- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- NCERT Medieval History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

mBridge Project

mBridge Project

According to Bank for International Settlements (BIS), Project mBridge reached the minimum viable product (MVP) stage in mid-2024.

About Project mBridge

- Launched in 2021, mBridge is a cross-border, decentralised, multiple central bank digital currency (mCBDC) platform.

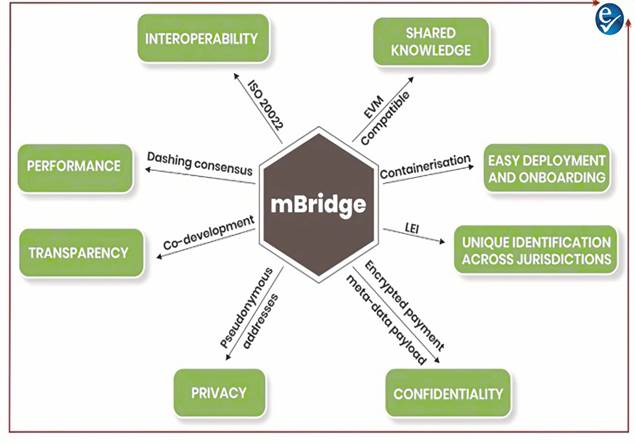

- Key Features:

- A new blockchain called the mBridge Ledger supports real-time, peer-to-peer cross-border payments and foreign exchange transactions.

- Built on Distributed Ledger Technology (DLT), it utilizes a decentralized ledger network that draws resources from multiple nodes to ensure data security and transparency.

|

Central Bank Digital Currency (CBDC): A legal tender and a central bank liability in digital form denominated in sovereign currency and appearing on central bank balance sheet. (RBI) Legal tender: Money issued by monetary authority and cannot be refused by any citizen of the country for settlement of any kind of transaction. |

- Participants:

- Initially led by the BIS Innovation Hub.

- Collaborating central banks: China, Thailand, UAE, and Hong Kong.

- Saudi Central Bank joined in 2024.

- More than 31 observing members, including the Reserve Bank of India.

Significance of mCBDC

The project has several potential benefits for global trade and finance, including:

- Lower Transaction Costs: By utilizing digital currencies and blockchain technology, mBridge can reduce the cost of cross-border transactions.

- Increased Efficiency and Speed: Real-time payments and foreign exchange transactions enhance the efficiency and speed of cross-border financial exchanges.

- Enhanced Security and Transparency: Leveraging blockchain and AI technologies improves the security and transparency of transactions.

- Monetary Sovereignty: mBridge helps ensure that countries can maintain control over their own currencies, enhancing trust and credibility in their financial systems.

- Prevention of Monopoly and Digital Dollarization: Reduces the risk of one dominant currency taking over international trade, allowing for more diversified financial systems.

|

Bank for International Settlements (BIS)

|

Challenges associated with mCBDC

While the project has great potential, there are several challenges that could hinder its widespread adoption:

- Global Acceptance and credibility as BIS has announced backing out from project after involvement for about four years.

- Regulatory Uncertainty due to lack of a coherent regulatory framework across jurisdictions.

- Volatility and Macroeconomic Stability associated with digital currencies.

- Security Concerns regarding data breaches, Illegal uses such as money laundering, tax evasion or financing illegal activities, etc.

- Risks of creating Parallel and unregulated structures of transactions.

|

Similar Global Initiatives

|

Project mBridge represents a significant shift toward a multipolar global financial system, where digital currencies backed by local economies could play a crucial role in international trade. It promises to give countries greater control over their financial transactions, reducing the impact of sanctions or economic pressures from foreign nations. However, the initiative faces challenges, particularly in terms of global acceptance, regulatory frameworks, and security concerns. Nonetheless, mBridge could reshape the future of cross-border finance, but its long-term success will depend on overcoming these obstacles.