- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

NPCI LAUNCHES UPI IN NEPAL

NPCI LAUNCHES UPI IN NEPAL

12-03-2024

NPCI International Payments Limited (NIPL) has partnered with Fonepay Payment Service Limited to enable cross-border UPI transactions between India and Nepal, enhancing payment convenience for Indian tourists.

- The collaboration aims to enhance convenience and efficiency in transactions for tourists visiting Nepal from India.

- NPCI International Payments Ltd (NIPL) and Fonepay Payment Service Ltd have officially launched UPI for cross-border transactions between India and Nepal.

- The initiative aims to facilitate QR-code-based person-to-merchant (P2M) UPI transactions.

|

- Approximately 30% of Nepal’s tourists are Indian, this partnership is expected to significantly improve the payment experience for Indian travelers.

- UPI will simplify financial transactions, benefiting both tourists and the Nepali economy.

- Initially, Indian consumers will be able to make instant, secure, and convenient UPI payments at various businesses in Nepal using UPI-enabled apps.

- Merchants connected to Fonepay Network can seamlessly accept UPI payments from Indian customers.

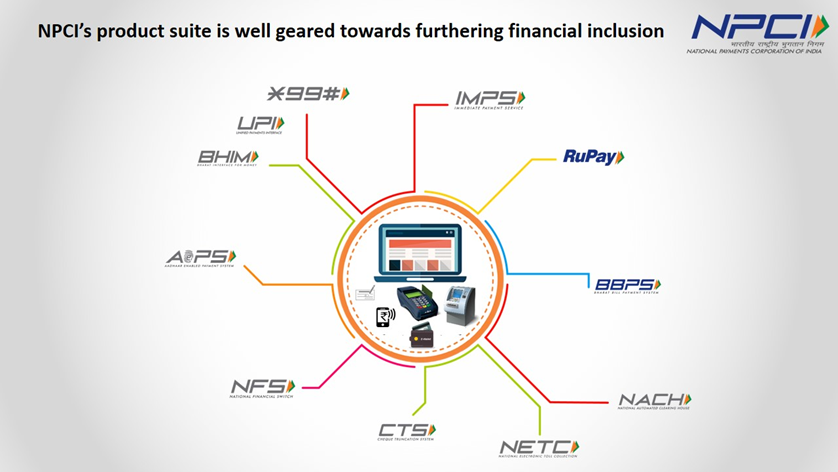

An introduction to NPCI and its various products

- National Payments Corporation of India (NPCI) is an initiative of the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA) established under the Payment and Settlement Systems Act, 2007.

- It operates retail payments and settlement systems in India, aiming to create a robust Payment & Settlement Infrastructure.

- NPCI aims to transform India into a ‘less-cash’ society by providing accessible payment services to every Indian, thereby advancing its vision to become the best payments network globally.

Legal Status:

- NPCI is registered as a “Not for Profit” Company under the provisions of Section 8 of the Companies Act 2013.

- Its objective is to provide infrastructure for both physical and electronic payment and settlement systems in India.

RuPay

- RuPay is an indigenous payment system designed to meet Indian consumer, bank, and merchant needs.

- It supports debit, credit, and prepaid cards issued by banks in India, promoting retail electronic payments.

- Collaborates with international network partners for global acceptance and world-class payment solutions.

IMPS (Immediate Payment Service)

- India leads the world in real-time payments in the retail sector with IMPS.

NACH (National Automated Clearing House)

- Provides an electronic mandate platform for bulk push and pull transactions, facilitating paperless collection processes for corporates and banks.

APBS (Aadhaar Payment Bridge System)

- Facilitates Direct Benefit Transfers for various Central and State-sponsored schemes, aiding government agencies.

AePS (Aadhaar enabled Payment System)

- Drives financial inclusion by providing doorstep access to funds, particularly in underserved areas.

NFS (National Financial Switch)

- Largest network of shared ATMs in India, enabling interoperable cash withdrawal, funds transfer, and other value-added services.

UPI (Unified Payments Interface)

- It makes it easy to send and receive by just scanning a QR code or using a user’s phone number. Unlike most digital payment systems, the amount gets directly debited to the linked bank account.

Bharat Bill Payment System

- Offers a one-stop bill payment solution for recurring payments across various categories, enhancing consumer convenience.

NETC (National Electronic Toll Collection)

- Meets electronic tolling requirements in India through FASTag, enabling electronic toll payments without stopping at toll plazas..

List of countries that accept UPI :

|

Sr.no |

Country Name |

|

1 |

Bhutan (first country to adopt UPI payments outside India) |

|

2 |

France (E-commerce) (first country in the European region to access UPI payments) |

|

3 |

Mauritius |

|

4 |

Singapore |

|

5 |

Sri Lanka |

|

6 |

UAE( third-largest trade partner of India) |

|

7 |

Nepal |

List of countries that accept RuPay :

|

Sr.no |

Country Name |

|

1 |

Bhutan (first country to adopt and issue RuPay bank cards) |

|

2 |

Nepal |

|

3 |

Mauritius |

|

4 |

Singapore |

|

5 |

UAE |