- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

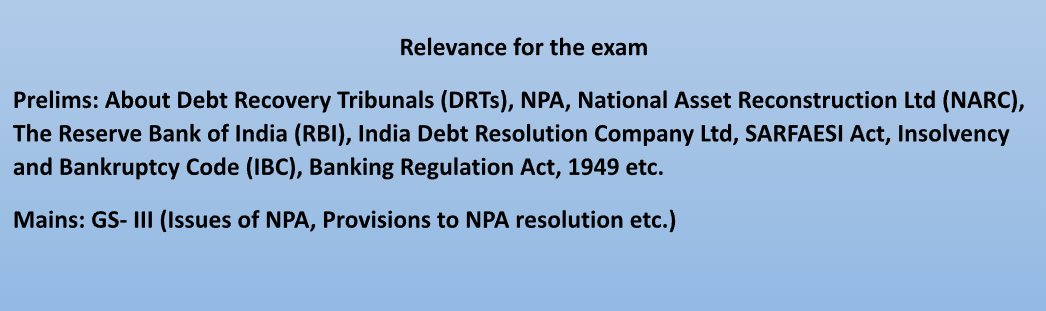

WILFUL DEFAULTERS, FRAUDSTERS CAN GO FOR COMPROMISE SETTLEMENT: RBI

WILFUL DEFAULTERS, FRAUDSTERS CAN GO FOR COMPROMISE SETTLEMENT: RBI

14-06-2023

Latest Context

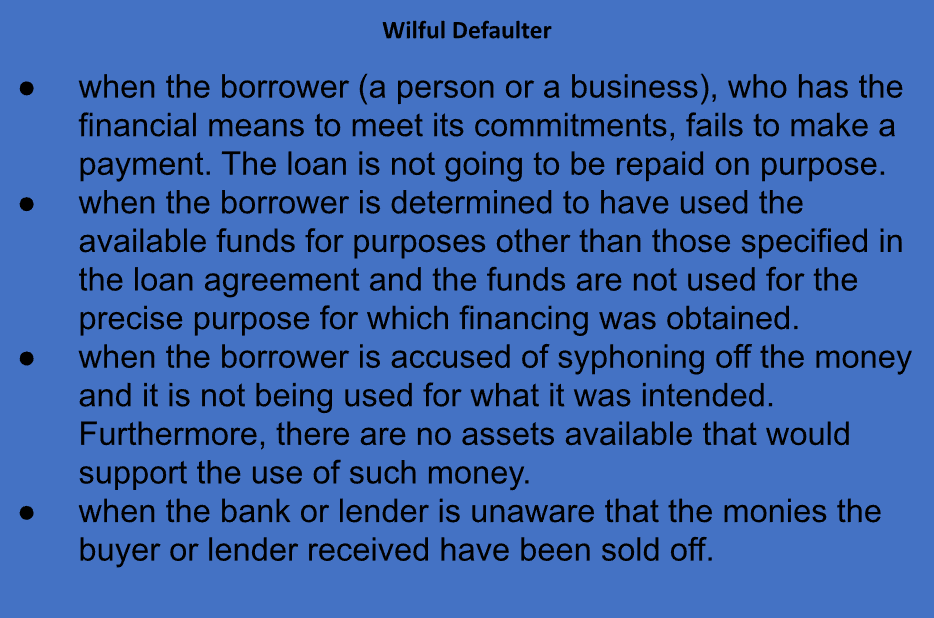

The Reserve Bank of India (RBI) has released a circular that enables fraud-related companies and willful defaulters to choose compromise settlements or technical write-offs.

- The circular outlines criteria for managing such issues for banks and financing institutions.

Key Points Related to Circular

Technical Write-Offs and Compromise Settlements:

- Regardless of whether criminal procedures against the debtors are still pending, banks and finance companies may enter into compromise agreements or technical write-offs for accounts labelled as willful defaulters or fraud.

- These agreements are made possible by the RBI's circular, which also makes sure that criminal processes are unaffected.

Cooling Period for Fresh Loans:

- Before making new loans to customers who have undergone compromise settlements, banks must impose a minimum cooling period of 12 months.

- In addition to exposures to agricultural credit, the cooling time also applies to other exposures, with regulated entities having the authority to impose longer cooling periods in accordance with their board-approved policies.

Concerns:

- Potential Loss of Public Money:

- Banks have in the past authorised compromise agreements that resulted in large losses because of high haircuts on overdue payments.

- Allowing compromise settlements has raised worries that it may reward large defaulters and fraudsters.

- Even if financial policies are unstable, allowing compromise settlements will artificially lower NPA.

