- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

NITI Aayog launches the “Fiscal Health Index 2025”

NITI Aayog launches the “Fiscal Health Index 2025”

27-01-2025

- The Fiscal Health Index (FHI) 2025, launched by NITI Aayog on January 24, 2025, to assess the fiscal status of 18 major states in India for the financial year 2022-23.

- The report is meant to provide data-driven insights to guide state-level policymakers in improving fiscal governance, promoting economic resilience, and ensuring national stability.

- The FHI 2025 will be published annually and aims to highlight the fiscal status of states based on key financial parameters.

- The report uses data from the Comptroller and Auditor General of India (CAG) for the fiscal year 2022-23, supplemented by trends from 2014-15 to 2021-22.

- FHI covers states contributing significantly to India’s GDP, demographics, public expenditure, and revenues.

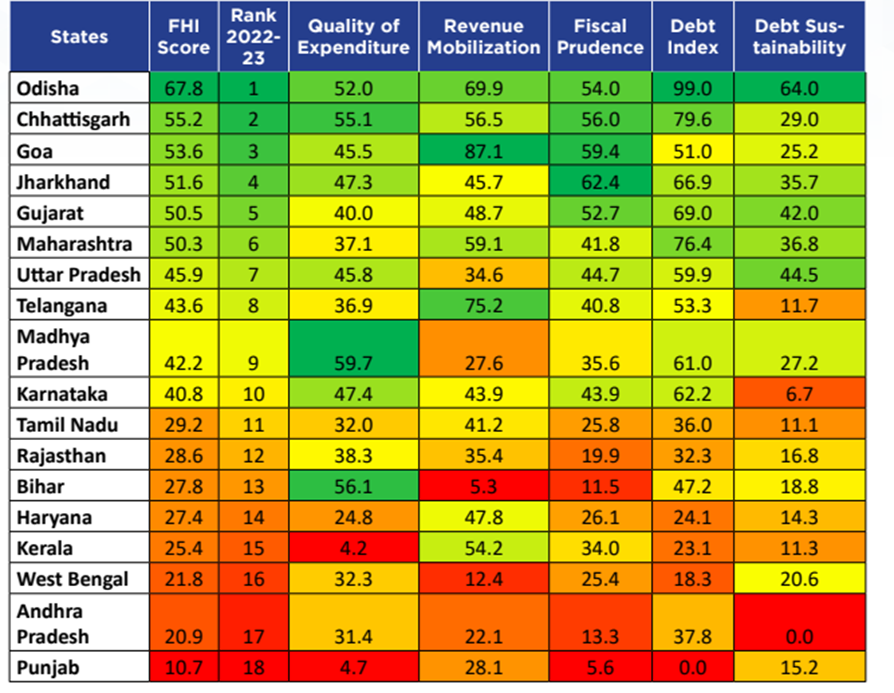

- The states are categorized into four groups: Achievers, Front-Runners, Performers, and Aspirational based on their fiscal health.

State Categories & Key Performance Indicators

|

Category |

States |

Key Characteristics |

|

Achievers |

Odisha, Chhattisgarh, Goa, Jharkhand |

High capital outlay, low fiscal deficit, sustainable debt, revenue surplus. |

|

Front-Runners |

Maharashtra, Uttar Pradesh, Telangana, MP, Karnataka |

Balanced fiscal management, consistent tax growth, improved debt sustainability. |

|

Performers |

Tamil Nadu, Bihar, Rajasthan, Haryana |

Moderate fiscal health; some need improvement in revenue and debt management. |

|

Aspirational |

Punjab, Andhra Pradesh, West Bengal, Kerala |

High fiscal deficits, low revenue generation, rising debt burden. |

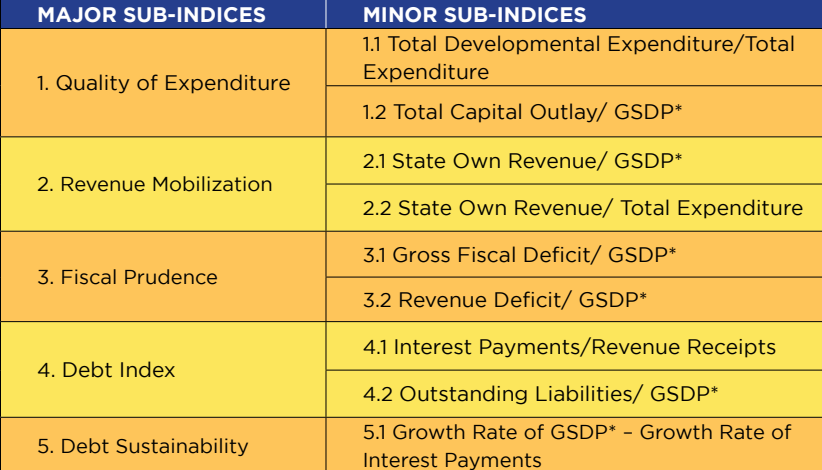

Components of the Fiscal Health Index:

The FHI evaluates the fiscal health of states on the basis of 5 major sub-indices:

Final Ranking of states for 2022-23

Long-Term Vision and Impact:

- The FHI aligns with India’s long-term vision of becoming a Viksit Bharat @2047

- It encourages states to adopt good fiscal policies and improve resource management, contributing to long-term economic stability.

- The ranking system motivates states to benchmark their fiscal practices, promoting healthy competition and driving improvements.

- The FHI will be published annually, providing continuous updates and insights for policymakers to track progress and implement necessary reforms.

Key Term: 5 major sub-indices

|

|

Also Read |

|

FREE NIOS Books |

UPSC Daily Current Affairs |

UPSC Monthly Mgazine |

Previous Year Interview Questions |

Free MCQs for UPSC Prelims |

UPSC Test Series |

ENSURE IAS NOTES |

Our Booklist |