- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Union Budget 2025-26 Highlights Four Engines of Development

Union Budget 2025-26 Highlights Four Engines of Development

On 1st February 2025, Union Finance Minister Nirmala Sitharaman presented the Union Budget for the fiscal year 2025-26. The budget outlined four main engines for India's growth and development:

- Agriculture

- Micro, Small, and Medium Enterprises (MSMEs)

- Investments

- Exports

The Finance Minister emphasized that these engines of growth would be driven by reforms, guided by inclusivity, and lead to the destination of a “Viksit Bharat” (Developed India)

What is the Union Budget?

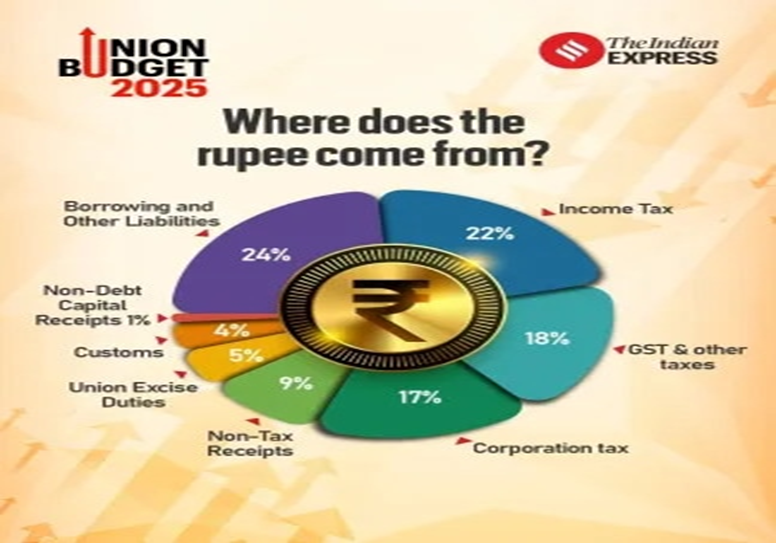

The Union Budget, referred to as the Annual Financial Statement under Article 112 of the Indian Constitution, provides an overview of the government’s financial health. It includes:

- Estimated receipts and expenditures for the current financial year.

- Revised estimates for the previous year.

- Actual figures from the year before that.

Must Read: Economic Survey 2025: Key Summary and Important Points; Download PDF

What does the Union Budget 2025-26 say on agriculture?

Agriculture, supports over 60 per cent of India’s population, is a major part of the country’s rural economy. Finance Minister Nirmala Sitharaman said that agriculture was one of the four engines driving India’s development journey and announced several new initiatives for the sector.

Some of the key initiatives are:

- Prime Minister Dhan-Dhaanya Krishi Yojana (PMDDKY):

PMDDKY will be implemented in collaboration with states, across 100 districts in its first phase.

- The scheme aims to increase agricultural productivity, adopt crop diversification and sustainable agriculture practices, improve post-harvest storage after harvest at the panchayat and block levels, improve irrigation facilities, and provide short-term and long-term credit.

2. National Mission on High Yielding Seeds: A National Mission on High Yielding Seeds will be launched, aimed at: -

- strengthening the research ecosystem,

- targeted development and propagation of seeds with high yield, pest resistance and climate resilience, and

- commercial availability of more than 100 seed varieties released since July 2024

3. Pulse Mission: The government has announced an allocation of Rs 1,000 crore for a six-year initiative called the “Pulse Mission,” aimed at boosting pulse production to achieve self-sufficiency. This initiative will focus on three types of pulses: tur (arhar), urad (mash), and masoor.

4. Makhana board for Bihar: A Makhana Board will be set up in Bihar to boost the cultivation and marketing of fox nuts. The people engaged in Makhana cultivation will be organised in FPOs.

- Bihar accounts for approximately 90% of India’s makhana production.

5. Rural Prosperity and Resilience’ program: A holistic, multi-sectoral ‘Rural Prosperity and Resilience’ program will be launched in collaboration with states.

- This initiative aims to tackle under-employment in agriculture by promoting skill development, investment, technology adoption, and revitalization of the rural economy.

