- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

RBI Guidelines for Asset Reconstruction Companies

RBI Guidelines for Asset Reconstruction Companies

24-05-2024

The Reserve Bank of India (RBI) has issued a direction outlining updated guidelines for Asset Reconstruction Companies (ARCs), effective from 24th April 2024.

New RBI Guidelines for Asset Reconstruction Companies (ARCs):

Increased Minimum Capital Requirement:

- ARCs must now maintain a minimum capital of Rs 300 crore, significantly higher than the previous requirement of Rs 100 crore.

- Existing ARCs have a transition period till March 31, 2026, to achieve the new net owned fund (NOF) limit of Rs 300 crore.

- As part of this transition, ARCs must ensure a minimum capital of Rs 200 crore by March 31, 2024.

- Non-compliance with any of these steps may result in supervisory action, including a ban on doing incremental business until the required minimum NOF is reached.

Eligibility as Resolution Applicants:

- ARCs with a minimum NOF of Rs 1000 crore are eligible to act as resolution applicants in the asset resolution process under the Insolvency and Bankruptcy Code, 2016 (IBC).

Investment Opportunities:

- ARCs can deploy funds in government securities and deposits with scheduled commercial banks, Small Industries Development Bank of India (SIDBI), National Bank for Agriculture and Rural Development (NABARD), and other entities specified by the central bank from time to time.

- ARCs can also invest in short-term instruments like money market mutual funds, certificates of deposit, and corporate bonds/commercial papers.

- However, there is a cap of 10% of the NOF on the maximum investment in such short-term instruments.

What are Asset Reconstruction Companies?

-

About:

- ARCs, regulated by the Reserve Bank of India and incorporated under the Companies Act, 2013, are financial institutions that specialize in acquiring Non-Performing Assets (NPAs) or bad assets from banks and financial institutions.

- By purchasing these NPAs, ARCs facilitate the cleansing of balance sheets of banks and financial institutions and contribute to the overall health of the financial system.

- The legal framework for ARC operations is provided by the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002.

-

Examples:

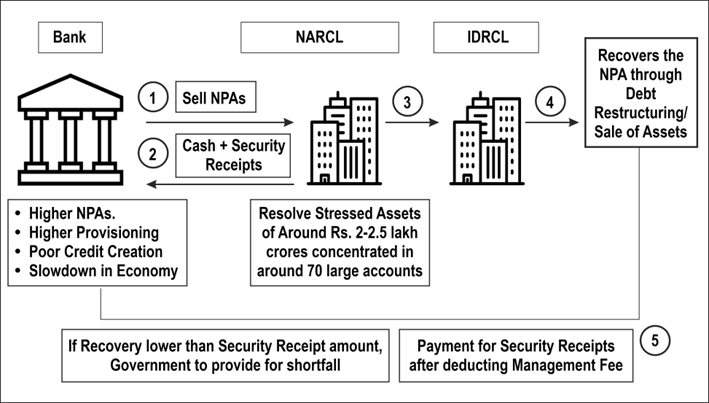

- National Asset Reconstruction Company Limited (NARCL) is a company created by banks to gather and organize stressed assets for further resolution. It is mostly owned by Public Sector Banks (PSBs), which hold a 51% stake.

- India Debt Resolution Company Ltd. (IDRCL) is another organization in charge of trying to sell the stressed assets on the market.

- PSBs and Public Financial Institutes (FIs) will hold a maximum of 49% stake in IDRCL. Private-sector lenders will own the remaining 51% stake.

-

Function:

- In accordance with the SARFAESI Act of 2002, ARCs specialize in revitalizing and recovering stressed assets. They acquire non-performing or bad debts from lenders through cash or a combination of cash and security receipts.

-

Business Model:

- Acquisition of Stressed Loans: Lenders can free up their resources to focus on new loans by selling stressed loans to asset recovery companies (ARCs) at a discount.

- Security Receipts: ARCs issue security receipts to lenders, which can be redeemed upon the recovery of a specific loan.

- Management Fees and Earnings: ARCs charge a management fee of 1.5% to 2% of the asset value annually and earn from recoveries, sharing the upside with the selling financial institutions.

-

Challenges:

- ARCs regularly handle chronic non-performing assets (NPAs), creating valuation and recovery challenges due to long delays.

- Consolidating loans from multiple lenders to a single borrower often creates complexity, requiring extensive coordination and agreement among stakeholders.

- ARCs face difficulties in raising funds, limiting their ability to acquire distressed assets or provide borrowers with the support they need for revival.

- Establishing the fair value of distressed assets for acquisition and recovery can be difficult, particularly in cases involving illiquid or complex structured assets.

-

Recent Changes in ARC Regulations by RBI:

- Strengthened Corporate Governance: To improve corporate governance in asset reconstruction companies (ARCs), the Reserve Bank of India (RBI) mandated that at least half of the directors and the board chair must be independent directors.

- Transparency Enhancement: ARCs must disclose their track record of returns generated for security receipt investors. Moreover, to enhance transparency for schemes launched in the last 8 years, they are required to engage with rating agencies.

- Investment Requirements Modifications: ARCs must invest in security receipts (SRs) at a minimum of 15% of the transferors' investment in such receipts, or 2.5% of the total receipts issued, whichever is higher. This requirement has been adjusted from the previous mandate of investing 15% of total security receipts in all cases.

Must Check: Best IAS Coaching In Delhi