- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

NEW CATEGORY OF MUTUAL FUNDS UNDER ESG SCHEME

NEW CATEGORY OF MUTUAL FUNDS UNDER ESG SCHEME

Latest Context

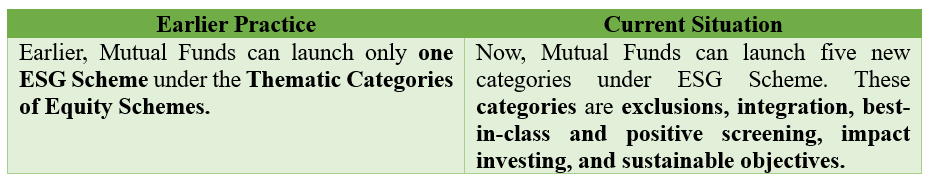

Recently, the Securities and Exchange Board of India (SEBI) announced that Mutual Funds can launch five new categories under ESG (Environmental, Social, and Governance) Scheme.

Key Information

Objective: It will provide responsible investment avenues for investors. In addition, it will also expand the ESG investing opportunities in mutual funds which will mark a significant step in promoting sustainable efforts.

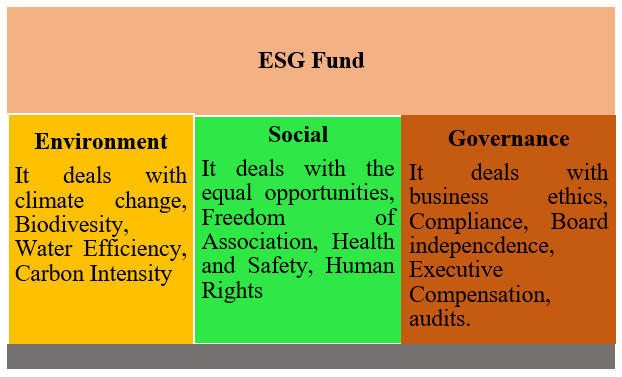

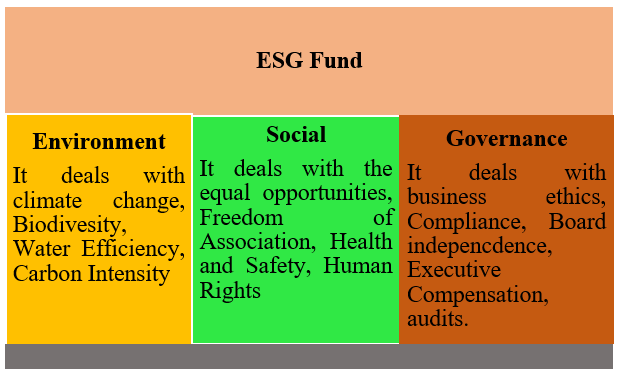

ESG Fund

-

It refers to a set of standards or norms for a company’s behaviour used by socially conscious investors to screen potential investment. ESG investing is used to screen investments based on corporate policies and to encourage companies to act responsibly.

-

ESG funds are those funds whose asset allocation mostly includes shares and bonds of companies that are evaluated based on environmental, social, and governance factors.

Significance of ESG

-

As ESG funds gain momentum in India, companies will be forced to improve governance and ethical practices and act with greater social and environmental responsibility.

-

As the policy framework changes, companies that do not alter business models or become more environmentally sustainable, could have their revenue and profits impacted in the long term.

-

Globally, many pension funds and sovereign wealth funds do not invest in companies that are seen as polluting or socially not responsible.