- A significant portion of the overall Gross NPAs are attributable to public sector banks. Around 72% of the total NPAs are held by public sector banks, with the remainder held by private sector banks, foreign banks, and small financial institutions.

- The government recapitalizes PSBs, which results in a loss of public money.

- Challenges with Debt Recovery Tribunals (DRTs):

- In certain cases, banks entered into compromise settlements without letting the Debt Recovery Tribunals (DRTs) know, according to reports.

- The DRT in Ernakulam saw a situation in which a settlement was achieved, but the bank failed to secure the consent decree and kept the settlement a secret from the DRT for a considerable amount of time.

- Additionally, it reduces the significance of the IBC and the Asset Reconstruction Company.

Advantages of Compromise Settlements:

- Reduces Cost:

- Compromise agreements make it easier to recover debts quickly and save banks money by lowering related costs like legal fees.

- The main goal is to collect debts as quickly as feasible and to the greatest degree possible.

- Technical Write-Offs and NPA Reduction:

- Over the past ten years, banks have used write-offs to lower non-performing assets (NPAs), leading to lower reported NPA numbers.

- There are worries that this practise permitted banks and corporations to "evergreen" their loan books, even while write-offs were utilised for accounting and tax purposes.

- Compromise Settlements seek to offer critical humanitarian aid to financially strapped businesses dealing with Non-Performing Assets (NPA) brought on by unanticipated market risks.

What is a Non-Performing Asset?

- NPA refers to a classification for loans or advances that are in default or are in arrears on scheduled payments of principal or interest.

- When loan payments have not been made for a minimum of 90 days, debt is often regarded as non-performing.

- Agricultural loans are categorised as NPAs if the principal and interest are not repaid after two cropping seasons.

- Gross NPA: Sum of all the loans that have been defaulted by the individuals.

- Net NPA: Amount that is realised after provision amount has been deducted from the gross non-performing assets.

Laws and provisions related to NPAs:

- Bad Bank:

- NARC (National Asset Reconstruction Ltd.) is the name of the bad bank in India.

- Asset rebuilding will be the role of this NARC.

- The banks' NPA will be reduced since it will purchase their bad loans from them. The stressed loans will subsequently be offered for sale by NARC to purchasers of distressed debt.

- India Debt Resolution Company Ltd. (IDRCL), a company the government has previously established, would be selling these stressed assets on the open market. IDRCL will therefore try to sell them on the market.

- The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002:

- According to the SARFAESI Act, banks and other financial institutions are free to seize collateral assets and sell them to recoup unpaid debts.

- It enables banks to send demand notifications to borrowers who are in default and has measures for the enforcement of security interests.

- The Insolvency and Bankruptcy Code (IBC), 2016:

- A thorough framework for the settlement of insolvency and bankruptcy in India is provided by the IBC.

- It attempts to establish a creditor-friendly climate and speed up the settlement of stressed assets.

- A debtor or creditor may start bankruptcy procedures against a non-paying borrower in accordance with the IBC.

- To monitor the procedure, it creates the National Company Law Tribunal (NCLT) and the Insolvency and Bankruptcy Board of India (IBBI).

- The Recovery of Debts Due to Banks and Financial Institutions (RDDBFI) Act, 1993:

- Debt collection Tribunals (DRTs) are created under the RDDBFI Act for the swift adjudication and collection of debts owed to banks and financial institutions.

- DRTs have the authority to hear and rule on matters involving the recovery of defaulted debts that exceed a certain level.

- The Indian Contract Act, 1872:

- The contractual arrangement between lenders and borrowers is governed by the Indian Contract Act.

- The legal foundation for loan agreements, terms and conditions, default, and remedies accessible to lenders in the event of non-payment are all established.

Way Forward

- Consent Decree and Recovery Proceedings: While negotiating compromise agreements, banks must take into account current recovery processes under judicial forums. The receipt of a consent decree from the pertinent judicial authorities should be a requirement for settlements.

- Significance of NPA Recovery: To safeguard the interests of stakeholders and depositors, NPAs must be recovered. In compromise settlements, the fastest, least expensive way to collect the most debt possible should take precedence.

- Consideration of Public Interest: Banks should prioritise the interests of the tax-paying public over the interests of borrowers during compromise settlements since they are public sector organisations.

Prelims

Q. With reference to the governance of public sector banking in India, consider the following statements:(2018)

- Capital infusion into public sector banks by the Government of India has steadily increased in the last decade.

- To put the public sector banks in order, the merger of associate banks with the parent State Bank of India has been affected.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)