investments in digital infrastructure and technologies, such as e-commerce platforms, online education, and telemedicine, are expected to grow rapidly.

- Sustainable Investing: Sustainable investing, which involves investing in companies or projects that prioritize environmental, social, and governance (ESG) factors, is becoming increasingly popular in India. Investors are looking for opportunities to support companies that are making a positive impact on the environment and society, and there is growing demand for investments that align with ESG principles.

- Infrastructure: Infrastructure investment remains a key area of focus for investors in India. The government's push for infrastructure development, including the National Infrastructure Pipeline (NIP), is expected to create significant opportunities for investment in areas such as roads, railways, airports, and urban infrastructure.

- Private Equity: Private equity (PE) investment continues to be a major driver of investment in India, with investments in sectors such as technology, healthcare, and consumer goods expected to grow in the coming years.

- Foreign Direct Investment: India is one of the top destinations for foreign direct investment (FDI) in the world, and FDI inflows are expected to remain strong in the coming years. The government's push for reforms and its focus on attracting foreign investment is expected to support continued growth in FDI.

- Startups: India has a thriving startup ecosystem, and investments in startups are expected to continue to grow in the coming years. The government's Startup India initiative, which aims to support the growth of startups in the country, is expected to create new opportunities for investment in this sector.

Factors affecting Indian economy

- Government policies: Government policies can have a major impact on the Indian economy. For example, policies related to taxation, subsidies, and regulations can affect the cost of doing business and investment decisions. Policies related to infrastructure development, healthcare, education, and social welfare can also have a significant impact on the economy.

- Global economic conditions: India's economy is closely linked to global economic conditions, particularly those in major trading partners such as the United States, China, and the European Union. Global economic conditions can affect demand for Indian exports and the availability of capital and investment funds.

- Domestic demand: Domestic demand is a major driver of the Indian economy, and factors such as consumer confidence, income levels, and spending patterns can affect economic growth. The size and composition of the Indian population, as well as demographic factors such as age and income distribution, also play a role in shaping domestic demand.

- Infrastructure: The state of infrastructure in India, including transportation, power, and telecommunications, can also affect the economy. Inadequate infrastructure can make it difficult for businesses to operate efficiently, and can lead to high costs and delays.

- Political stability: Political stability is an important factor for economic growth and development. Instability, uncertainty, and conflict can undermine investor confidence, discourage foreign investment, and disrupt economic activity.

- Climate change: Climate change is a global challenge that is affecting the Indian economy in several ways, including through changes in weather patterns, water scarcity, and natural disasters. Climate change can affect agriculture, food security, and water availability, and can also lead to social and economic dislocation.

- COVID-19 pandemic: The COVID-19 pandemic has had a significant impact on the Indian economy, causing a sharp decline in economic activity and leading to job losses and business closures. The pandemic has also highlighted the need for investments in healthcare infrastructure and digital technologies to support remote work and education.

Reforms needed to enhance investments in Indian economy

- Labour Reforms: The Indian labour market has been characterized by a rigid labour regime, which has made it difficult for businesses to hire and fire employees. Reforms such as the introduction of fixed-term employment contracts, easing of labour laws and simplifying the compliance process can help in attracting more investments in the country.

- Land Reforms: Land acquisition has been a major challenge for businesses in India, and has led to significant delays and increased costs for many projects. Land reforms such as digitization of land records, reducing the time taken for land acquisition, and creating land banks can help in streamlining the process and encouraging more investment.

- Financial Sector Reforms: India's financial sector has been characterized by a high level of regulation and government control, which has limited the availability of credit and investment. Reforms such as liberalizing the banking sector, increasing the penetration of capital markets, and simplifying the regulatory framework can help in increasing access to finance and encouraging more investment.

- Tax Reforms: India's tax regime has been complex and burdensome, which has made it difficult for businesses to operate and invest. Reforms such as reducing corporate tax rates, simplifying the tax structure, and introducing a goods and services tax (GST) can help in creating a more business-friendly environment and attracting more investment.

- Infrastructure Reforms: India's infrastructure has been a major bottleneck for investment, with inadequate road, rail, and port facilities. Reforms such as public-private partnerships (PPPs), increasing private sector participation in infrastructure projects, and improving the regulatory framework for infrastructure development can help in attracting more investment.

- Ease of Doing Business Reforms: India has made significant progress in improving its ranking in the World Bank's Ease of Doing Business Index, but there is still a long way to go. Reforms such as reducing the time taken for business registrations, improving contract enforcement mechanisms, and simplifying the compliance process can help in creating a more business-friendly environment and attracting more investment.

National Investment and Infrastructure Fund (NIIF)

- The National Investment and Infrastructure Fund (NIIF) is a government-sponsored sovereign wealth fund established by the Government of India in 2015. The fund is intended to catalyze investment in infrastructure projects across the country, particularly in sectors such as transportation, energy, water, and telecommunications.

- The NIIF operates as a "fund of funds," meaning that it invests in other funds and projects rather than making direct investments. The fund has two main components: the NIIF Master Fund, which invests in infrastructure-focused funds managed by third-party fund managers, and the NIIF Strategic Fund, which makes direct investments in infrastructure projects.

- The NIIF is backed by a combination of government funding and private sector investment. The government has committed to provide INR 20,000 crore (approximately $2.7 billion) to the fund, while the remaining funding is expected to come from institutional investors such as sovereign wealth funds, pension funds, and insurance companies.

- The NIIF has already made several investments in infrastructure projects across India. In 2017, the fund invested in two renewable energy platforms, Green Growth Equity Fund and National Investment and Infrastructure Fund Energy Efficiency Services, which focus on solar and wind power projects. The fund has also invested in the Delhi-Mumbai Industrial Corridor Development Corporation, which aims to create a new industrial corridor spanning several states in India.

TO ACCESS ALL THE GENERAL STUDIES NOTES CLICK ON: https://ensureias.com/notes