- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

What are Asset Reconstruction Companies (ARCs)?

What are Asset Reconstruction Companies (ARCs)?

The Reserve Bank of India (RBI) issues Master Direction to Asset Reconstruction Companies (ARCs), which is important for resolution of stressed financial assets and improving the health of the financial system.

- The Directive outlines requirements for ARCs, including minimum net owned funds, registration, investment limits, capital adequacy, leadership tenure and reporting of irregularities.

What are Asset Reconstruction Companies (ARCs)?

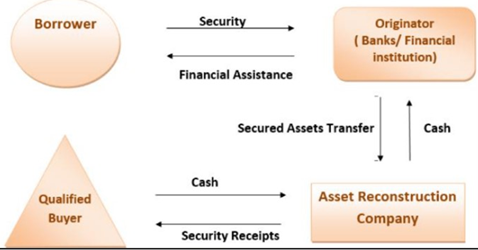

- ARCs are specialized financial institutions designed to purchase Non-Performing Assets (NPAs), or bad loans, from banks and financial institutions.

- Their primary goal is to help banks clean up their balance sheets. This allows banks to focus on their core business of lending and taking deposits rather than managing stressed assets.

How do ARCs work?

- Acquisition of NPAs: ARCs acquire NPAs from banks at a discounted price. The discount reflects the risk and uncertainty associated with recovering the bad loan.

- Resolution strategies: ARCs use various strategies to recover value from the acquired NPAs. These strategies include:

- Restructuring: Renegotiating loan terms with the borrower to make repayment more manageable.

- One-time settlement (OTS): Negotiating a lump sum payment with the borrower that is lower than the outstanding loan amount.

- Sale of assets: Selling the underlying assets (collateral) pledged against the loan.

- Legal action: Initiating legal proceedings against the borrower for recovery.

- Profit generation: ARCs earn profits by recovering more than they pay for NPAs.

Regulation of ARCs in India

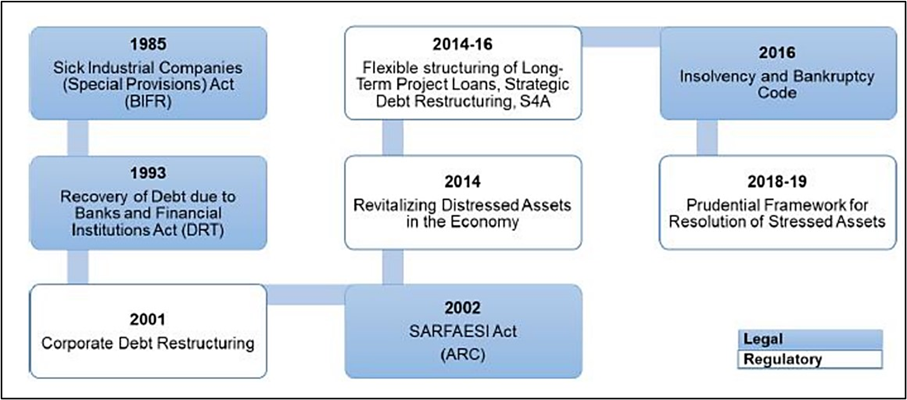

- ARCs in India are regulated by the Reserve Bank of India (RBI) under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI Act), 2002.

- The SARFAESI Act provides special powers to ARCs to take possession of secured assets and sell them without court intervention, making the recovery process more efficient.

Benefits of ARCs

- Improved bank health: ARCs help banks reduce their NPA burden, freeing up capital and improving their financial health.

- Enhanced credit flow: Clean balance sheets allow banks to lend more freely.

- Specialized expertise: ARCs have expertise in resolving complex NPAs, leading to better recovery outcomes.

- Market development: ARCs contribute to the development of a market for distressed assets.

- A distressed asset is an asset that is sold at less than its value because the owner or business needs immediate cash.

Asset Reconstruction vs. Securitization:

- Asset Reconstruction: The process of acquiring and resolving Non-Performing Assets (NPAs) to recover the outstanding loan value. It involves actions like restructuring loans, selling collateral, or taking legal action.

- Securitization: The process of pooling together liquid financial assets (such as debt) and converting them into marketable securities (backed by those assets). These securities are then sold to investors.

Key Differences

Feature |

Asset Reconstruction |

Securitization |

|

Focus |

Managing and resolving bad loans (NPAs) |

Creating liquid, tradable assets from illiquid loans

|

|

Players |

Asset Reconstruction Companies (ARCs) |

Banks, Special Purpose Vehicles (SPVs) |

|

Goal |

Maximizing recovery of debt from defaulted borrowers |

Raising funds for banks, improving liquidity |

|

Methods |

Debt restructuring, asset sale, legal action |

Pooling assets, issuing securities backed by those assets |

|

Risk Transfer |

ARC takes on the risk of the NPA |

Investors who buy the securities bear the risk |

Relationship

- Securitization as a tool: Securitization is one of the tools ARCs can use to resolve NPAs. After acquiring bad loans from banks, an ARC might pool similar NPAs together and create securities (Security Receipts) backed by them. This creates a liquid asset the ARC can sell to investors.

- Not interchangeable: While related, the terms are not interchangeable. Asset reconstruction is a broader concept, including various strategies to resolve NPAs. Securitization is a specific financial technique that can be one part of the asset reconstruction process.

Q: What is a Non-Performing Asset (NPA)?

Non-performing asset (NPA) is a loan or advance whose principal or interest payment is overdue for a period of 90 days.

Must Check: Best IAS Coaching In Delhi