- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

India, UK secure ‘historic’ Free Trade Agreement

India, UK secure ‘historic’ Free Trade Agreement

- India and the United Kingdom have concluded a mutually beneficial Free Trade Agreement (FTA).

- on May 6, 2025,Iit was Announced by PM Narendra Modi and UK PM Keir Starmer

- The agreement includes a Double Contribution Convention on social security.

- FTA is a historic milestone that:

- Enhances trade, investment, and innovation.

- Deepens India–UK Comprehensive Strategic Partnership.

Aims to double bilateral trade (currently ~USD 60 billion) by 2030

What is a Free Trade Agreement (FTA)?

- An FTA is a bilateral or multilateral agreement between countries to reduce or eliminate customs duties and non-tariff barriers on goods and services traded between them.

- Objective of FTAs

- Promote trade by reducing costs and simplifying procedures for importers and exporters.

- Enhance market access for domestic producers.

- Encourage cross-border investments and ease mobility of professionals.

- Strengthen strategic and economic ties among partner nations.

- Scope of FTAs

- Trade in goods: Lower customs duties and quotas.

- Trade in services: Easier access and licensing.

- Investment protection: Stable and transparent frameworks.

- Intellectual Property Rights (IPR): Harmonized standards and enforcement mechanisms.

- Benefits of FTAs

- Wider choice and lower prices for consumers.

- Boost to exports and domestic production.

- Creation of jobs and support to MSMEs.

- Promote technology transfer and industrial upgrading.

- Facilitate integration into global value chains (GVCs).

Timeline of Negotiations between India and UK

|

Year |

Event |

|

Jan 2022 |

Official talks began post-Brexit Progress hampered by:

|

|

Nov 2024 |

Renewed push after meeting at G-20 Summit, Rio de Janeiro (Nov 2024). |

|

Feb 2025 |

Final rounds of negotiations resumed |

|

May 6, 2025 |

FTA officially concluded |

Trade in Goods: Tariff Outcomes

For India:

- 99% of Indian exports to the UK will face zero duty.

- Covers nearly 100% of bilateral trade value.

- Boosts labour-intensive exports, including:

- Textiles & garments

- Marine products

- Leather and footwear

- Gems and jewellery

- Toys, sports goods

- Engineering goods, auto components, engines

- Organic and specialty chemicals

For the UK:

- India to reduce tariffs on 90% of tariff lines.

- 85% of these become fully duty-free within 10 years.

- Notable reductions:

- Whisky & Gin: Current 150% → 75% (initial), then 40% by Year 10.

- Automotive imports: Tariffs drop from 100%+ to 10%, under quota.

- Medical devices, cosmetics, aerospace parts, electrical machinery, soft drinks, chocolates and biscuits, salmon, and lamb — significant duty cuts.

Who Benefits:

- British shoppers: Cheaper clothes, seafood (e.g., frozen prawns), footwear, and Indian food products.

- Indian consumers: Lower prices on high-end UK imports like whisky, cosmetics, and medical devices.

Services, Investments & Mobility

- Services & Investment Liberalisation

- FTA includes provisions to ease norms for:

- Cross-border services

- Digital trade

- Financial services

- Educational exchanges

- Promotes greater UK investment in Indian sectors like fintech, aerospace, healthtech, and education.

- FTA includes provisions to ease norms for:

- Professional Mobility

- It supports:

- Contractual service suppliers

- Business visitors

- Intra-corporate transferees (ICTs) and their families (with right to work)

- Independent professionals (e.g. chefs, yoga instructors)

- It supports:

What Is Double Contribution Convention (DCC) ?

- A bilateral social security agreement to avoid double social security payments by workers.

- Benefits for Indian Workers:

- 3-year exemption from paying UK social security taxes.

- Prevents double taxation—contributions in India recognized in the UK.

- Ensures retirement benefits eligibility without financial loss.

- Lowers employment costs for Indian IT and services companies in the UK

India’s FTA Landscape (as of May 2025) :

India has signed FTAs with 16 countries or regional groupings, including:

|

Country/Bloc |

Key Notes |

|

Sri Lanka, Bhutan |

Early bilateral FTAs in South Asia |

|

Thailand, Singapore, Malaysia |

Part of India–ASEAN engagements |

|

South Korea, Japan |

Comprehensive Economic Partnership Agreements (CEPAs) |

|

Australia, UAE, Mauritius |

Recently concluded, covering goods and services |

|

ASEAN (10 nations) |

Multilateral framework for regional cooperation |

|

EFTA (Iceland, Liechtenstein, Norway, Switzerland) |

Signed in 2024–25; includes investment chapters |

India-UK Economic Relations:

Historical Perspective

|

Era |

Key Developments |

|

Colonial Rule |

1858–1947: British Crown governed India; Queen Victoria became Empress of India. |

|

Post-Independence |

1950: India remained in the Commonwealth after becoming a Republic. |

|

Cold War Period |

Strained ties due to India's non-alignment vs. UK's NATO alliance. |

|

1990s Reforms |

Economic liberalisation improved trade, investment, and political engagement. |

|

2004 Onward |

Strategic Partnership established; regular high-level visits and enhanced cooperation. |

- India and the UK share a strong bilateral economic relationship , with growing trade in goods and services, investment flows, and strategic cooperation.

