- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

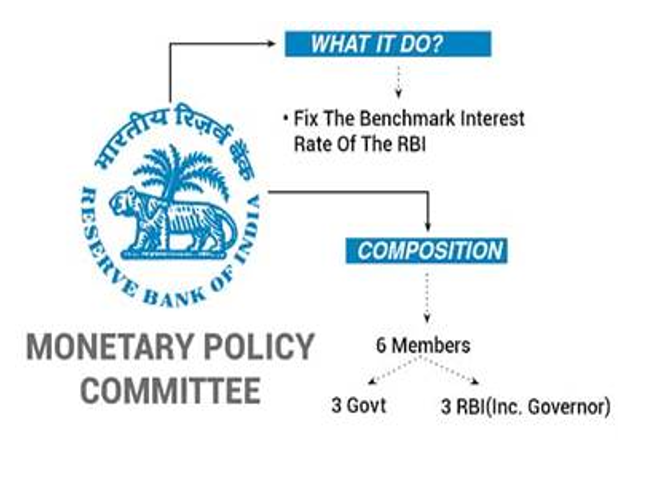

MONETARY POLICY COMMITTEE

MONETARY POLICY COMMITTEE

11-10-2023

Context

Recently, in its bimonthly Monetary Policy Committee (MPC) Meeting, the Reserve Bank of India (RBI) decided to keep benchmark interest rates unchanged for the 4th time in a row.

Key Highlights of the MPC Meeting

- Repo Rate Unchanged: The policy repo rate of 6.5% was unanimously maintained by the RBI in order to maintain a balance between inflation control and economic growth.

-

GDP Growth and Inflation:

- The Reserve Bank of India maintained its forecasts for real GDP (Gross Domestic Product) growth in 2023–2024 at 6.5% and average CPI inflation in the current fiscal year, FY24, at 5.4%.

- The MPC increased its headline inflation estimate for the second quarter to 6.4%.

- The governor of the Reserve Bank of India emphasized the necessity of adhering to the 4% inflation target and the need to be ready to move quickly to stop shocks to the price of food and fuel from impacting underlying inflation trends.

-

Liquidity Management and Financial Stability:

- As per the monetary policy stance, the system's liquidity would be actively managed.

- Sales through Open Market Operations (OMO) will be conducted by the RBI when needed. Financial stability is essential for growth and price stability.

-

Gold Loan under Bullet Repayment Scheme:

- The RBI announced raising the maximum loan amounts for gold loans to Rs 4 lakh for urban cooperative banks participating in the Bullet Repayment Scheme (BRS).

- As of March 31, 2023, Urban Cooperative Banks (UCBs) that have achieved both the overall and sub-targets under the Priority Sector Lending (PSL) program have been granted this decision.

- A BRS is one where a borrower repays interest and the principal amount at the end of a loan tenure without worrying about repayment during the loan tenure.

-

Accommodative Stance:

- The Reserve Bank of India has emphasized its policy of "withdrawing of accommodation" until all inflationary threats have passed.

- The central bank is willing to increase the money supply in order to promote economic growth when it adopts an accommodating stance.

- Removing accommodations will result in a decrease in the amount of money in the system, thus controlling inflation.

Reasons for Keeping Benchmark Rates Unchanged

-

Resilient Economic Activity:

- The Indian economy has proven to be resilient in the face of numerous uncertainties and difficulties.

- Because of this, benchmark rates have been decided to remain unchanged, indicating confidence in the economy's resilience to future shocks.

-

Previous Policy Repo Rate Hikes:

- The MPC took into consideration the 250 basis point total cumulative effect of previous policy repo rate increases.

- In the recent meeting, the committee decided to keep the rates unchanged because it will take some time for the economy to fully adjust to these rate hikes.

- The MPC admitted that the economy is still being impacted by the earlier policy repo rate hikes.

-

Inflation Risk Management:

- The MPC is still committed to permanently bringing inflation into line with the 4% target.

- To accomplish this goal without requiring an instantaneous rate adjustment, the current policy stance is required.

- The MPC expressed concerns about the possibility of food price shocks returning and impacting headline inflation.

- Rates remaining steady could be a cautious move meant to keep a close eye on the situation and ensure that action is swiftly taken should inflationary pressures increase.

What concerns did the RBI raise during the MPC meeting?

-

High Inflation:

- High inflation is seen by the RBI as a serious threat to macroeconomic stability and long-term growth.

- The core rate of inflation (excluding fuel and food) is dropping, but the future for inflation as a whole is uncertain.

- This uncertainty is exacerbated by variables including decreased kharif sowing for vital crops, low reservoir levels, and variations in the price of food and energy globally.

-

Geopolitical and Economic Risks:

- The global economy is slowing down, there are geopolitical tensions, geoeconomic fragmentation, instability in the world's financial markets, and other challenges that the RBI has identified.

- The economic outlook is at risk due to these external influences, thus careful consideration is needed.

- Financial Stability and Surveillance: The RBI emphasized the need of financial stability, describing it as essential to both economic and price stability. The strong balance sheet of the banking industry was recognized, but caution and improved internal monitoring systems were suggested, particularly in light of the increase in personal loans.

Q. Which of the following statements is/are correct regarding the Monetary Policy Committee (MPC)? (UPSC-2017)

1. It decides the RBI’s benchmark interest rates.

2. It is a 12-member body including the Governor of RBI and is reconstituted every year.

3. It functions under the chairmanship of the Union Finance Minister.

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 2 and 3 only

Ans: (a)