- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Why India Secretly Flew Its 200 Tonnes of Gold Back?

Why India Secretly Flew Its 200 Tonnes of Gold Back?

04-11-2024

- On Dhanteras (October 29, 2023), a day when many Indians buy gold for good luck, the Reserve Bank of India (RBI) announced it had brought back 102 tonnes of gold from the Bank of England and the Bank for International Settlements (BIS).

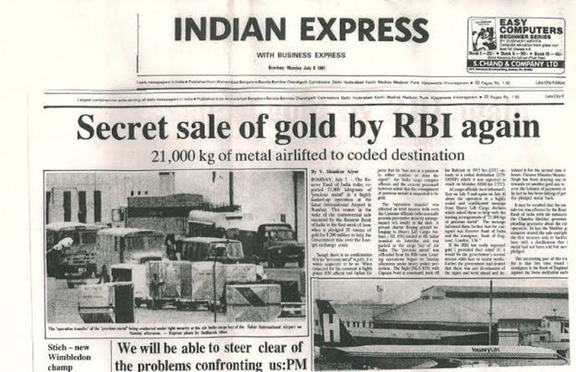

- This follows a similar move in May 2023, when the RBI repatriated 100 tonnes of gold, marking the largest gold transfer since the 1990s.

Recent Developments

- Gold Transportation:

- The RBI transported 102 tonnes of gold with strict security measures, using special planes.

- The gold is now stored safely in RBI vaults in Mumbai and Nagpur.

- Total Gold Reserves:

- After this repatriation, India’s total gold reserves stand at 854.73 tonnes. Out of this, 510.5 tonnes are in India, while 344.23 tonnes are still overseas.

- Specifically, 324.01 tonnes are stored in the Bank of England and the BIS, with 20.26 tonnes in gold deposits.

Historical Context

- Why Was the Gold Kept Abroad ?

- Many countries store some of their gold in foreign banks to reduce risks and make trading easier.

- The gold was moved to the UK during India’s 1991 foreign exchange crisis when the country had very low foreign reserves—less than $1 billion, enough for only 3 weeks of imports.

- Leasing Strategy:

- In May 1991, India leased smuggled gold to the State Bank of India, which sold it to a Swiss bank to raise $200 million.

- The RBI then secured loans from the Bank of England and the Bank of Japan using gold as collateral.

Reasons for Recent Repatriation

- Economic Growth:

- Bringing the gold back shows that India’s economy is getting stronger.

- The past decision to send gold abroad was linked to economic struggles, while the recent return reflects confidence in growth.

- Economist Sanjeev Sanyal said that this move symbolizes a major shift from the failures of 1991.

- Global Tensions:

- The timing is significant, as it coincides with global issues, like the Russia-Ukraine war and rising conflicts in West Asia.

- Gold is viewed as a safe investment during uncertain times, as it tends to keep its value.

- Protection Against Inflation:

- Gold helps protect against inflation and currency drops.

- It is generally more stable than other assets, making it a reliable choice.

- Gold’s liquidity makes it attractive for investors needing quick access to cash.

Official Statements

- Shaktikanta Das, the RBI Governor, explained that the amount of gold stored outside India had increased due to ongoing purchases. With enough space in India, it was sensible to bring some back.

- P. Chidambaram, a former finance minister, said that moving the gold makes no difference to its management; it can still be effectively used wherever it is stored.

Future Use of Gold

With the gold now in India, the RBI can:

- Stabilize Local Gold Prices: By managing gold reserves at home, the RBI can help control local prices and stabilize the market.

- Prepare for Financial Risks: Gold can serve as a backup during financial crises, helping to manage inflation and protect against currency drops.

The Economic Crisis of 1990-91

Import Compression Strategy

|

Conclusion

Bringing the gold back is an important step in India’s financial strategy, showing improved economic conditions and smart management of reserves. This move is not just about the gold itself; it symbolizes national strength and confidence in future growth. As global tensions continue and uncertainties arise, the return of gold reinforces India’s commitment to financial stability and security.