- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- NCERT Medieval History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

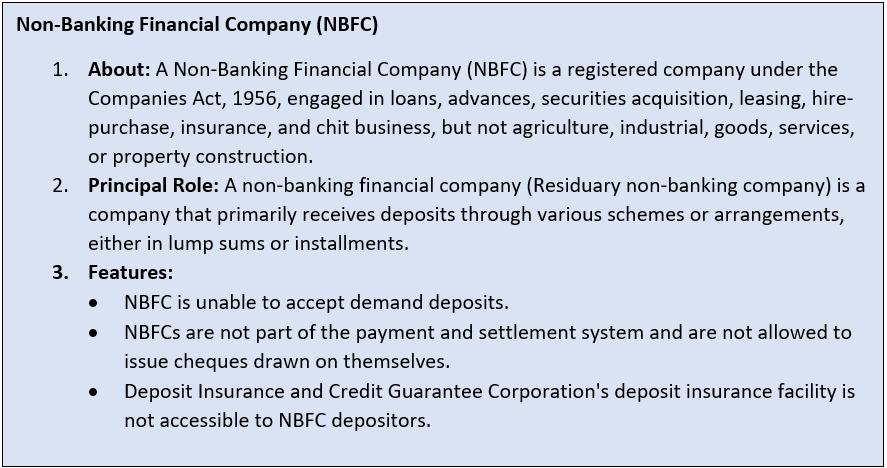

RBI to extend PCA supervisory norms to government-owned NBFCs

RBI to extend PCA supervisory norms to government-owned NBFCs

11-10-2023

Why in News?

- Recently, RBI announced that it will extend Prompt Corrective Action (PCA) Framework to Government owned Non-Banking Financial Companies (NBFCs) from October,2023.

- The Framework will be extended to Government NBFCs, except those in Base Layer, starting October 1, 2024, based on audited financials as of March 31, 2024 or later.

- The base layer refers to Non deposit-taking NBFCs with assets below ₹1000.

- The three remaining layers are the Middle Layer, Upper Layer, and Top Layer.

What is Prompt Corrective Action?

- About: PCA is a system that the RBI imposes on banks exhibiting financial stress, deeming them unsafe if they fail to meet certain financial metrics or parameters.

- Criterion/Reasons for Invoking PCA:

- The RBI considers profitability, asset quality, capital ratios, and debt level when deciding if a bank should be placed under the PCA framework.

- The central bank grades factors based on actions, categorizing them from 1 to 3, with 1 being the lowest and 3 being the highest, based on banks' frameworks.

- Capital Adequacy Ratio (CRAR): The CRAR measures a bank's capital required, based on assets disbursed, with higher assets indicating higher capital retention to cover asset book risk.

- Asset Quality: This parameter refers to the non-performing assets of a bank. If the net NPA of a bank is more than 6%, but less than 9%, it falls under the first threshold. If Net NPA crosses the 9% mark, it triggers the second grade. That said, if this metric is 12% or more, the bank will fall in the third grade of PCA.

- Profitability: The regulator considers the return on assets (ROA) of a bank as the key measure for profitability. Note that if a bank’s ROA is negative for two, three and four years in a row, it will be categorized as grade 1, grade 2 and grade 3, respectively.

- Debt Level/Leverage: The RBI evaluates a bank's financial risk by assessing its overall debt level/leverage.

- Trigger for invoking PCA:

- The regulator triggers grade 1 if the overall leverage of a bank is more than 25 times its Tier 1 capital. However, when total leverage is over 28.5 times its core capital (including disclosed reserves), RBI takes action according to grade 2 of PCA.

- The PCA Framework was introduced for NBFCs due to their growing size and interconnectedness with other financial system segments.

Impact of PCA

- Restriction on dividend distribution/ remittance of profit;

- Restriction on branch expansion;

- Discretionary actions related to governance, capital, profitability and business.

- Ask a Bank’s board to implement a resolution plan after seeking approval from the supervisor.

- Advise banks to gauge their viability over the medium to long term besides evaluating balance sheet estimates.

- RBI may allow PCA banks to incur capital expenditure only to upgrade technology.

How Can Banks Get Out of RBI’s PCA List?

Banks and the government have attempted to remove banks listed under the PCA list through two methods.

- Mergers and Amalgamation:

-

-

-

-

- Mergers and amalgamations have been the go-to option for the Government to rescue banking institutions in India.

- For Example: Dena Bank and Vijaya Bank merged with Bank of Baroda on April 1, 2019, a preferred method for RBI for growth and sustainability of banks.

-

-

-

-

- Bank Recapitalisation:

-

-

-

-

- The government uses equity and debt instruments to recapitalize a banking institution by injecting fresh capital into its balance sheet.

-

-

-

-

Conclusion

While some banks have the capacity to withstand challenging phases of operations, others not so much. This is where RBI steps in through the PCA framework, essentially providing an opportunity for the banks to clean their operations. It can benefit both banks and depositors of the banks.