- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

NEW RULES AND REGULATIONS OF UPI: RBI

NEW RULES AND REGULATIONS OF UPI: RBI

In Jan 2024, the Reserve Bank of India (RBI) has announced new rules and regulations to enhance the scope of Unified Payments Interface (UPI) payments.

- Enhancing UPI transaction limit: The limit for UPI payments to hospitals and educational institutions has increased to Rs 5 lakh from Rs 1 lakh.

- Except for certain categories like Capital Markets, Collections, and Insurance, the general UPI transaction limit remains Rs 1 lakh, while it's Rs 2 lakhs for these specified categories.

- Increased e-Mandates for Recurring Online Transactions: The execution limit for e-mandates without Additional Factor of Authentication (AFA) has risen from Rs 15,000 to Rs 1 lakh.

- This limit has risen for credit card bill payments, mutual fund subscriptions, and insurance premiums.

- An e-Mandate is a digital payment service that allows businesses to collect recurring payments automatically without human interaction.

- An Additional Factor of Authentication (AFA) is a security process that requires users to provide two different authentication factors (like OTP) to verify themselves.

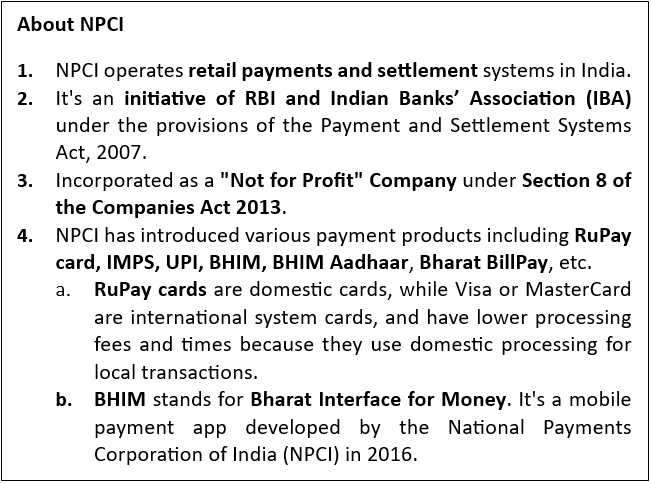

About UPI

- UPI consolidates multiple bank accounts into a single mobile application, offering various banking services like fund transfers.

- Developed by NPCI in 2016 over the Immediate Payment Service (IMPS) infrastructure.

- Immediate Payment Service (IMPS) is a service that allows users to transfer money instantly between banks in India. It is available 24/7, including on bank holidays.

- IMPS is facilitated by the National Payment Corporation of India (NPCI). It can be used through mobile phones, internet banking, or ATMs.

- It stands as the most successful real-time payment system globally, ensuring simplicity, safety, and security in person-to-person (P2P) and person-to-merchant (P2M) transactions in India.

New Features of UPI

- Credit Line on UPI: Now, banks can offer pre-approved credit lines through UPI, allowing transactions beyond deposited amounts. Earlier, only the deposited amount could be transacted through the UPI System.

- UPI Lite X: Enables offline money transfers using Near Field Communication (NFC) on compatible devices for both sending and receiving funds.

- NFC is a set of wireless technologies that allow two electronic devices to communicate within 4 centimeters of each other. It is a subset of radio-frequency identification (RFID), which uses radio waves to identify things.

- UPI Tap & Pay: Allows contactless payments at merchants using NFC-enabled QR codes, requiring just a single tap without PIN entry.

- Conversational Payments:

- Hello! UPI: Enables fund transfers through voice commands, followed by entering a UPI PIN for transaction completion.

- BillPay Connect: Customers can pay bills by sending a simple message or giving a missed call.

- Other Proposed Changes for UPI Payments:

- Deactivate UPI IDs: NPCI has instructed banks and mobile payment apps like Google Pay to deactivate UPI IDs and account numbers inactive for a year.

- Four-hour Time Limit: Users initiating first payments over Rs 2,000 to new recipients will have a four-hour window for UPI transactions, enhancing security and control.

- This allows users to reverse or modify transactions within that window.

- Introduction of UPI ATMs: Allows cash withdrawal by scanning a QR code, expanding UPI's utility.

Initiatives to Promote UPI

- UPI for Secondary Market: Introduced by NPCI to facilitate equity trading.

- UPI Chalega Campaign: NPCI's initiative to promote UPI as a safe, instant payment method and educate users about features like UPI LITE for swift low-value transactions.

- MoU between Google India Digital Services and NPCI International Payments: Expanding UPI use for travellers abroad and easing remittance processes.

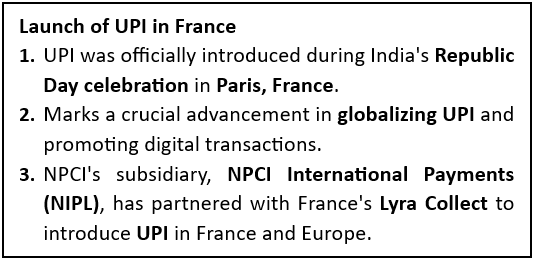

- India’s UPI in Overseas Markets: Several countries such as Oman, UAE, France, Nepal, and Bhutan have adopted the UPI system for payments.

- UPI 123PAY: An instant payment system for feature phone users, enabling them to use UPI services securely.

Benefits of UPI

Merchants |

Banks |

Customers |

Fintechs/PSPs |

|

|

|

|

Challenges and solutions

Challenges |

Solutions |

|

Expanding UPI globally requires compliance with various countries' data protection and financial laws, posing regulatory challenges. |

Collaborative efforts among nations and financial institutions are needed to establish a uniform regulatory framework. |

|

Cybercriminals can exploit system vulnerabilities or use social engineering to access sensitive information, leading to financial losses. |

Collaboration among UPI service providers, banks, and users is crucial to identify and address fraud incidents. |

|

Managing currency conversion and exchange rates for cross-border transactions poses significant challenges. |

Balancing security and transaction flexibility is essential to promote wider adoption of UPI across various sectors. |

|

Limited familiarity with digital payments among individuals hinders (hamper) UPI adoption and increases the risk of financial fraud. |

Training programs and user-friendly guides should be developed to educate people about the UPI ecosystem and address concerns. |

|

Dominance of foreign entities like PhonePe and Google Pay in the Indian fintech sector. PhonePe holds 46.91% market share, Google Pay has 36.39%, while BHIM UPI has only 0.22%. |

Banks and payment service providers must enhance their infrastructure to handle higher transaction volumes and accommodate global users and Indian fintech sector should make their infrastructure robust to compete. |