6. New urea plant to come up in Assam: Setting up of a new urea plant with an annual production capacity of 12.7 lakh tonnes (lt) at Namrup in Assam.

Must Read: FIRST LIQUID NANO UREA PLANT

7. Grameen Credit Score (GCS): GCS, a framework to be developed by the public sector banks for the credit needs of the members of Self Help Groups (SHGs) and people in rural areas.

8. Mission for Cotton Productivity: For the benefit of cotton growing farmers a 5-year ‘Mission for Cotton Productivity’ is announced.

9. Enhancing loan limits for farmers: The finance minister also announced increasing the loan limit under the Modified Interest Subvention Scheme (MISS) from Rs 3 lakh to Rs 5 lakh.

What are the major announcements for India’s MSME sector in the Union Budget 2025-26?

Giving new definitions for micro, small and medium enterprises (MSMEs) and announcing a slew of initiatives to help such businesses, Finance Minister termed them the second power engine for development.

It encompasses manufacturing and services with a focus on MSMEs numbering 5.7 crore. Several key initiatives announced to address the challenges faced by the manufacturing sector, particularly for MSMEs are:

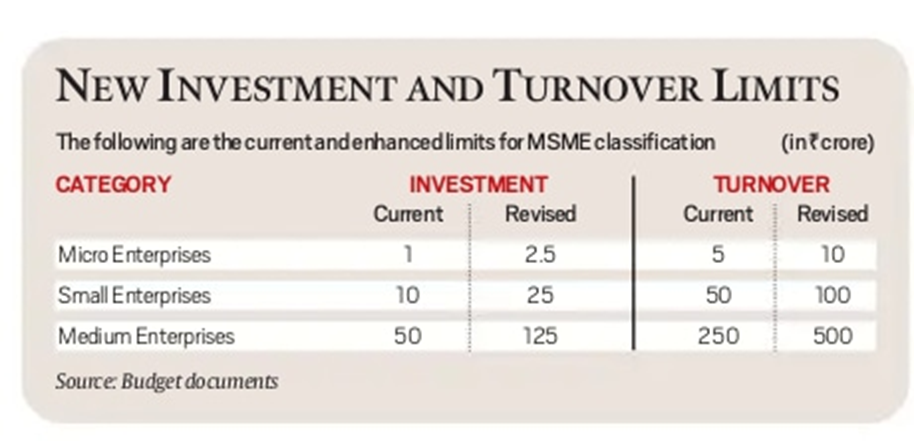

- Revised Definition of MSMEs: Finance Minister said the investment and turnover limits for classification of all MSMEs will be increased 2.5 and two times respectively.

- This means the investment limit to be classified as a micro enterprise goes up to Rs 2.5 crore. For small enterprises, this limit goes up to Rs 25 crore, and for medium ones, it becomes Rs 125 crore.

- Similarly, the turnover limit for these classifications goes up to Rs 10 crore for micro enterprises, Rs 100 crore for small ones, and Rs 500 crore for medium enterprises.

- Credit Guarantee Limit Increased: The finance minister also announced the enhancement of the credit guarantee cover from Rs 5 crore to Rs 10 crore for micro and small enterprises, and from Rs 10 crore to Rs 20 crore for startups.

- As part of the initiatives for MSMEs, she announced that a National Institute of Food Technology, Entrepreneurship and Management will be established in Bihar.

- Customised credit cards (CCC): Customised credit cards with a limit of Rs 5 lakh were announced in the Budget for micro enterprises registered on the Udyam portal. In the first year, 10 lakh of these cards will be issued.

|

High-level committee for regulatory reforms |

|

- National Manufacturing Mission (NMM): The Central government will set up a National Manufacturing Mission for small, medium and large industries with a focus on clean tech manufacturing.

- The mission’s mandate will include five focus areas – ease and cost of doing business, upskilling for in-demand jobs, MSMEs, availability of technology, and quality products.

- Scheme for First-time Entrepreneurs: A new scheme will be launched for 5 lakh women, Scheduled Castes (SCs) and Scheduled Tribes (STs) first-time entrepreneurs. This will provide term loans up to Rs 2 crore during the next 5 years.

