- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

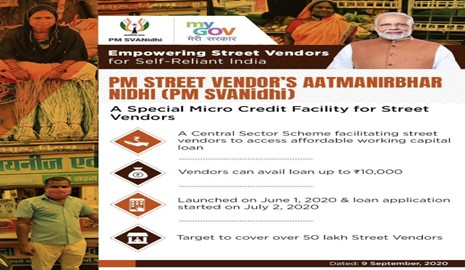

PM SVANidhi scheme

PM SVANidhi scheme

25-10-2023

Context

Recently, SBI analysed the PM SVANidhi scheme's impact on street vendors.

Background

- The Modi government's microcredit PM SVANidhi plan for street sellers has been commended by an SBI research paper for promoting inclusive entrepreneurship.

- According to recent sources, 44% of OBC recipients of the PM SVANidhi plan are from the non-general category, making up 75% of the scheme's beneficiaries.

- According to the research, women make up 43% of the overall beneficiaries of PM Street Vendor's AtmaNirbhar Nidhi (PM SVANidhi) initiative, with Scheduled Castes and Scheduled Tribes accounting for 22% of all disbursements.

- SVANidhi has been tagged as a gender equalizer by the SBI research, which stated that the female share implies empowerment of entrepreneurial capacities of urban girls.

About PM SVANidhi scheme

- PM SVANidhi scheme Launched in 2020.

- Ministry: Ministry of Housing & Urban Affairs.

- Implementation agency: Small Industries Development Bank of India (SIDBI).

- Objective: Enabling vendors on the streets who have suffered because of the COVID-19 lockdown to resume their livelihoods by offering them reasonable Working Capital loans.

- The scheme aims to provide working capital loans to about 50 lakh street vendors with no collateral needed and a one-year term of up to INR 10,000.

- It is a Central Sector Scheme.

- Central sector schemes: programs carried out by the Central Government apparatus and fully financed by the Central Government.

- Duration of the scheme: Originally, the scheme was to run until March 2022.

Extension of the scheme

- It is now valid till December 2024.

- This was carried out with an emphasis on the comprehensive socio-economic development of the street vendors and their families, heightened use of digital transactions, and improved collateral-free, affordable loan corpus.

- A third loan with a maximum amount of ₹50,000 was added to the first and second loans, which had limits of ₹10,000 and ₹20,000, respectively.

Features of the scheme

- Loan limit: Up to Rs. 10,000 in working capital loans are available to vendors.

- For a period of one-year, monthly installments are required to be paid back on this loan.

- Because there is no collateral needed to apply for the loan, street sellers can get it more easily.

- Processing fee: Street vendors can apply for the scheme at no cost because there is no processing fee.

- Loan repayment period: one year.

- Interest subsidy: an interest subsidy at the rate of 7% annually upon timely or early loan return.

- Through Direct Benefit Transfers, it will be credited to beneficiaries' bank accounts on a quarterly basis.

- Early repayment: No penalty on early repayment of the loan.

- Additional benefits: The vendors can avail of the facility of escalation of the credit limit on timely/ early repayment of a loan.

- Credit limit: the maximum amount of credit a financial institution extends to a client on a credit card or a line of credit.

Target beneficiaries under the scheme

- Street vendors are the intended beneficiaries of this scheme.

- Any person involved in selling items, goods, wares, or food items on a street, footpath, or pavement, or while moving from one location to another is referred to as a vendor in the scheme's standards.

- Goods supplied: fruits, vegetables, ready-to-eat street food, tea, pakodas, apparel, artisan products, books/ stationary etc.

- Services provided: cobblers, barber shops, pan shops, laundry services etc.

Advantages of the scheme

- The scheme encourages online purchases by offering cash-back incentives up to Rs. 100 each month.

- The scheme promotes entrepreneurship.

- Additionally, it promotes employment opportunities. (PM SVANidhi's Socio-Economic Profiling Program started).

Must Check: Best IAS Coaching In Delhi