- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Lending Service Providers (LSPs)

Lending Service Providers (LSPs)

30-04-2024

The Reserve Bank of India (RBI) has recently proposed a regulatory framework for loan products aggregated by loan service providers (LSPs).

- The objective of this framework is to ensure transparency and protect the interests of borrowers.

What are Lending Service Providers (LSPs)?

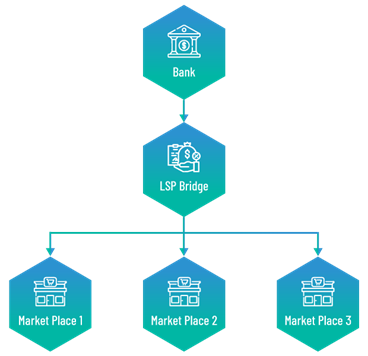

- LSPs are third-party agents that work with Regulated Entities (REs), such as banks or Non-Banking Financial Companies (NBFCs), to facilitate various stages of the lending process.

- They often operate via digital platforms or apps, making loans more accessible.

Some Examples of Lending Service Providers (LSPs) Operating in India:

- Paisabazaar: A major loan aggregator platform, connecting borrowers with multiple banks and NBFCs.

- BankBazaar: Another popular aggregator with a wide range of loan products.

- CreditMantri: Specializes in credit analysis and helps borrowers improve their credit scores to secure better loan terms.

- Lendingkart: Focuses on providing loans to small and medium-sized enterprises (SMEs).

Key Services Offered by LSPs:

-

Customer Acquisition:

- Marketing of loan products

- Lead generation of potential borrowers

- Collection and preliminary analysis of customer data

-

Underwriting Support:

-

Assisting REs in assessing borrower creditworthiness

-

Verification of documents

-

Background checks

-

-

Pricing Support:

- Helping REs determine appropriate interest rates and fees based on borrower risk profiles.

-

Disbursement:

- Facilitation of loan disbursement processes once approval is granted.

-

Servicing:

- Answering borrower questions and managing loan accounts.

- Payment processing

-

Monitoring:

- Tracking loan performance and borrower behavior for the RE.

-

Collection and Recovery:

- Management of collections on behalf of the lender.

- Implementation of recovery strategies for overdue or defaulted loans.

Why do REs use LSPs?

- Enhanced reach: LSPs can extend the reach of lenders, particularly in online lending, accessing a wider pool of borrowers.

- Improved efficiency: LSPs can streamline lending processes, automating some tasks to reduce the time and effort required.

- Technology expertise: LSPs often have specialized technologies and platforms that REs can take advantage.

- Cost reduction: In some cases, LSPs help REs lower operating costs.

Important Considerations:

- RBI Regulations: LSPs in India, and in many other countries, operate under regulations set by the central bank (Reserve Bank of India in India's case). These regulations ensure transparency, fair practices, and consumer protection.

- LSP Partnerships: Borrowers should always understand the relationship between an LSP and the actual lending institution.

What is Non-Banking Financial Companies (NBFCs):

- An NBFC is a company registered under the Companies Act 1956 and engaged in the business of loans, advances, and investments.

- NBFCs provide banking services such as loans, credit facilities, retirement planning, and investment opportunities, but they do not have a banking license.

- Unlike traditional banks, NBFCs are not allowed to accept demand deposits from the public.

- The Reserve Bank of India (RBI) regulates NBFCs to ensure their smooth functioning and compliance with regulations.