Must Read: Budget 2025-26: Highlights and major announcements

How does the Union Budget 2025-26 address investment-related challenges to stimulate economic growth?

Union Budget 2025-26 identifies investment as the third engine of India’s growth. It focuses on investing in people, the economy, and innovation. The following initiatives have been announced in the budget:

- Urban Challenge Fund: The Government will establish a ₹1 lakh crore Urban Challenge Fund to support initiatives like ‘Cities as Growth Hubs,’ ‘Creative Redevelopment,’ and ‘Water & Sanitation’.

- The fund will cover up to 25% of viable project costs, requiring at least 50% funding from bonds, bank loans, or PPPs. ₹10,000 crore is allocated for 2025-26.

- Public Private Partnership (PPP) in Infrastructure: Each infrastructure-related ministry will come up with a 3-year pipeline of projects that can be implemented in PPP mode.

- States will also be encouraged to do so and can seek support from the IIPDF (India Infrastructure Project Development Fund) scheme to prepare PPP proposals.

- FDI in Insurance Hiked: The limit for foreign direct investment (FDI) in the insurance sector has been increased from 74% to 100%, inviting global insurers to invest in the Indian market.

Must Read: GST exemption is proposed for health insurance premiums up to ₹5 lakh.

- SWAMIH Fund 2: It will be established as a blended finance facility with contribution from the Government, banks and private investors.

- The existing Special Window for Affordable, Mid-Income Housing (SWAMIH) scheme aims to help middle-class families who pay EMIs on loans taken for apartments, and rent on their current dwellings.

Must Read: New ‘Gyan Bharatam Mission’ for Manuscripts : Union Budget 2025

|

Do you Know? |

|

Investment Friendliness Index of States will launch this year for competitive cooperative federalism. |

- Nuclear Energy Mission for Viksit Bharat: A Nuclear Energy Mission for research & development of Small Modular Reactors (SMR) with an outlay of Rs. 20,000 crores will be set up.

- At least 5 indigenously developed SMRs will be operationalized by 2033.

Must Read: Union Budget 2025 Increased Allocation for PM Surya Ghar Muft Bijli Yojana

- Deep Tech Fund of Funds: Investing in innovation the budget announced a ‘Deep Tech Fund of Funds’ for next generation startups and ten thousand PM research fellowships for technological research in IITs and IISc in next 5 years.

- Maritime Development Fund: A Rs 25,000 crore fund will be established to support the maritime industry, with 49% government support.

