- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

SEBI proposed Retail Algo Trading Framework

SEBI proposed Retail Algo Trading Framework

Recent Context

- In February 2025, The Securities and Exchange Board of India (SEBI) allowed participation of retail investors in Algorithmic trading.

- Earlier, only institutional investors were allowed to use it via Direct Market Access (DMA)

- Direct market access (DMA) is a way of trading financial instruments directly on an exchange, without using a third-party broker.

- In this regard, SEBI also put out a framework to regulate the participation of retail investors in the algorithmic trading space.

What is Algo trading?

- Algorithmic trading (or algo trading) is trading using automated execution logic.

- Here, computers are programmed using pre-set rules to automatically buy and sell stocks.

- Thus, instead of a human clicking “buy” or “sell”, a computer program executes trades at high speeds.

- Two main strategies in Algo trading:

- Low-frequency strategies

- To make a few trades over hours or days

- For example, Trend-following algos may buy/sell when the market reaches a certain level.

- High-frequency strategies

- To execute several thousands of trades per millisecond

- For example, Market-making algos constantly place buy and sell orders, profiting from tiny price differences.

- Low-frequency strategies

Advantages of Algo Trading

|

ADVANTAGE |

DESCRIPTION |

|

Speed |

Executes trades at high speeds, much faster than human traders, taking advantage of market opportunities in milliseconds. |

|

Accuracy |

Minimizes the likelihood of human errors in placing trades. |

|

Market Monitoring |

Continuously monitors multiple markets and securities, identifying and seizing opportunities instantly. |

|

Emotion-Free Trading |

Eliminates emotional and psychological factors from trading decisions, relying solely on logic and rules. |

|

Back testing |

Allow traders to test strategies using historical data to forecast how they would perform in real market conditions. |

What are the key highlights of the Regulatory Framework?

- Role of brokers:

- Retail investors will get access to the approved algos only from the registered brokers.

- Sole responsibility of brokers in handling investor grievances.

- Trading Limits for Retail Traders:

- Retail traders must follow exchange-set limits (yet to be decided).

- Registration of algos developed by retail investors if they cross the specified order per second threshold.

- Registration of Algo Providers:

- Algo providers are not regulated by SEBI but must register with exchanges and partner with a broker to sell algos.

- Categorization of Algorithms:

- White box: Logic is disclosed and replicable i.e. Execution Algos.

- They must be registered with the exchanges once and can be offered to any trader once registered.

- Black box: Algos where the logic is not known to the user and is not replicable

- To offer them the algo provider will have to get a Research Analyst (RA) license from SEBI and meet certain compliances.

- White box: Logic is disclosed and replicable i.e. Execution Algos.

- Unique identifier:

- Each algo order would be tagged with a unique identifier to establish an audit trail.

- Responsibility of stock exchanges:

- Supervision of algo trading

- Establishing comprehensive Standard Operating Procedure (SOP) for testing of algos.

- Surveillance on all algo orders and monitoring their behaviour at all times.

Key market-related terms

|

TERM |

DEFINITION |

|

Retail investor |

Nonprofessional investor who buys and sells securities for their own personal use |

|

Institutional investor |

Organization that pools money to invest in securities, real estate, and other assets |

|

Stockbroker |

Financial professional who buys and sells stocks as per clients' direction. For example, Zerodha, Groww etc. |

|

Algo providers |

Businesses that sell algorithmic trading strategies and programs to traders |

|

Stock exchange |

Exchange where stockbrokers and traders can buy and sell securities. For example, BSE |

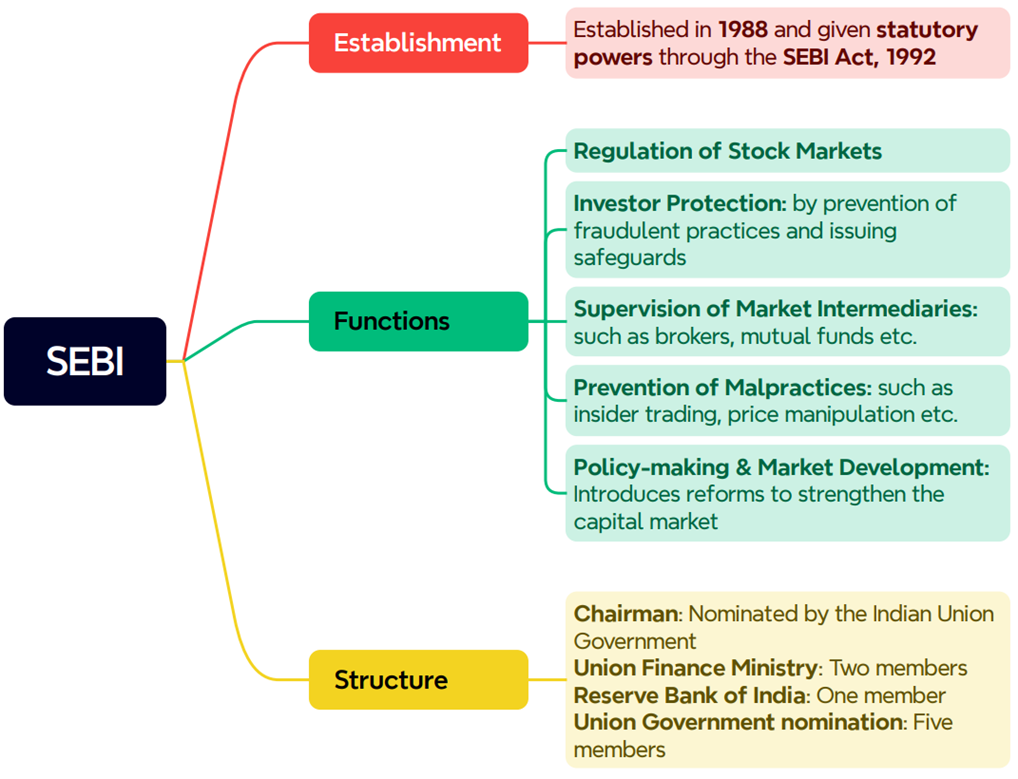

What is SEBI?

|

Also Read |

|

| FREE NIOS Books | |