- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

RBI's Balance Sheet Grows Significantly in FY24

RBI's Balance Sheet Grows Significantly in FY24

01-06-2024

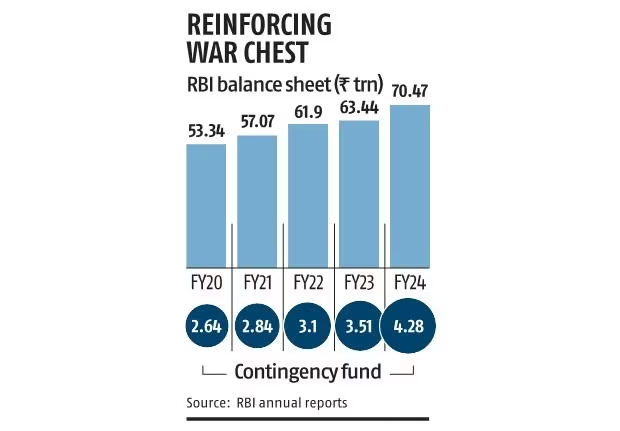

The Reserve Bank of India (RBI) reported a substantial 11.08% increase in its balance sheet size to ₹70.47 lakh crore for the fiscal year ending March 31, 2024 (FY24).

- This growth is attributed to increased liquidity and foreign exchange operations, with notable increases in foreign investments, gold holdings, and loans and advances on the asset side.

- On the liability side, the expansion was driven by increased notes issued, deposits, and other liabilities.

How the RBI Generates Income:

The RBI employs various methods to generate income, including:

- Interest on Loans and Advances: Charging interest on loans provided to commercial banks and the government.

- Investments: Earning interest on investments in government securities and foreign assets.

- Foreign Exchange Operations: Profiting from buying and selling foreign currencies and managing foreign exchange reserves.

- Issue of Currency: Generating seigniorage, the profit made from issuing currency.

- Management of Government Accounts and Other Services: Charging fees and commissions for various services.

- Open Market Operations: Buying and selling government securities in the open market.

- Discount and Rediscount Operations: Providing liquidity to commercial banks and charging interest.

- Penalties and Fines: Imposing penalties on non-compliant financial institutions.

- Miscellaneous Income: Earning from subsidiary organisations and other financial services.

Key Highlights of RBI's Financial Performance in FY24

- The balance sheet size increased by 11.08% to ₹70.47 lakh crore, driven by increased liquidity and forex operations.

- The balance sheet size now represents 24.1% of India's GDP, normalising to pre-pandemic levels.

- Net income surged by 141.22% due to reduced expenditures and lower provisions.

- Expenditures declined by 56.29% to ₹64,694.33 crore, including a ₹42,819.91 crore provision transferred to the contingency fund.

- The surplus transferred to the central government increased to ₹2.1 trillion in FY24.

Overall, the RBI's financial performance in FY24 reflects its diverse income sources and active role in managing India’s monetary and financial systems.

Must Check: UPSC Coaching Institute In Delhi