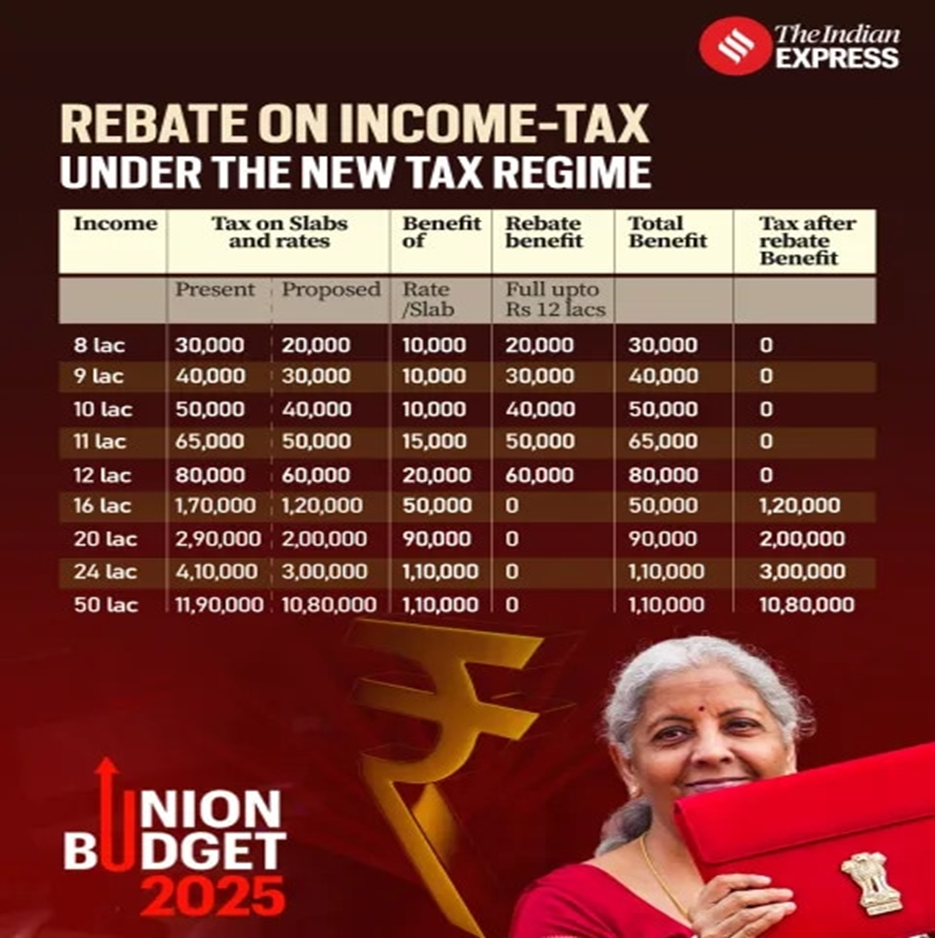

- Historic Tax Cut: The income tax rebate limit has been raised from Rs 7 lakh to Rs 12 lakh, reducing tax liability for those earning up to Rs 12 lakh.

Question 4: How does the Union Budget 2025-26 align with India’s goal of becoming a global export hub?

Finance Minister Nirmala Sitharaman identified exports as a key engine for development over the coming year. To this end, she announced five initiatives:

- Export Promotion Mission: The mission will be jointly driven by the Ministries of Commerce, MSME, and Finance, aiming to simplify export credit access, cross-border factoring, and support MSMEs in dealing with non-tariff barriers in foreign markets.

- BharatTradeNet (BTN): A unified platform for international trade documentation and financing solutions will be created to streamline export processes.

- Global Supply Chain Integration: Support domestic manufacturing to integrate India’s economy into global supply chains, focusing on Industry 4.0 and youth talent.

- National Framework for Global Capability Centres: As guidance to states for promoting Global Capability Centres (GCCs) in emerging tier 2 cities. GCCs offer support to MNCs.

- The proposed policy aims at enhancing availability of talent and infrastructure, building-byelaw reforms, and mechanisms for industry collaboration.

- Air Cargo Warehousing Facilities: Infrastructure improvements for air cargo, including high-value perishable goods, will be supported to boost export logistics.

The Union Budget 2025-26 lays a strong foundation for India's development with its focus on agriculture, MSMEs, investments, and exports. By fostering these key areas, the government aims to propel the country toward becoming a globally competitive economy.

Prelims Questions

(1) Consider the following statements:

1. Revenue expenditure does not result in the creation of assets for the Government of India.

2. Capital expenditure reduces the government’s liability or increases the government’s assets.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans C

(2) Along with the Budget, the Finance Minister also places other documents before the Parliament which include ‘The Macro Economic Framework Statement’. The aforesaid document is presented because this is mandated by (UPSC CSE 2020)

(a) Long-standing parliamentary convention

(b) Article 112 and Article 110(1) of the Constitution of India

(c) Article 113 of the Constitution of India

(d) Provisions of the Fiscal Responsibility and Budget Management Act, 2003

Ans D

(3) With reference to the Union Government, consider the following statements: (UPSC CSE 2015)

1. The Department of Revenue is responsible for the preparation of the Union Budget that is presented to the Parliament.

2. No amount can be withdrawn from the Consolidated Fund of India without the authorization from the Parliament of India.

3. All the disbursements made from Public Account also need the authorization from the Parliament of India.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3

Ans C

(4) There has been a persistent deficit budget year after year. Which action/actions of the following can be taken by the Government to reduce the deficit? (UPSC CSE 2016)

1. Reducing revenue expenditure

2. Introducing new welfare schemes

3. Rationalizing subsidies

4. Reducing import duty

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2, 3 and 4

Ans c

|

Also Read |

|