- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Special Economic Zones Rules Amendment, 2023

Special Economic Zones Rules Amendment, 2023

07-12-2023

Context

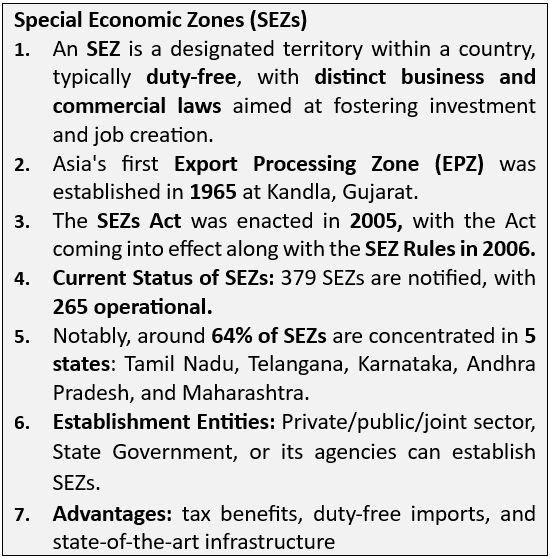

- The Ministry of Commerce has issued the Special Economic Zones (SEZ) (5th Amendment) Rules, 2023. The Ministry invoked powers granted by section 55 of the Special Economic Zones Act, 2005.

Amendment Highlights

- Demarcation Provision: The Board of Approval can authorize the demarcation of a segment within an Information Technology Enabled Services SEZ as a non-processing area.

- Area Clarification: The processing area in an SEZ is designated for the manufacture of goods or services, while the non-processing area serves as supporting infrastructure.

- Tax Benefits Repayment: The amendment outlines the calculation of tax benefits repayment, based on the proportion of the built-up non-processing area to the total built-up processing area.

Significance

- The amendment enhances business flexibility within SEZs.

- It safeguards the interests of both developers and occupiers within SEZs.

- The freed-up space allows for improved utilization, accommodating a diverse range of occupiers.

- It contributes to diversifying the tenant base within SEZs.