- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- NCERT Medieval History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Redistribution of Wealth

Redistribution of Wealth

A 9-judge Constitution Bench is hearing a reference to Article 39 (b) of the Constitution's Directive Principles of State Policy (DPSP), including whether privately-owned resources could be considered as ‘material resources of the community’.

Constitutional Provisions about Property Rights

- When the Constitution was enacted in 1950, it provided the Right to Property under Article 19 (f).

- Article 31 of the Constitution states that if a state is going to acquire property, the person shall be adequately compensated.

Implementation of DPSP

- Article 38 directs the state to minimize inequality and Article 39 for the equitable distribution of wealth and property.

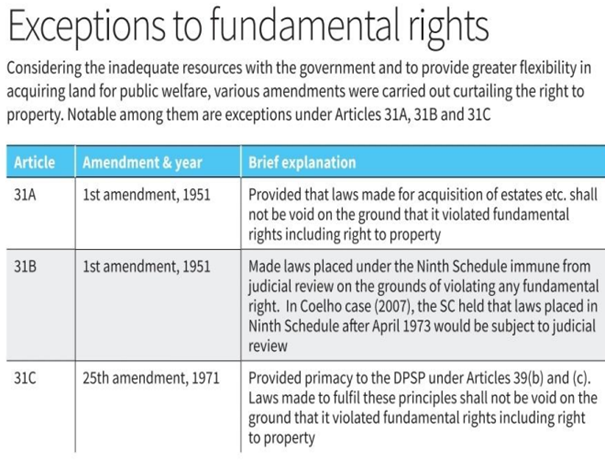

- To implement the above two Articles (DPSP), the government of India implemented the 1st Constitutional Amendment Act in 1951. This inserted Articles 31A and 31B.

- Article 31A: any law that is made for the acquisition of property shall not be void on the ground that it violated fundamental rights including the right to property.

- Article 31B: if any such law is placed under the 9th Schedule it is completely immune from the judicial review on the ground that it is violating the fundamental right.

- This blanket was removed by the Supreme Court in the IR Coelho Case 2007.

- The Acts which are kept in the 9th Schedule after 1973 will be under judicial review.

- The 25th Constitutional Amendment Act of 1971 inserted the Article 31C.

- The act provided that the Fundamental Rights (Articles 14 & 19) are subordinate to the DPSP [39(b) & (c)]. If the government is making any such law to implement the DPSP, it cannot be considered void on the ground that it violates Fundamental Rights.

- This provision of Article 31C was reviewed by the Supreme Court in the Kesavananda Bharati Case 1973. The SC upheld the validity of the Article 31C. But it has been put under judicial review.

- The government then enacted the 44th Constitutional Amendment Act of 1978.

- This Act made the Right to Property as a ‘Legal & Constitutional Right’ (not Fundamental Right) under Article 300A.

- This Act also abolished Article 19 (1) (f) and Article 31.

- This Article states that no person can be deprived of their property except by the authority of law. This means that a person can only be deprived of their property through an Act passed by the Parliament or State Legislature, and not by executive order.

- Further in the Minerva Mills Case of 1980, the SC held that Constitution exists on the harmonious balance between Fundamental Rights and DPSP.

- The government can bring the Acts to implement the DPSP but at the same time, it shall not conflict with the Fundamental Rights.

Can the government acquire property?

- Yes, the government can acquire property but under three conditions:

- Such acquiring of the property shall be for any public purpose.

- The government shall provide you with the compensation on the land rate of time.

- One can go to the court to challenge such enactment of the Act under the judicial review power of the SC provided under Articles 13 and 32 of the Constitution.

Following the socialist principle, the government followed the Socialist Model of Governance (1951-1991)

- Redistribution of Property (Land Reforms)

- Zamindari Abolition Act of 1951

- Tenancy Act: land is provided to farmers and cultivators who do not have land.

- Land Ceiling Act 1961: it identified the family as a unit of 5 members.

- A family can own 10-27 acres of irrigated land

- 35-54 acre of any dry land

- To enhance financial inclusion the nationalisation of bank and insurance sectors. So that even the marginalised sections of society can avail of loans and advances.

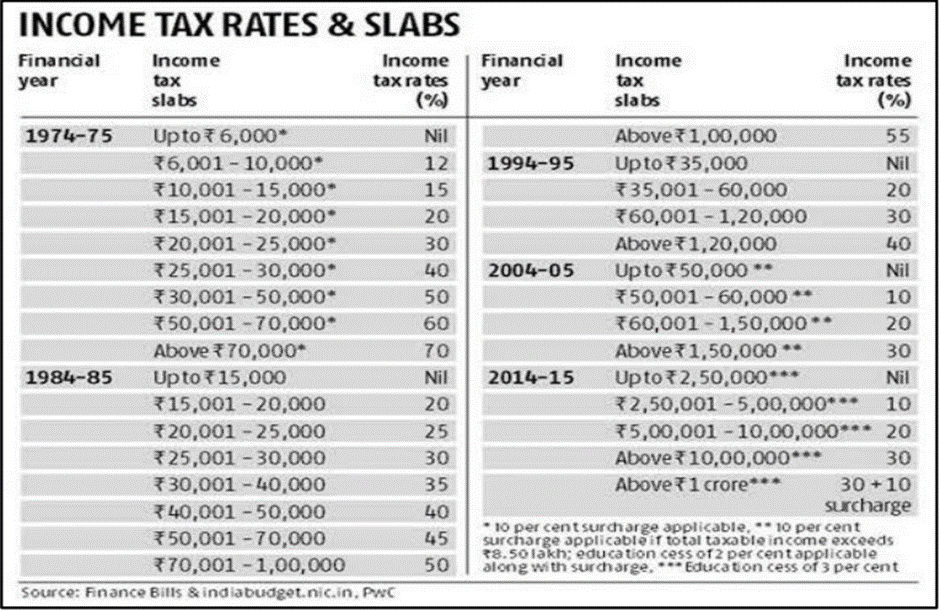

- To overcome income inequality, a high rate of direct taxes has been introduced as an inheritance tax on wealth.

