- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Microfinance Institutions (MFIs)

Microfinance Institutions (MFIs)

Microfinance Institutions (MFIs)

Why in News?

Recently, a Report stated that Microfinance Institutions (MFI) will play a leading role in the growth process of India.

- As per World Bank data, close to 1.7 billion people across multiple countries do not have access to basic financial services. This is where microfinance institutions play a major role.

What are MFIs?

- These are organizations that offer financial services to low-income populations.

- In India, a microfinance loan is defined as a collateral-free loan given to a household having an annual income of up to Rs 3 lakh. (Recently revised by RBI. Earlier it was Rs 1 Lakh)

- Micro-finance Institutions provide small loans to people who do not have any access to banking facilities.

- Their area of operation includes rural areas and among low-income people in urban areas.

- The Non-Banking Financial Company -Micro Finance Institutions (Reserve Bank) Directions, 2011 of the Reserve Bank of India (RBI) is regulating all the Non-Banking Finance Company (NBFC)-MFIs in India.

- Example of MFIs: Bandhan Bank Limited, Ujjivan Small Finance Bank, Annapurna Finance Pvt. Ltd, Muthoot Microfin Limited, etc.

- The different types of institutions that offer microfinance are:

- Credit unions

- Non-governmental organisations

- Commercial banks

Goals of Microfinance Institutions:

- Transform into a financial institution that assists in the development of communities that are sustainable.

- Help in the provision of resources that offer support to the lower sections of the society.

- There is special focus on women in this regard, as they have emerged successful in setting up income generation enterprises.

- Evaluate the options available to help eradicate poverty at a faster rate.

- Mobilize self-employment opportunities for the underprivileged.

- Empowering rural people by training them in simple skills so that they are capable of setting up income generation businesses.

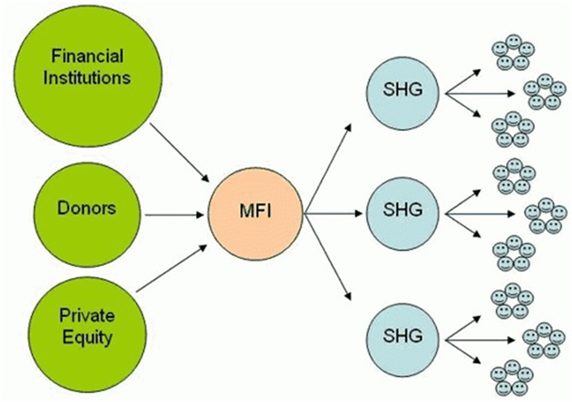

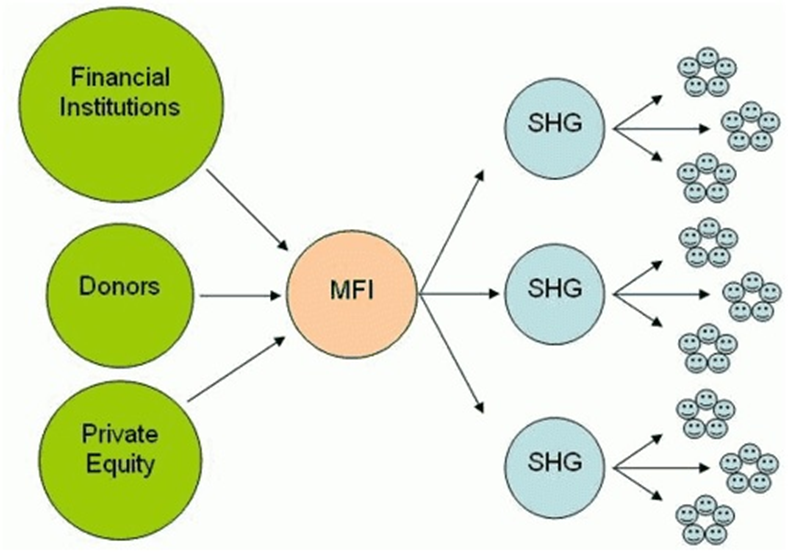

Major Business Models:

|

Joint Liability Group: |

This is usually an informal group that consists of 4-10 individuals who seek loans against mutual guarantee. The loans are usually taken for agricultural purposes or associated activities. |

|

Self Help Group:

|

It is a group of individuals with similar socio-economic backgrounds. These small entrepreneurs come together for a short duration and create a common fund for their business needs. These groups are classified as non-profit organisations. The National Bank for Agriculture and Rural Development (NABARD) SHG linkage programme is noteworthy in this regard, as several Self-Help Groups are able to borrow money from banks if they are able to present a track record of diligent repayments. |

|

Grameen Model Bank:

|

It was the brainchild of Nobel Laureate Prof. Muhammad Yunus in Bangladesh in the 1970s. It has inspired the creation of Regional Rural Banks (RRBs) in India. The primary motive of this system is the end-to-end development of the rural economy. |

|

Rural Cooperatives: |

They were established in India at the time of Indian independence. However, this system had complex monitoring structures and was beneficial only to the creditworthy borrowers in rural India. Hence, this system did not find the success that it sought initially. |

Salient provisions of RBI document on Regulation of Microfinance sector:

- There is no common definition for microfinance loans available from various microfinance entities in India. The document aims to provide one common definition for all regulated microfinance sector entities.

- Capping the outflow on account of repayment of loan obligations of a household to a percentage of the household income. Further, borrowers can determine the period of repayments as per their requirements.

- A Board approved policy for household income assessment.

- There should be no pre-payment penalty, no collateral requirement, and greater repayment frequency for all microfinance loans.

- Alignment of pricing guidelines for NBFC-MFIs with guidelines for NBFCs.

- Introduction of a standard simplified fact sheet on the pricing of microfinance loans.

Growth of microfinancing Recently:

- 1990s --- microcredit was given by scheduled commercial banks either directly or via NGOs to women’s self-help groups, but given the lack of regulation and scope for high returns, several for-profit financial agencies such as NBFCs and MFIs emerged.

- Mid 2000s --- There were widespread accounts of the malpractices of MFIs such as Andhra Pradesh, arising out of a rapid and unregulated expansion of private for-profit micro-lending.

- The microfinance crisis of Andhra Pradesh led the RBI to review the matter, and based on the recommendations of the Malegam Committee, a new regulatory framework for NBFC-MFIs was introduced in December 2011.

- A few years later, the RBI permitted a new type of private lender, SFBs, with the objective of taking banking activities to the “unserved and underserved” sections of the population.

- Today, 31% of microfinance is provided by NBFC-MFIs, and another 19% by SFBs and 9% by NBFCs.

|

Significance of MFIs |

Challenges of MFIs |

|

It helps low-income households to stabilize their income flows and save for future needs. Microfinance helps families and small businesses to prosper, and at times of crisis it can help them handle the situation and rebuild. It makes credit available easily which can improve the income and employment status. It helps in serving the under-financed sections such as women, unemployed people and those with disabilities. Families benefiting from microloans are more likely to provide better and continued education for their children. |

To handle and manage the diverse nature of customer segments, such as small farmers, vendors and labourers, is a tough task. The consumer behaviour and loan requirements for different customers may require varied levels of services with financial products and digital literacy. The dependence on physical modes of interaction carries a challenge for MFIs to reach last-mile borrowers, which has been seen during pandemic, when group gatherings could not be held.

|

Way Forward:

The future course of the industry will be determined by the ability of MFIs to forge partnerships, develop new products and investment channels and leverage technology. RBI should encourage all institutions to monitor their impact on society by means of a ‘social impact scorecard’.

Must Check: Top IAS Coaching Centre in Delhi