- The Indian diaspora in the UK (over 1.8 million people ) plays a crucial role in enhancing ties.

Bilateral Trade : (As of August, 2024)

- India’s Rank for UK: 12th Largest Trading Partner

- Contribution to UK Total Trade: 2.1%

- India enjoys a services surplus with the UK.

Total Trade (Goods + Services)

|

Year |

Total Trade (£ billion) |

|

2021–22 |

£27.1 |

|

2022–23 |

£36.3 ↑ 34.2% (£9.2 bn increase) |

Investment Flows

Indian Investment in UK

- 108 Projects (2023–24), 7,533 New Jobs

- Ranked 2nd largest FDI source after the US.

- 971 Indian Companies in UK:

-

- Combined Revenue: £68.09 billion

- Corporate Tax Paid: £1.17 billion

- Employees: 118,430

- Over 65,000 Indian-owned companies in UK:

-

- Revenue: £36.84 billion

- Tax Paid: £1 billion+

- Jobs Created: 174,000+

UK Investment in India

- 6th Largest FDI Source (after Mauritius, Singapore, USA, Netherlands, Japan)

- Cumulative Equity Inflows: $35 billion (April 2000 – March 2024)

- Accounts for ~5.17% of total FDI inflows into India

- 635 British Companies in India:

-

- Turnover: INR 4,888.4 billion

- Employees: 666,992

Masala Bonds

- First issued by HDFC in London (2016)

-

- Masala bonds are rupee-denominated bonds issued by Indian entities in international markets.

- They are a type of debt instrument that allows Indian companies to raise funds from foreign investors in Indian rupees (INR) rather than the investor's local currency.

- The name "masala" is a reference to the Indian origin of these bonds, similar to how masala is a blend of spices used in Indian cuisine.

- Listed on London Stock Exchange

- Indian firms have raised over £13.41 billion via masala, dollar, and green bonds

- Notable issuers: NTPC, IREDA, IRFC

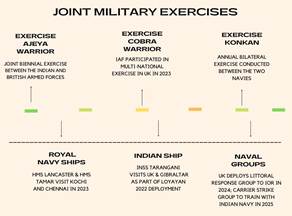

Key India-UK Joint Military Exercises :

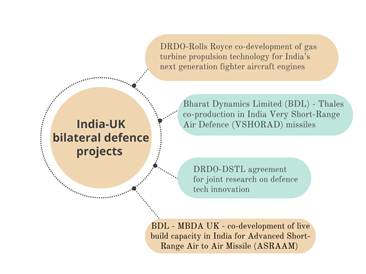

Key India-UK Bilateral Defence Projects

Significance of Bilateral Relations

- UK is part of India’s Indo-Pacific vision.

- “China Plus One” strategy aligns UK with India as a reliable partner.

- Support on UNSC reforms and Indo-Pacific stability.

- Cooperation in AUKUS, Commonwealth, G20, and Afghanistan

- Focus on renewables, net-zero targets, and energy access.

- Collaborations: Glasgow Pact, OSOWOG (One Sun One World One Grid).

5. Challenges in Bilateral Relations

|

Issue |

Details |

|

Russia-Ukraine War |

UK criticizes Russia; India remains neutral → policy divergence. |

|

Pakistan/China Ties |

UK’s balancing act complicates India’s security engagement. |

|

Khalistan Issue |

Allegations of UK harbouring Sikh separatist elements → diplomatic strain. |

|

Defence Procurement |

UK slow to align with India’s G2G (Government-to-Government) model. |

|

Extradition Issues |

Delays in high-profile cases like Vijay Mallya, Nirav Modi. |

|

Illegal Migration |

1 lakh+ undocumented Indians in UK; no migration pact yet. |

|

Colonial Legacy |

Historical grievances remain sensitive (Partition, cultural restitution, etc.). |

|

Also Read |

|

UPSC Foundation Course |

|

| UPSC Monthly Magazine | CSAT Foundation Course |