- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

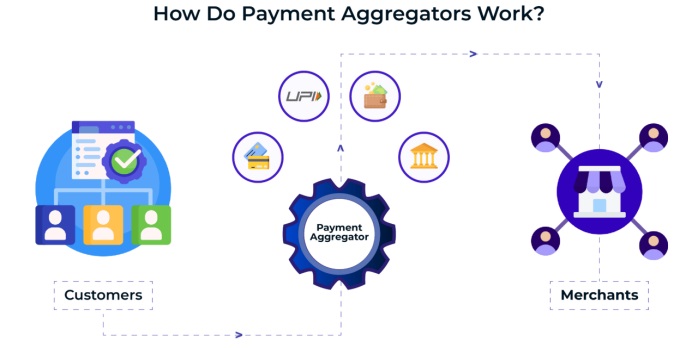

Payment Aggregation: Facilitating Seamless Transactions

Payment Aggregation: Facilitating Seamless Transactions

he Reserve Bank of India (RBI) has issued two consultation papers to enhance regulation of payment aggregators carrying out face-to-face transactions. It also seeks to strengthen the protection of the ecosystem.

What is Payment Aggregators (PAs):

1. Definition: A payment aggregator (PA), also known as a merchant aggregator, is a third-party service provider that enables merchants to seamlessly accept various payment methods from customers.

2. Integration: PAs provide merchants with multiple payment options such as debit and credit cards, EMIs, UPI, bank transfers, e-wallets and e-mandates through easy integration into their websites or apps.

3. Bank Transfer Acceptance: PAs provide merchants the ability to accept bank transfers without the need for a bank-based merchant account. It simplifies the merchant's banking processes.

4. Legal Framework: In India, a PA is incorporated under the Companies Act of 2013.

5. Entities Eligible: PAs can be either banks or non-bank entities.

6. Regulatory Oversight: PAs handling funds require a license from RBI. Only non-bank PAs require explicit authorization from the RBI, as fund management is considered part of normal banking relationships for bank PAs.

Examples of Payment Aggregators in India:

- Amazon (Pay) India

- Google India

- Razorpay

- Pine Labs

Payment Gateway:

Payment gateway is a software service that connects your bank account to the platforms where you need to transfer money. It authorizes online transactions through various payment modes like net banking, credit card, debit card, UPI and online wallets.

Comparison: Payment Aggregator vs. Payment Gateway

|

Payment Aggregator |

Payment Gateway: |

|

1. while a payment aggregator connects various payment gateways into a single interface. |

|

2. while a payment aggregator acts as an interface where the payment gateway processes the transactions. |

Integration of Payment Gateways: Many payment aggregators own payment gateways to offer exclusive services to their merchant customers.

FAQs:

Q: What is a Merchant Account ?

- A merchant account is a business bank account that is created and used for business purposes.

- It allows companies to make and accept payments, including credit or debit card payments, and facilitates deposits through many other payment methods.

Merchant accounts require businesses to partner with an acquiring bank or a merchant account provider that supports electronic payment transactions.