- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

NPCI launched new features for UPI

NPCI launched new features for UPI

07-09-2023

Recent Context:

Recently, the National Payments Corporation of India (NPCI) launched new features for UPI.

About the Unified Payments Interface (UPI)

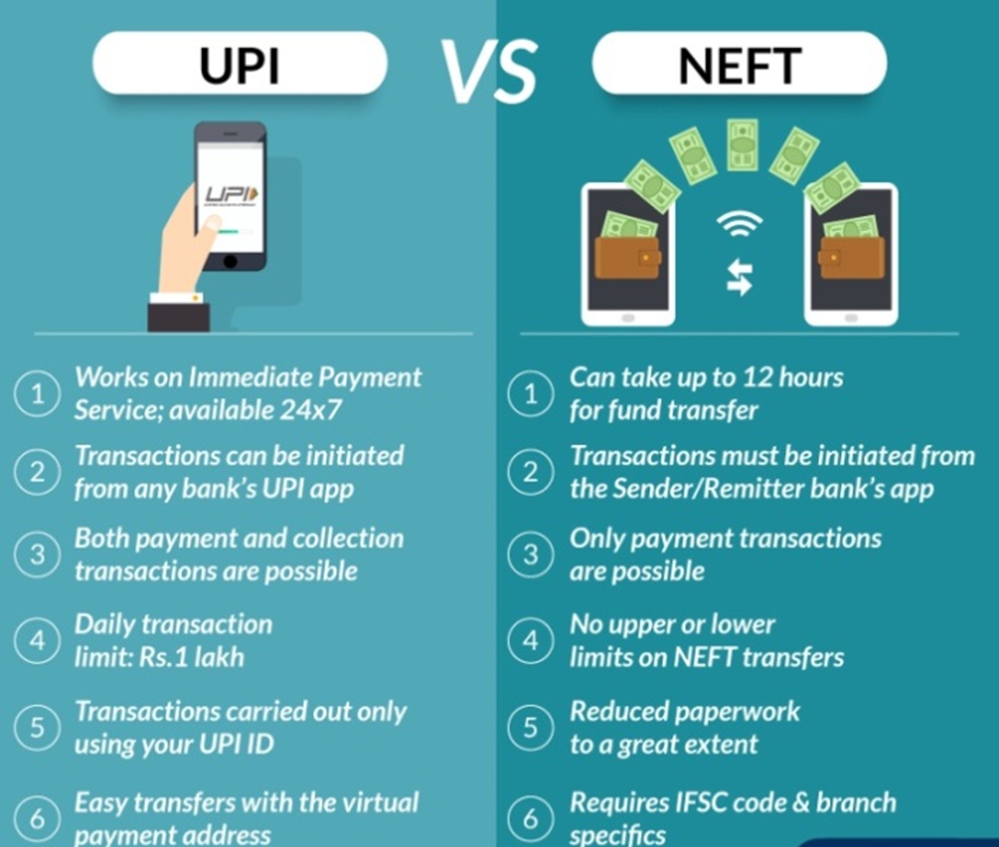

- UPI is a payment system that allows people to send and receive money using their smartphones with the help of a mobile app.

- UPI was launched in 2016 and has since become one of the most popular and widely used digital payment systems in the country.

Some key features of UPI are:

- Real-time Interbank Fund Transfer: UPI enables instant money transfers between two bank accounts on a real-time basis, 24/7, including weekends and holidays. It operates on the National Payments Corporation of India (NPCI) platform.

- Mobile-Centric: UPI is primarily designed for mobile devices. Users need to have a smartphone and a linked bank account to use UPI services. Various banks and financial institutions offer their UPI-enabled mobile apps.

- Virtual Payment Address (VPA): To send or receive money through UPI, users need to create a unique Virtual Payment Address (VPA). This VPA acts as a nickname for their bank account, making it easy to share and use instead of sharing bank account numbers and IFSC codes.

- Multiple Bank Accounts: UPI allows users to link multiple bank accounts to a single mobile app. This feature provides flexibility for users who have accounts with different banks.

- Various Transaction Types: UPI supports various types of transactions, including person-to-person (P2P) transfers, person-to-merchant (P2M) payments, bill payments, and more. Users can also check their account balance and view transaction history through the UPI app.

- Security Features: UPI transactions are secured through two-factor authentication (2FA), typically involving a UPI PIN and mobile OTP (One-Time Password). Additionally, the use of VPAs instead of sharing sensitive bank account information enhances security.

- QR Code Payments: UPI facilitates payments through QR codes, allowing users to scan QR codes at merchant outlets to make payments without sharing their phone numbers or VPAs.

- Third-Party Apps: Various third-party apps, including popular ones like Google Pay, PhonePe, and Paytm, offer UPI-based payment services. Users can choose their preferred app to access UPI.

- Government Initiatives: UPI has been promoted by the Indian government as part of its digital payments and financial inclusion initiatives. It has played a significant role in reducing the reliance on cash transactions in the country.

New Features

- Credit Line on UPI: Now on UPI app, the users can use the credit facility which was pre-approved by their bank. Earlier only the deposited amount can be transacted through the UPI System.

- UPI Lite X: Now, the users can send money offline also without any internet connectivity.

- UPI Tap & Pay: It allows the QR codes at merchants to complete payments, with a single tap without entering the PIN.

- Hello! UPI: Now, the users can simply give voice commands to transfer funds and input a UPI PIN to complete the transaction.

- BillPay Connect: Customers can fetch and pay their bills by sending a simple ‘Hi’ message or by giving a missed call.

Challenges in front of UPI are:

- Security Concerns: As digital transactions increase, so does the risk of cybercrimes, including phishing attacks, identity theft, and fraud. Maintaining robust security measures and educating users about safe practices is an ongoing challenge.

- Data Privacy: The collection and handling of user data by UPI service providers raise concerns about data privacy. Users' personal and financial information must be safeguarded to prevent misuse or breaches.

- Network Connectivity: UPI relies on internet connectivity, which can be inconsistent in some areas of India, particularly in rural regions. Ensuring seamless access to UPI services across the country is a challenge.

- Interoperability: While UPI has enabled interoperable transactions across various banks and payment service providers, ensuring that all banks and financial institutions participate fully in the UPI ecosystem can be a challenge. Some smaller banks may face technical and operational barriers to full UPI integration.

- Customer Support: Providing effective customer support for UPI users is essential. Many users may require assistance with troubleshooting, transaction disputes, or other issues related to UPI, and banks and service providers must offer reliable support channels.

- Digital Literacy: A significant portion of India's population still lacks digital literacy, especially in rural areas. Educating users about how to use UPI and other digital payment methods effectively can be a challenge.

- Competition: As the digital payment space in India becomes increasingly crowded, UPI service providers face stiff competition. They must continually innovate to attract and retain users.

- Transaction Limits: UPI has transaction limits to prevent misuse. However, these limits can sometimes be restrictive for users, especially for larger transactions, and may need to be reviewed periodically.

Conclusion:

Despite these challenges, UPI has been successful in transforming the digital payment landscape in India. Ongoing efforts by regulators, service providers, and the government are aimed at addressing these challenges and further enhancing the UPI ecosystem's reliability, security, and accessibility.