- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

RBI’S STRENGTHEN UCBs

RBI’S STRENGTHEN UCBs

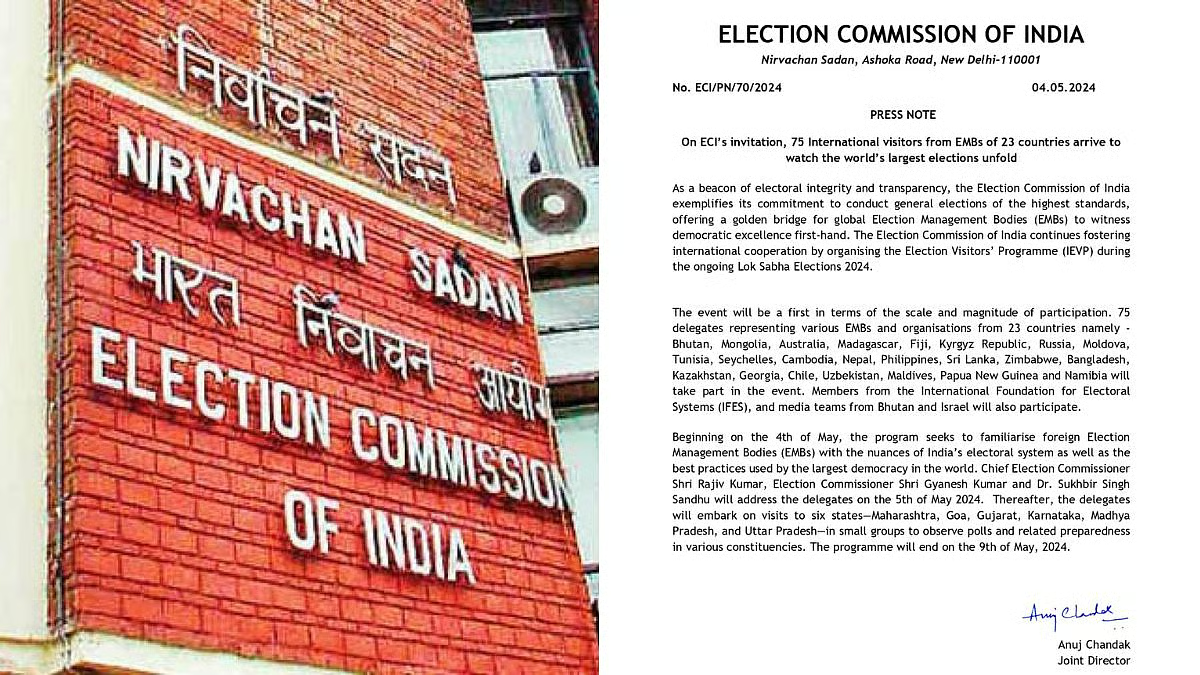

Latest Context

The Reserve Bank of India has announced four crucial steps to strengthen 1,514 urban cooperative banks, including providing them an additional two years to reach their lending goals for priority sectors.

Key Measures taken by RBI

Four Key Measures:

- Allowing UCBs to open up to 10% (a maximum of 5 branches) of the number of branches in the preceding fiscal year in new locations without seeking RBI permission first.

- Enabling UCBs to conduct One-Time Settlement on an equal footing with commercial banks.

- Extending the deadline by two years, to March 31, 2026, for UCBs to meet their Priority Sector Lending (PSL) goals. After PSL's shortfall is covered during FY 2022–2023, all leftover deposits will be returned to the UCB.

- A nodal officer is being informed to facilitate improved coordination and targeted communication between RBI and the cooperative sector.

Possible Effects:

- These programmes will support the UCBs, who operate in urban settings and have difficulty meeting PSL goals.

- In order to strengthen cooperatives and treat them equally with other types of economic organisations, the Ministry of Cooperation is dedicated to doing so.

What is Cooperatives Banks in India?

- It is an institution founded on a cooperative basis to handle standard banking operations. In order to start a cooperative bank, money is raised through the sale of shares, along with deposits and loans.

- They are cooperative credit unions in which individuals from the same community band together to provide one another loans on advantageous conditions.

- They are registered under the Multi-State Cooperative Societies Act of 2002 or the Cooperative Societies Act of the relevant State.

- They can be generally divided into cooperative urban and rural banks.

- The Co-operative banks are governed by the,

- Banking Regulations Act, 1949.

- Banking Laws (Co-operative Societies) Act, 1955.

Facts about Urban Cooperative banks (UCB)

- Urban Cooperative Banks (UCBs) are primary cooperative banks that are situated in urban and semi-urban regions; the word is not technically defined.

- Due to their focus on specific localities, the Urban Cooperative Banks (UCBs), Primary Agricultural Credit Societies (PACS), Regional Rural Banks (RRBs), and Local Area Banks (LABs) might all be categorised as various types of banks.

- These banks were only permitted to make loans until 1996 for non-agricultural uses. Today, this difference is no longer valid.

- Since they primarily financed to small borrowers and enterprises, these banks were historically focused on neighbourhoods and local workgroups. Their current businesses have a far wider range.

What are Recent Developments?

- The RBI updated the Supervisory action Framework (SAF) for UCBs in January 2020.

- The Central Government enacted an Ordinance in June 2020 to directly subordinate all urban and multi-state cooperative banks to the RBI.

- The RBI has established a four-tier regulatory framework for classifying UCBs in 2022:

- Tier 1: With all unit UCBs and salary earner’s UCBs (irrespective of deposit size) and all other UCBs having deposits up to Rs 100 crore.

- Tier 2: With UCBs of deposits between Rs 100 crore and Rs 1,000 crore.

- Tier 3: With UCBs of deposits between Rs 1,000 crore and Rs 10,000 crore.

- Tier 4: With UCBs of deposits more than Rs 10,000 crore.

Prelims:

Q. With reference to ‘Urban Cooperative Banks’ in India, consider the following statements: (2021)

- They are supervised and regulated by local boards set up by the State Governments.

- They can issue equity shares and preference shares.

- They were brought under the purview of the Banking Regulation Act, 1949 through an Amendment in 1966.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Mains:

Q. The concept of cooperative federalism has been increasingly emphasized in recent years. Highlight the drawbacks in the existing structure and the extent to which cooperative federalism would answer the shortcomings. (2015)

Q. “In the villagesitself no formof credit organization will be suitable exceptthe cooperative society.” – All India Rural Credit Survey. Discuss this statement in the background of agricultural finance in India. What constraints and challenges do financial institutions supplying agricultural finance face? How can technology be used to better reach and serve rural clients? (2014)