- Inheritance tax on wealth means: if a father has bought 1 acre land five years back. Now the National Highway is being constructed on nearby land which increased the price of that land. Father has given this land under his will to his son, this wealth which originally belonged to his father was inherited by his son. Hence, the son needs to pay taxes to the government.

- To prevent the privatisation of the larger sector there existed the Monopolies & Restrictive Trade Practices (MRTP) Act 1969. The Act ensures that one company does not excessively grow and monopolise the market.

Is the socialist approach feasible in the long run?

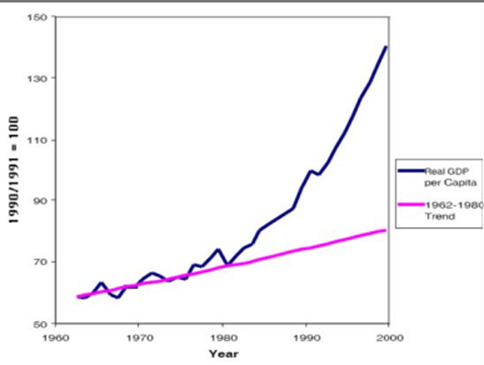

High intervention by the government restricted the growth of an economy. This was observed after the economic reforms of 1991 when the GDP was boosted in India.

- High taxes led to tax evasion which further increased the issue of black money in the economy.

- There was a high administrative cost (more than revenue) to collect and maintain the high Estate Duty and Wealth Tax.

1991 Onwards

- The government moved towards a mixed economy (socialist & capitalist) after 1991 and adopted the LPG Reforms of 1991.

- Under the New Industrial Policy of 1991, the MRTP Act was abolished and replaced with the Competition Act of 2002.

- Huge reduction in Direct Taxes (corporate tax has been reduced from 70% to 25%, no tax on buybacks and no enhanced surcharge).

- Estate Duty and Wealth Tax were abolished in 1985 and 2016 respectively.

Why the issue of redistribution of wealth has arisen again in 2024?

- As per the World Inequality Report 2022, there has been a rampant rise in inequality in India.

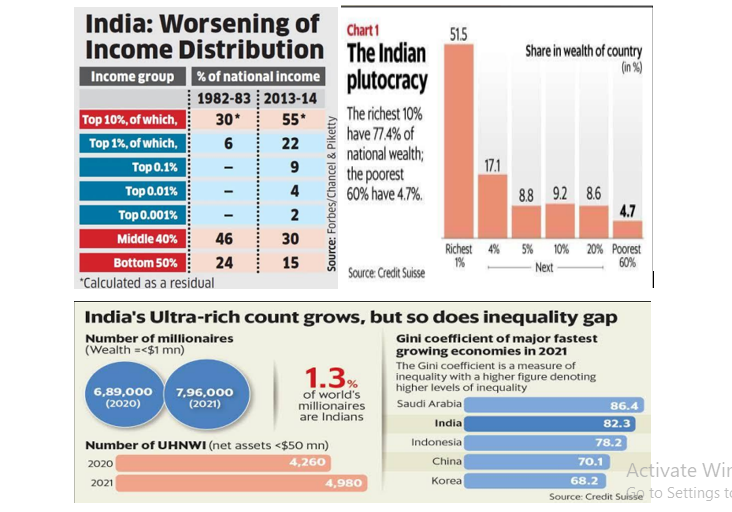

- The top 1% of the highest income group in India contributes 6% of national income in 1982-83. It has been increased to 22% in 2013-14.

- The top 10% share in national income has been increased from 30% in 1983-83 to 55% in 2013-14.

- The bottom 50% share of national income has declined from 24% in 1982-83 to 15% in 2013-14.

- As highlighted in the report, India’s ultra-rich count grows but so does the inequality gap in India.

- The report uses the Gini coefficient – the measure of inequality, which signifies that India with 82.3% has higher levels of inequality.

- The number of millionaires in India is growing significantly at the same time the number of multidimensional poor has also increased in India.

- 1.3% of the world’s millionaires are Indian and 23 crores of multidimensional poor in India (as per MPI).

- India is moving towards plutocracy (wealthocracy or moneyed rule) where the richest 10% have 77.4% of national wealth and the poorest 60% have 4.7% of the wealth.

The above data has raised the debate revolving around that there is a need for redistribution of wealth in India. At the same, the SC is examining the provisions of Article 39B, whether the private properties that are held by individuals can fall under the category of community resource as well. Earlier India experienced that government intervention could negatively affect growth numbers. Hence, we need a balanced approach to ensure the principle of economic justice which has been enshrined in the Preamble of the Indian Constitution.

Must Check: Best IAS Coaching In Delhi